Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Wednesday(4month26day)Asian period, spotgoldNarrow volatility, currently trading at1996.16dollar/Around ounces. Overnight market concerns about the banking sector rose, the US debt ceiling crisis intensified, US stocks fell sharply, and US bond yields recorded3The largest daily decline since the beginning of the month has provided support for gold prices, but on Wednesday, safe haven sentiment slightly declined in the Asian session, and gold prices are still affected by2000The resistance at the gate is suppressed.

Attention to the United States is required on this trading day3The monthly durable goods order data shows optimistic market expectations, which may support the US dollar and suppress gold prices during the session.

However, the market is more concerned about the first quarter announced on ThursdayGDPData and core personal consumption expenditure released on Friday(PCE)The price index, which is a favored inflation indicator by the Federal Reserve, is expected to be lower than the previous level, and the downward space for gold prices is expected to remain limited.

Analysis of gold market trend:

dayKAt present, it is mainly horizontal trading, waiting for fundamental stimuli. The Federal Reserve5Monthly interest rate resolution is necessary, and the market is relatively cautious; From past trends, it can be seen that the market may release expectations ahead of schedule one month before the Federal Reserve's interest rate decision, that is, bearish expectations for gold and bullish expectations for the US dollar. Therefore,4The time period at the end of the month is the best time to release expectations, but it is not yet known whether the market will move. After all, the Federal Reserve is notorious for its global aversion to the US dollar.

During the intraday fluctuations, trading must be carried out step by step, and once profits are made, profits must be maintained. Secondly, in the interval, it is possible to consider appropriate attempts to play the game of empty orders downwards, releasing fundamental expectations!

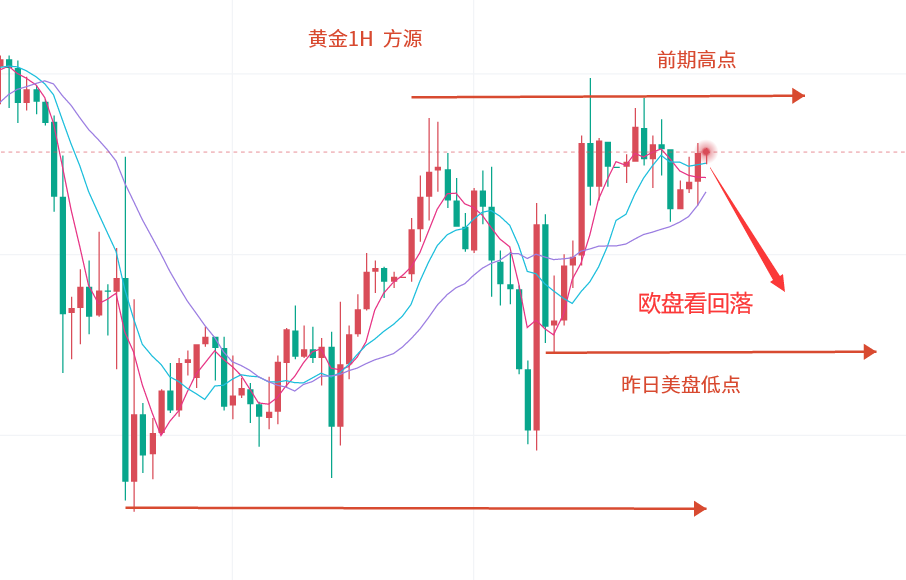

The hourly line continues to decline within the day and returns to the previous day's low line. This pattern, according to the formula, is the US market taking a double short and looking for a pullback. And the entry position is the intraday decline and rebound382Position, or European market opening downside.

But yesterday, there was a phenomenon of one yang swallowing multiple yin, regardless of whether it was382Location or618All have been broken through. This was a concern in the air yesterday. one side,6-8Point down, there was an example earlier where the US market did not retreat. However, due to the continuous decline of the European market, the daily trend cycle is negative, so there is a rhythm of free time for the rebound. However, overall, the US market took a short turn yesterday, which was a mistake.

And the US market rose twice, with prices hitting the previous day's high2000On the front line, the trading ended sideways and retreated early in the morning. So the current trend, coupled with today's discontinuous state, requires a change in the plan to rely on European operations. At the same time, the daily line is also at a high horizontal level, and there is no new trend to release. It is said that the price is at a high horizontal level, and there are no signs of significant pullback or top. It is said that the correction is over, and the price is still suppressed below the short-term moving average.

On the other hand, in the morning, it was still awkward to suppress the double top drop and wait for the European market to operate. Yesterday rose, today may not be a continuous rhythm. watershed2002Front line, morning high point. In terms of operation, relying on watershed clearance,1997-98Void2005, Objective1983-5frontline. The focus is still on the trend of the European market. But for the US market, relying on the layout of the European market is not significant, whether it is a breakthrough2002Still falling to1985Below, the US market cannot rely on the trend of the European market for layout, it can only be range fluctuations, doing high selling and low buying.

Golden Operation Strategy:1998Near empty, stop loss2005, Objective1983。

all day83-81More, break the bottom, look up92-03Break the position to see2015-20-28-37Key points of other points86-92。 (For reference only, specific firm offer shall prevail)

The US Energy Intelligence Agency will release weekly oil supply data for the United States on Wednesday morning. A survey conducted by S&P Global Commodity Insight shows that analysts on average expect domesticcrude oilSupply will decrease230Ten thousand barrels, reduced gasoline supply18Ten thousand barrels, reduced supply of distillate oil120Ten thousand barrels.

Analysis of crude oil market trend:

The overall trend of crude oil yesterday was weak, but it emerged from a sharp decline despite not breaking the previous high in the morning. The daily line continued to close negative and still did not break above the daily lineMA10Position, so the bulls are holding back, while our trading strategy continues to maintain the daily lineMA10It's good to be bearish below, but on the short lineH4The aspect of the daily moving average has weakened, so we can rebound and short it. The daily moving average is a typical downward trend, so as long as the price is atMA5You can boldly go up and down, while defense is on the daily lineMA10Above, this single position can be appropriately enlarged and should be very stable.

Operation suggestions:77.5-78Empty, stop loss78.5Look76.5-75.5(For reference only, specific firm offer shall prevail)

In addition to investing, life also includes poetry and distance. The article lacks too much fancy language and chicken soup. I believe that what every reader lacks is not chicken soup, but practical analysis and strong theory. I am Teacher Fang Yuan. If there are orders in the warehouse or there are serious losses in the near future, you can add Fang Yuan [official WeChat account]:qli19888,Official account: Fang Yuanshuijin] For help, I will take the time to give you some suggestions for reference. I hope this article can give you some help in your transaction. Finally, I wish you a happy transaction.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|