石油(布伦特crude oil、WTI)新闻与分析

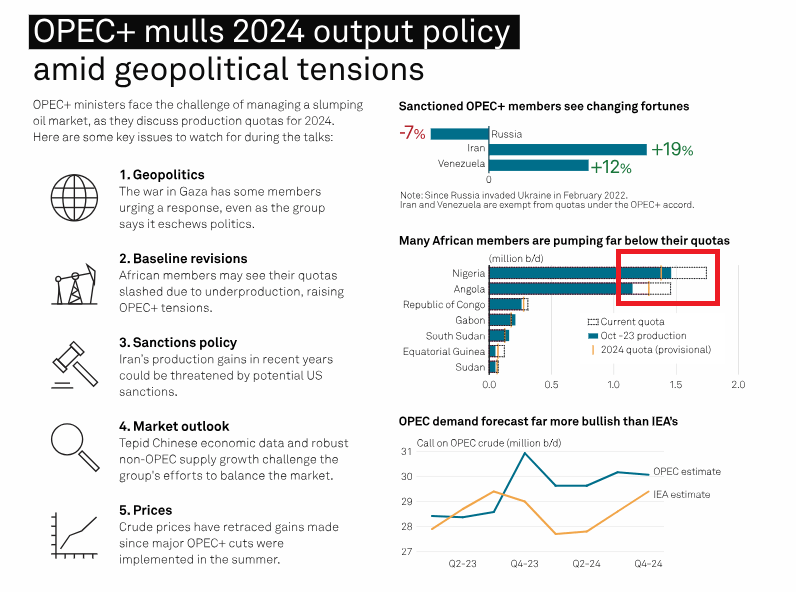

由于配额协议临近,欧佩克会议推迟至周四举行上周三,在欧佩克决定将会议推迟至本周周四的消息传出后,布伦特原油波动尤其剧烈。此后,消息人士指出,对于经常达不到现有产出配额的国家(即安哥拉和尼日利亚),在讨论产出水平时存在意见分歧。 下图凸显了非洲国家由于缺乏基础设施投资和能力挑战而在实现产出目标方面面临的困难。OPEC+将于格林威治标准时间周四 13:00 开始会议,阴谋集团目前正在权衡将减产期限延长至 2024 年的选择,有报道甚至暗示,鉴于油价疲软,将采取更积极的减产措施。欧佩克必须应对全球increase放缓的负面影响,主要是对未来需求下降的预期以及非欧佩克供应(美国)增加对油价造成的压力。 以色列和哈马斯之间为期四天的停火基本上是积极的,并且在释放更多人质的情况下,有关延长停火的谈判仍在继续。欧佩克拒绝了伊朗对以色列实施石油禁运的请求,这场战争似乎对近期油价的影响微乎其微。  Source:S&P全球、普氏能源资讯 周三宣布推迟 11 month OPEC 会议后波动加剧,布伦特原油测试了 82 美元附近的重要阻力区。该区域由过去多次被证明是枢轴点的 82 USD level and 200 Daily Simple Moving Average (SMA) 组成。如果看跌势头从这里开始,从技术上讲,几乎没有什么可以阻止下跌。当然,如果欧佩克加大减产力度,随着市场适应石油供应减少的世界,石油市场可能会上涨。 The resistance level is still 82 美元,轻微支撑位于 50% Fibonacci retreat 77 USD——50% 回撤位通常不太重要。此后,支撑位一路出现在 71.50 USD. 石油(布伦特原油)日线图

Source:TradingView WTI 的价格走势也出现了类似的走势——拒绝突破 200 SMAAnd in the OPEC 会议之前走低。在周三盘中看涨逆转之前,该商品有望形成“黄昏之星”——通常是看跌形态。 在跌破 200 移动均线和 77.40 的重要水平后,价格走势继续走低。支撑位为 72.50 USD. petroleum (WTI) Daily chart

Source:TradingView |