gold、白银和石油预测:gold、silver预测:中性

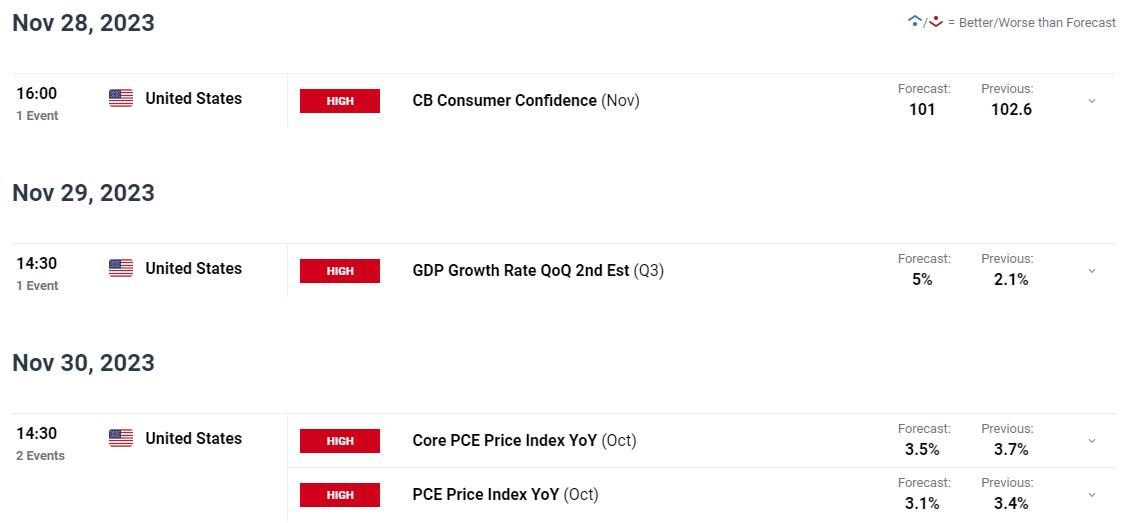

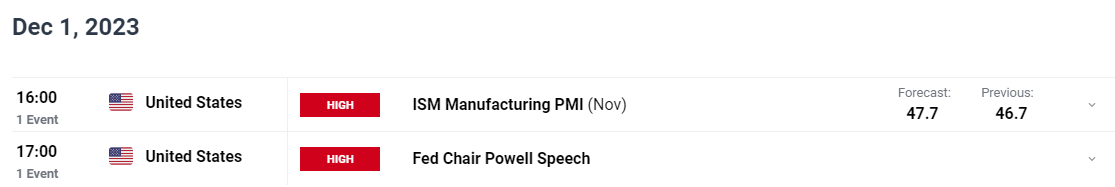

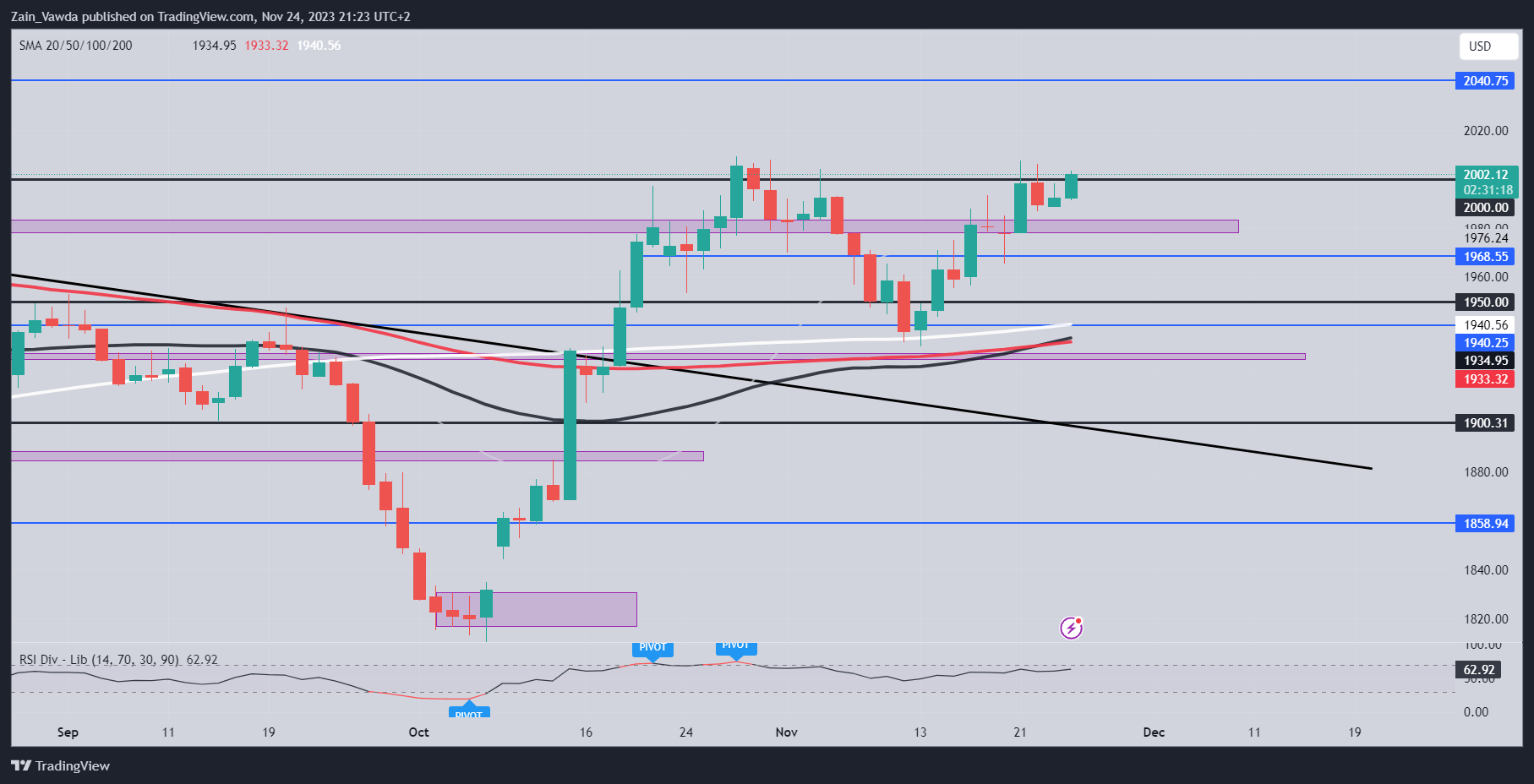

黄金和白银价格本周表现良好,买家在dollar疲软的帮助下对这两种金属提供支撑。本周黄金和白银均面临抛售威胁,但买家在交易周缩短的大部分时间里保持价格稳定。不过,就黄金而言,未能在 2000 dollar/盎司大关上方找到接受可能会使贵金属在下周变得脆弱。 ISM 数据和核心 PCE is the key随着中东进入期待已久的冷静期,美国数据可能成为金价的关键驱动因素,至少在本周初是如此。下周将是更加繁忙的一周,没有假期干扰,将发布大量高影响和中等影响的数据。 可能引发美元波动以及金价波动的关键事件可能是 ISM 数据,当然还有美联储首选的通胀指标——核心 PCE data市场已经接受了 2024 年降息的想法,目前已定价约 90 个基点。就我个人而言,我对未来的预期有复杂的感觉,因为我确实相信随着消费者感受到压力,需求将面临限制,但我更愿意看到一些迹象表明就业市场正在降温。 我预计数据发布后的短暂买卖将在未来一周继续,但我预计这两个数据都不会改变整体前景。年底前我们仍有 12 monthNon agricultural就业数据和联邦公开市场委员会(FOMC)会议以及通胀数据。因此,在美联储宣布结束加息周期之前,市场对美联储加息的预期可能会不断变化。