Goldman Sachs believes that the current decline in commodities is mainly due tofuturesThe disconnect between the market and the spot market has led to an exaggerated weakness in the commodity market due to a lack of liquidity, which is actually an attractive starting point. Last night in the market, the United StatesWTIcrude oilAnd Brent crude oil10Monthly crude oil futures all fell5.5%Every barrel lost100The threshold of the US dollar.WTI Crude oil daily6.6%, push down every barrel90The threshold of the US dollar. On the previous day, both types of oil prices had risen by more than4%Oil distribution achieved its largest increase in over a month.  European natural gas prices have also fallen sharply for two consecutive days, with benchmarkTTFDutch natural gas futures fell and exceeded8.6%, fell briefly during the day21%create4The largest intraday decline since the beginning of the month; UK natural gas prices have fallen by more than30%。 German electricity prices fell by more than14%Electricity prices in France have fallen by more than38%Defeat1000Euro level, as reported the previous day1200The euro reached a historic high. In response to the recent significant fluctuations in the commodity market, Goldman Sachs believes that,The current decline is mainly caused by the disconnect between the futures market and the spot market, and the exaggerated weakness of the commodity market due to a lack of liquidity is actually a very attractive starting point. The disconnect between the futures market and the spot market Global Head of Commodity Research at Goldman Sachs Jeff Currie In a report earlier this month, it was stated that "the market is irrational", and the combined effect of good demand, declining inventory, and tight supply should drive up oil prices:

Nearly two months ago, analysts discovered that the crude oil futures market was selling off due to concerns about an economic slowdown, while the spot market still seemed quite stable, with a mismatch between the two. Royal Bank of Canada also stated that,The oil financial market is seriously disconnected from the extremely tight physical market. The pricing of the physical market reflects the scarcity of supply, while the pricing of the financial market reflects the economic recession. This may generate some chaotic signals. Saudi Arabia has also made a decision to reduce oil production, stating that the trading price of financial assets for oil is too low and meaningless in the physical market. According to media reports, Saudi Energy Minister Abdulaziz bin Salman stated last week that "extreme" volatility and lack of liquidity mean that the crude oil futures market is increasingly disconnected from supply and demand fundamentals, and Saudi Arabia is considering reducing oil production to balance this situation:

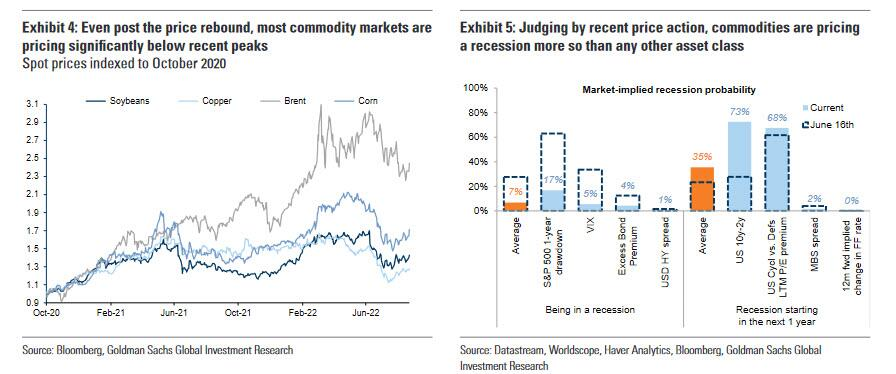

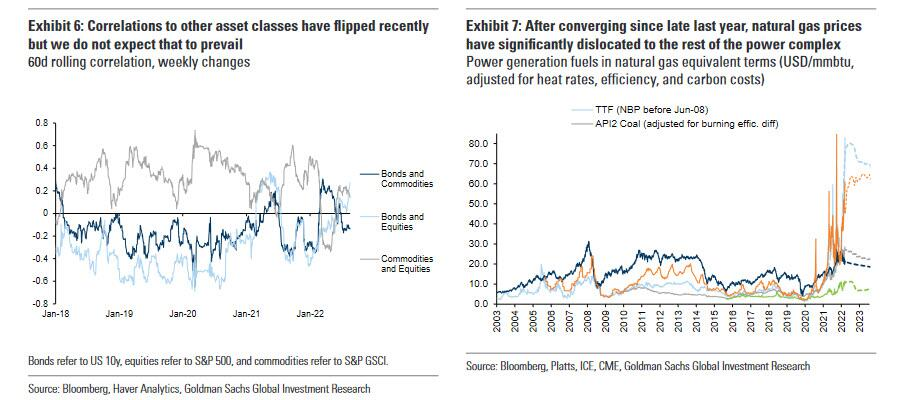

After analyzing the relationship between oil prices and economic recession, Goldman Sachs believes that:6The decrease in oil prices and refining profit margins since mid month is equivalent to the expected decline in the oil market2022-2023Global YearGDPWill decline1.1%。” Although the risk of future economic recession is increasing, Goldman Sachs is still very optimistic. They believe thatThe current oil deficit has not been resolved, and with declining inventories approaching extremely low levels, disrupting demand through high oil prices is the only solution. They stated that excessive concerns about economic recession continue to envelop commodity markets, with prices of oil, petroleum products, aluminum, wheat, corn, or sugar far below their highs so far this year, and the future curve weakening. In Goldman Sachs' view, commodities are priced higher for recession than any other asset class.  Commodity 'Future Promising' Before the economic recession truly arrived, Goldman Sachs still believed that commodities were the best assets in the later stages of the investment cycle. Global Head of Commodity Research at Goldman Sachs Jeffrey Currie Analysts recently released a report titled 'Buy commodities first, then worry about recession'. They believe that in an era of extreme energy shortages, oil is the last commodity to rely on,The weakness of the commodity market, which is exaggerated due to a lack of liquidity, is actually a very attractive starting point. The report points out that from a cross asset perspective, the stock market may be hit twice. Firstly, inflation remains high, and secondly, the Federal Reserve is more likely to surprise the market on the hawkish side. On the other hand, commodities are the most suitable asset class to hold during the end of the cycle when supply is still in short supply. Therefore, Goldman Sachs believes that the correlation between commodities and other risky assets will once again decline.  Goldman Sachs also reiterated its reasons for still predicting an increase in oil prices and wrote that physical fundamentals foreshadow the most tense situation in the market in decades:

In other words,Due to the higher risk of inventory depletion than the imminent global economic recession, Goldman Sachs believes that commodity spot premiums should rise. Goldman Sachs believes that the recent economic outlook is not without risks, and the macro situation remains challenging, with the possibility of further appreciation of the US dollar in the short term. The biggest risks mentioned include large-scale financial settlements by investors due to increased volatility, margin calls, and concerns about economic recession ultimately leading to price declines.Therefore, it cannot be completely ruled out that there will be another liquidity driven sell-off. In summary, Goldman Sachs' focus on commodities12The long-term outlook for the next month is very optimistic,And Goldman SachsGSCIandBCOMThe expected total return rate of the commodity index has been raised to38.3%and13.6%At the same time, maintain the demand for Brent crude oil to reach per barrel125The year-end price forecast for the US dollar. Risk Reminder and Disclaimer There are risks in the market, and investment needs to be cautious. This article does not constitute personal investment advice, nor does it take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, viewpoints, or conclusions in this article are in line with their specific situation. Invest accordingly and take responsibility. |