AUD/US dollar analysis and key points of conversation

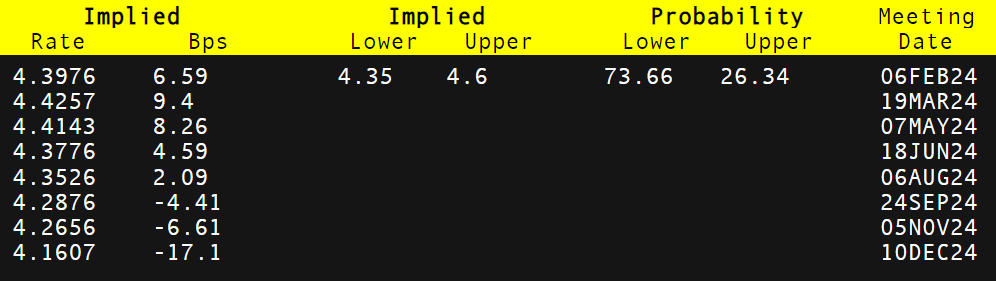

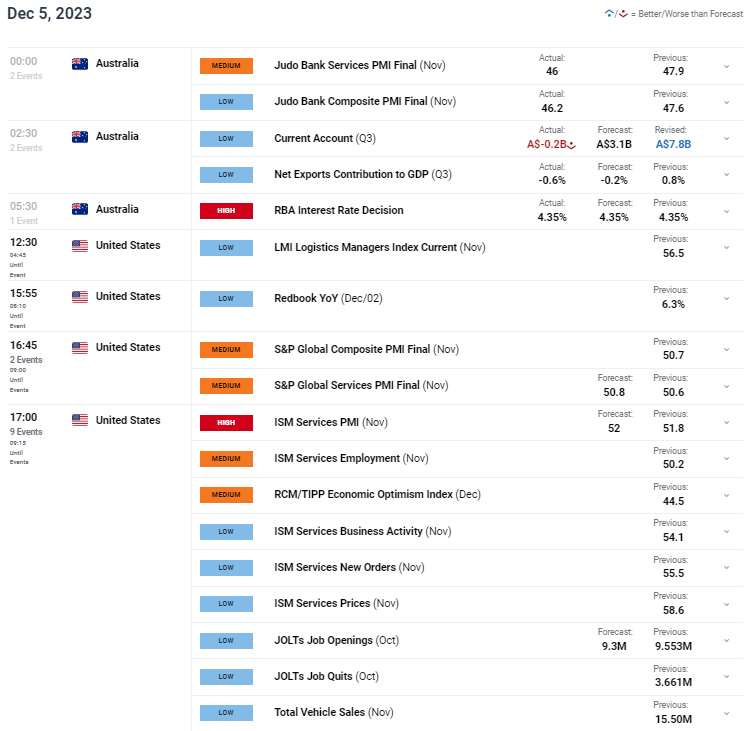

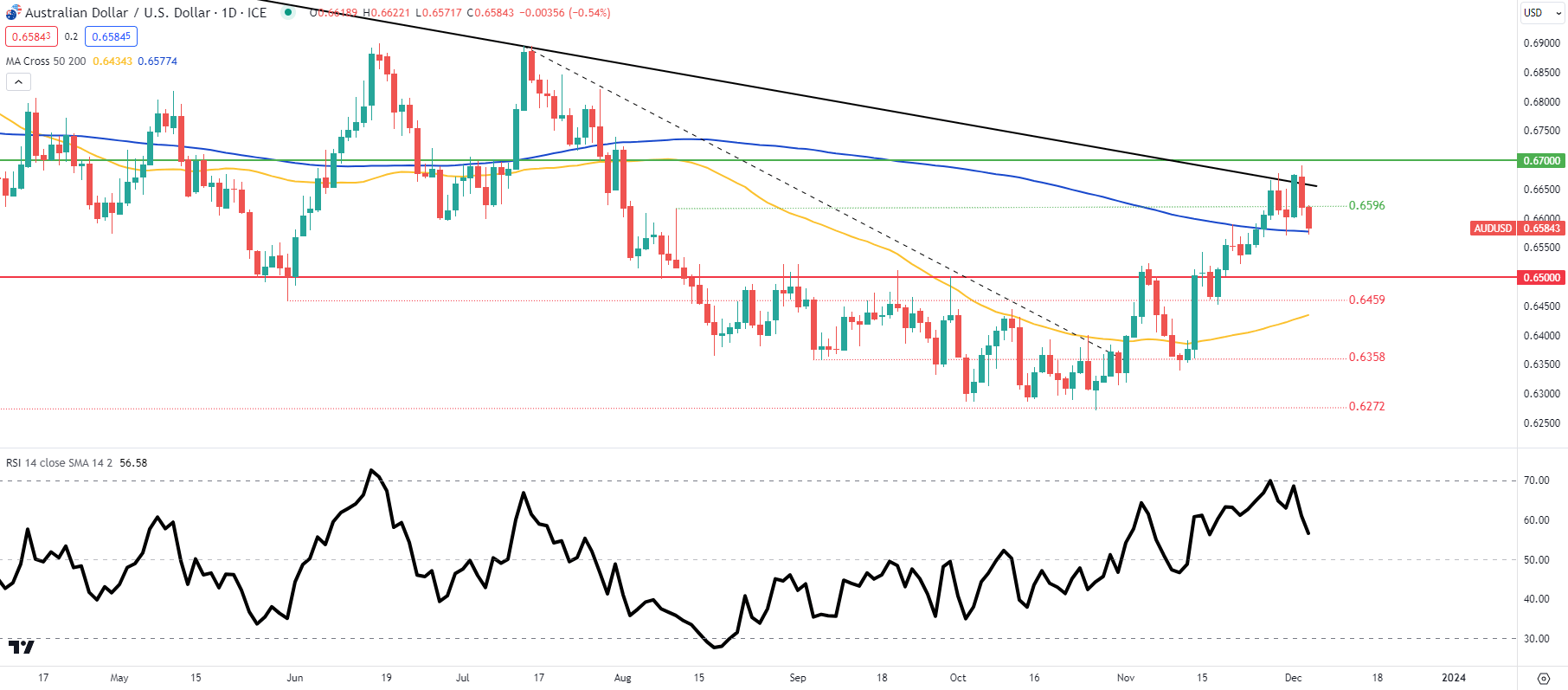

Background of Australian dollar fundamentalsAUDExchange to USD今天上午早些时候受到澳大利亚储备银行 (RBA) 利率决定的影响,预计该Central Bank决定将利率维持在4.35%。快速回顾一下上次会议,澳大利亚央行加息是因为通胀压力、房价上涨and劳动力市场紧张在评估中发挥了关键作用。此后,月度CPI指标数据的疲软以及限制性货币政策的滞后影响,以及劳动力市场的小幅疲软,都对房价构成压力。总体而言,强劲的就业市场可能是澳大利亚央行最关心的变量 — — 类似于美国经济和美联储的情况。 reach 2024 year 12 月,货币市场在一周内已额外累计降息约13 Basis points(参见下表),但如果需要,还有进一步加息的空间。我预测澳洲联储将继续依赖数据,但我们很可能正处于周期的顶峰,并可能在 2024 年追随其他主要央行的脚步。由于许多银行希望在 2024 年中期左右降息,澳洲联储的前景可能是再次“温和”地重新定价,使澳元容易遭受下行风险。 Reserve Bank of Australia interest rateprobability  Source: Lu Fute Judo Bank PMI 在利率公布之前发布,突显澳大利亚经济放缓,服务业和综合指标进一步陷入收缩区域,达到年度低点。第三季度的经常账户也自 2022 年第三季度以来首次出现负数,再次暗示increase低迷。今天晚些时候,随着市场为周五的非农就业数据 (NFP)做准备,澳元/dollar货币对将密切关注U.S.A ISM Service industry PMIand JOLT data。 AUD/USD Economic Calendar(GMT +02:00)  Source:DailyFX Economic Calendar technical analysisAUD/USD daily chart  Chart by TradingView Warren Venketas prepare AUD/USD per dayPrice trend显示,多头受到趋势线阻力(黑色)的限制,同时相对强度指数(RSI)上的超买阻力被推高。目前的支撑位来自200 Daily moving average(蓝色),但如果 ISM and JOLT 走强,则可能很容易跌破该支撑位。请记住,中东紧张局势升级也导致风险情绪恶化,这可能会补充美元的上涨空间。

Key support positions:

IG 客户情绪数据:看跌(澳元/USDIGCS 显示零售交易者目前持有AUD/dollar净Long position, of which61%的交易者目前持有多头头寸。 |