正如我们最近看到的那样,这可能会让金价发出混合信号,并且在年底之前我们可能无法接受高于 2000 dollar/盎司的大关。   黄金和白银的技术前景从技术角度来看,金价有望收于 2000 dollar/盎司大关上方。然而,正如已经讨论过的,上方的收盘价可能不会像最近的情况那样持续很长时间。 金价首先需要清除 10 Month high point 2009 dollar/盎司关口附近的直接阻力。这将是迈向 2000 美元大关上方接受的第一步,否则我们可能会出现更深的回调。 需要关注的关键支撑区域位于 1990.00、1980.00 and 1968.00 左右,可能会在上周 1931.65 左右的低点发挥作用之前提供支撑。 Gold(XAU/dollar) Daily chart – 2023 year 11 month 24 day  Source:TradingView silver (XAG/dollar) 在突破长期下降趋势线并在撰写本文时停留在关键阻力区域(24.30)之后,白银价格的解读更加清晰。继本周大部分时间犹豫不决之后,周五白银迎来了非常看涨的一天。 进入下周,周五的每日蜡烛收盘价将很重要。如果每日蜡烛图收于阻力位 24.32 上方,那么本周初可能会向阻力位 24.97 推进。或者,如果我们未能收于 24.32 上方,则在可能继续走高之前会进行回撤以重新测试趋势线。事实上,我们已经创下了更高的高点,这可能会导致在继续走高之前出现回调。 Key levels to focus on: Resistance level

