Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

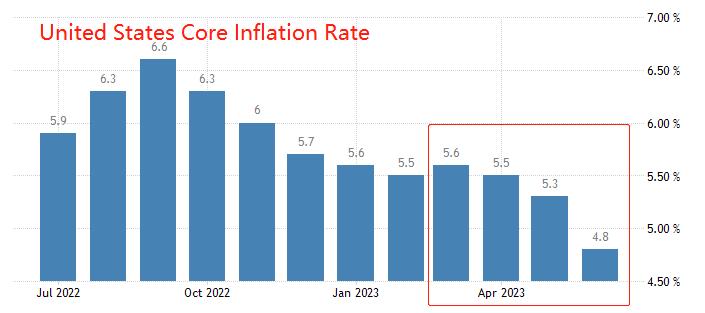

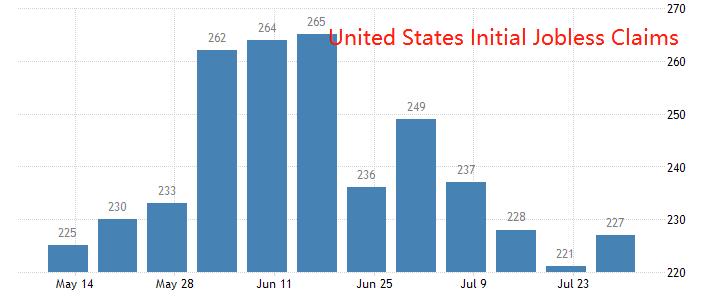

today20:30The Department of Fine Arts and Labor will announce7Monthly and quarterly adjustmentsCPIAnnual rate, previous value is3%, expected3.3%; Announced at the same time7Monthly and quarterly adjustment coreCPIAnnual rate, previous value is4.8%The expected value remains unchanged; to8month5The number of initial claims for unemployment benefits for the current week will also be released, with the previous value increasing22.710000 people, expected increase2310000 people.

Market expectations for the United States7The monthly nominal inflation rate will have0.3A percentage point increase, mainly due to7Energy prices skyrocketed in the month,WTIMonthly increase15.74%The cost of using oil has significantly increased. Affected by El Ni ñ o, the expectation of reduced food production has increased,7Month WheatfuturesThe price once surged to3Since the beginning of the month. Energy and food prices fluctuate significantly, often affecting nominalCPIDirection plays a leading role.

Market expectation coreCPIThe annual rate will remain unchanged4.8%Unchanged, this has changed the continuous downward trend over the past four months.7Month, Manufacturing in the United StatesPMIby49Located below the waxing and waning line, in a contracting state, with poor performance; Service industryPMIby52.3Although above the boom and bust line, it has been declining for three consecutive months and the outlook is not optimistic. During the three-year pandemic, the US government allocated a large amount of financial funds to subsidize household income, such as economic subsidies, and indirect assistance such as tenant eviction bans and student loan delays, resulting in a total surplus of US households2A trillion dollar excess savings. This excess savings have formed a strong purchasing power, causing the supply of goods in the United States to fall short and businesses to continue hiring. As of now, only about8%The strong demand state is approaching its end. From a comprehensive perspective, the United States7Poor economic performance in the month, coreCPIThe annual rate may remain stable as expected, but there is a greater probability that it will continue to decline.

The number of initial claims for unemployment benefits reflects the opposite of the US labor market. The number of people who have applied for unemployment benefits for the first time in the past four weeks is22.7Ten thousand people22.1Ten thousand people22.8Ten thousand people and23.7Ten thousand people, all within20More than ten thousand people. Despite the impressive performance of the non farm employment report, there is still a haze of employment difficulties.

From a macro perspective, although high interest rates are beneficial for attracting overseas funds, boosting the US dollar, and facilitating the liquidity of US bonds, their investment and inhibitory effects on the domestic market cannot be ignored.2022Throughout the year in the United StatesGDPYear-on-year growth2.2%When the Federal Reserve's benchmark interest rate is5.5%AlmostGDPTwice the growth rate. The income from depositing the same amount of funds into the bank to earn interest can already exceed the profits generated by flowing into the real economy. Although high interest rates can curb high inflation rates, they can only exist in stages, and maintaining high interest rates for a long time will inevitably damage economic resilience.

Federal Reserve officials continue to express hawkish views,9The probability of further interest rate hikes by the Federal Reserve in the month is relatively high. Philadelphia Fed Chairman Huck stated that the Fed is unlikely to cut interest rates in the short term; Federal Reserve Governor Bowman stated that further interest rate hikes are expected to be needed to reduce inflation to target levels; New York Fed Chairman Williams believes that it is necessary for the Federal Reserve to maintain monetary policy restrictions for a period of time. As of now, there have been no clear rate cuts from Federal Reserve officials.

If at nightCPIIf the data exceeds expectations and rises, the Federal Reserve will have more confidence to choose aggressive interest rate hikes; IfCPIThe continued decline in data means that high interest rates have already played a role in curbing high inflation, and market expectations for the Federal Reserve to cut interest rates by the end of the year will be strengthened.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-10

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|