gold前景与分析

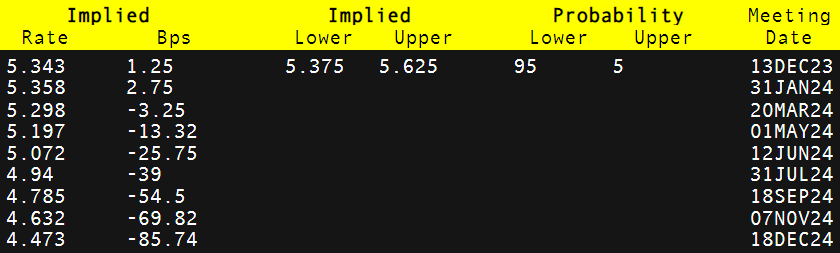

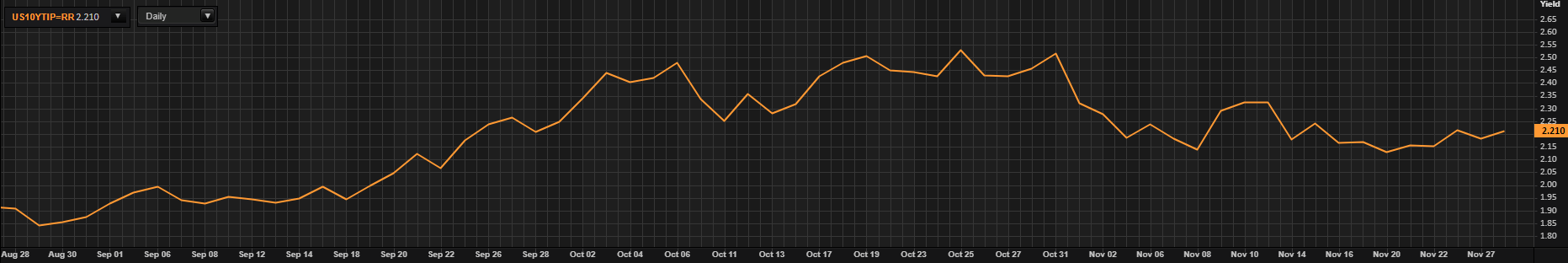

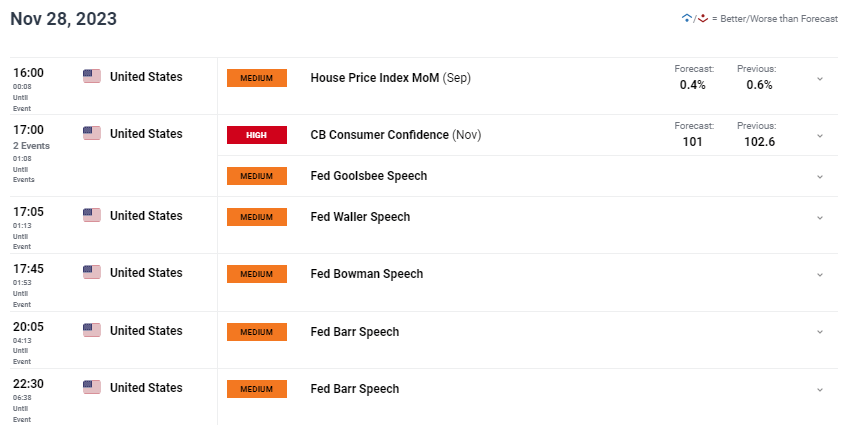

XAU/美元基本面背景Gold price一直走强,主要是由于2024 year美元的看跌言论。市场一直在迅速走高,但可能有点不耐烦。尽管隐含的联邦fundfutures(见下表)表明到2024 year 12 Monthly累计降息约 85 Basis points,but美联储和其他Central Bank在语言上一直相当谨慎,并且高度依赖数据,如果经济数据反对,这可能很容易影响预测当前的趋势。 隐含的美联储基金期货  Source: Lu Fute 美国国债收益率下降是金价看涨的一个关键因素(与实际收益率下降相对应),昨天美国国债拍卖表现平平,2年期国债收益率延续下行趋势,而10年期国债收益率依然低迷。 美国实际收益率(10 年期)  Source: Lu Fute 今天的经济日历包括CB消费者信心和美联储官员在整个美国交易时段的安排(见下面的经济日历)。fromAvoidance角度来看,以色列和哈马斯之间的战争现已进入商定休战的第五天,这可能会限制金条的吸引力。最后,中国和印度的金价已接近当地高点,可能会抑制这两个主要黄金消费国的需求。 黄金经济日历  Source:DailyFX technical analysis黄金价格日线图

Chart byWarren Venketasand TradingViewprepare everyday XAU/dollar Price trend保持坚挺,高于2000.00 USDbracepsychology手柄,但Relative strength index (RSI)向多头发出令人担忧的信号,因为较低的高点可能表明短期内将出现看跌/负面背离。黄金多头可能会对 50 Rihe200 Daily moving average趋同的前景感到兴奋,该移动平均线可能会分解成kdj 形态。 Resistance level:

Support level:

|