支持级别

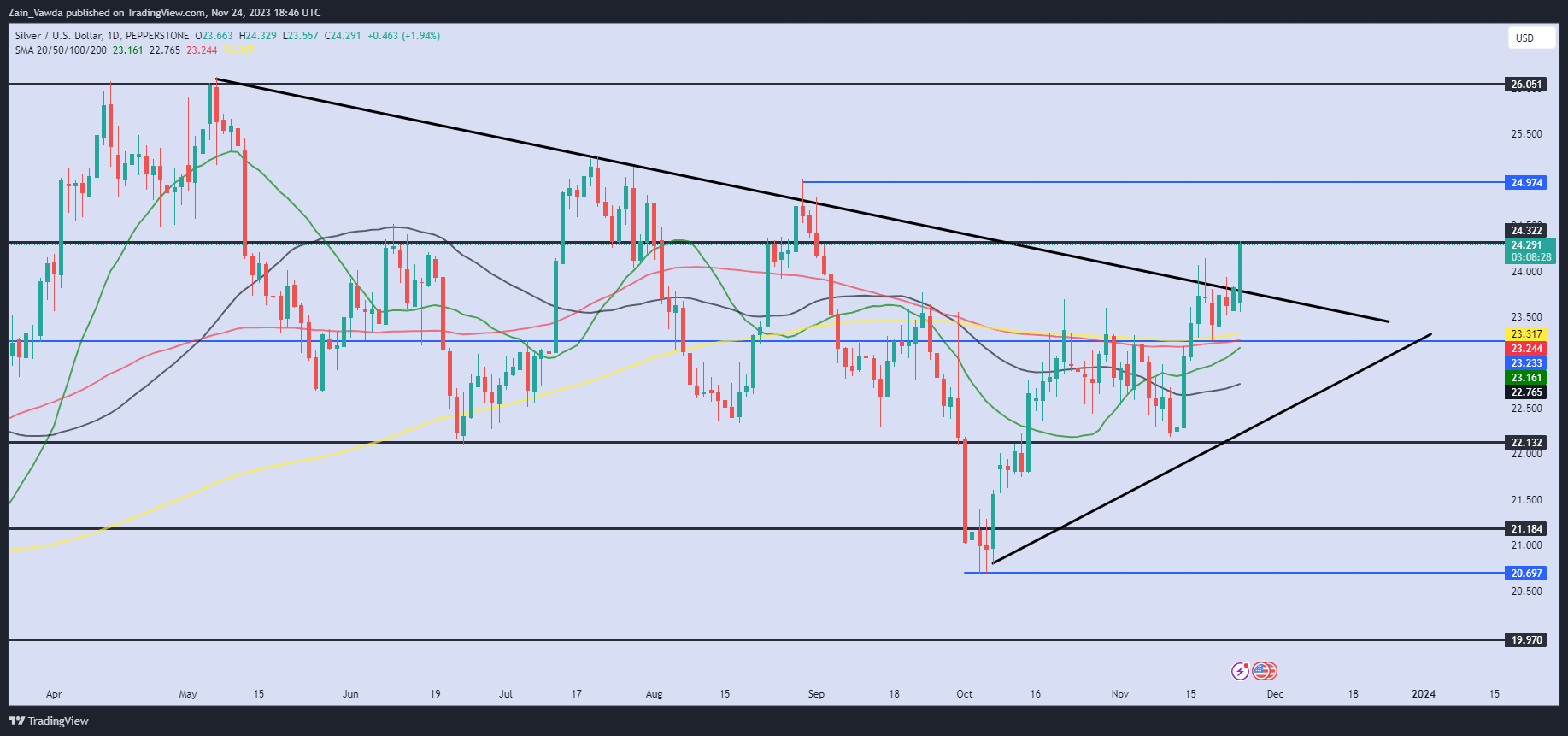

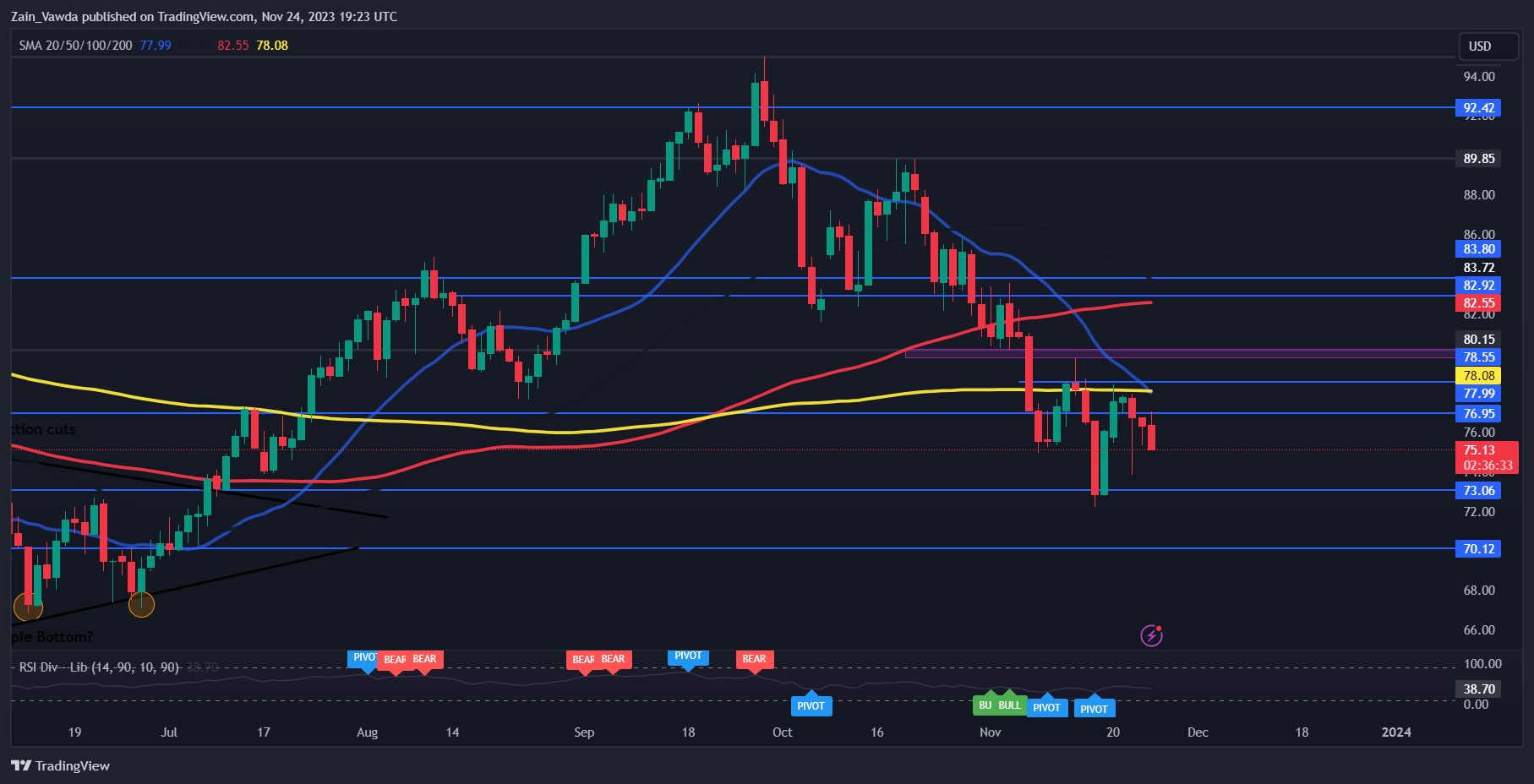

Silver(XAG/USD Daily chart – 2023 year 11 month 24 day  Source:TradingView 石油前景petroleum价格经历了有趣的一周,波动幅度很大。在周一和周二的看涨走势之后,油价似乎即将复苏,随后有关 OPEC+ 会议的消息令市场陷入短暂恐慌。由于有关各国就 2024 年产量数据陷入争执的传言越来越多,OPEC+ 宣布推迟会议。 尤其是非洲生产商似乎与其他成员发生争执,这似乎浪费能源。我之所以这么说,是因为如果需求按预期下降并且不削减产量,那么油价将随着库存增加而下跌。然而,周五有消息称,欧佩克+正在接近与非洲石油生产国达成妥协,因为原本希望提高产量的安哥拉和尼日利亚似乎正在转变。 这显然会给推迟到 11 month 30 日举行的会议增添一层额外的阴谋。会议预计将以虚拟方式举行,消息人士称 99% 的确定性将达成协议。这将是未来一周油价面临的最大风险,并可能为持续复苏提供催化剂。 WTI 石油日线图 – 2023 year 11 month 24 day  Source:TradingView 就价格走势而言,我们仍然看跌,会印出更低的高点和更低的低点。价格拒绝了 200 日均线,并关注每桶 73 美元附近的近期低点。下方支撑位于 71.50,然后心理关口 70.00 成为焦点。从技术角度来看,下行趋势似乎确实存在,因为 20 Daily moving average below 200 日均线,确实出现了死亡交叉。这显然是进一步下行的好兆头。 考虑到上涨的潜力,第一个感兴趣的区域将是 200 Daily moving average and 78.00 关口附近的波动高点。如果我们要看到结构的变化并发出看涨价格走势的信号,则每日蜡烛收盘价必须高于该水平。upper78.00关口,阻力位在80.00Gateway. |