Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

一直在强调"金九银十",不是说gold白银会在九月十月涨多少多少。而是说依照以往的惯例,每年的九.十月起做黄金、白银等foreign exchange相关产品投资的朋友们更为活跃,行情也会相对波动较大,理所当然赚钱的机会就更多了。而九月十月甚至到年底,都是交易的大好时机,但建议大家有入市操作难或准备入市的朋友先找好领头羊。

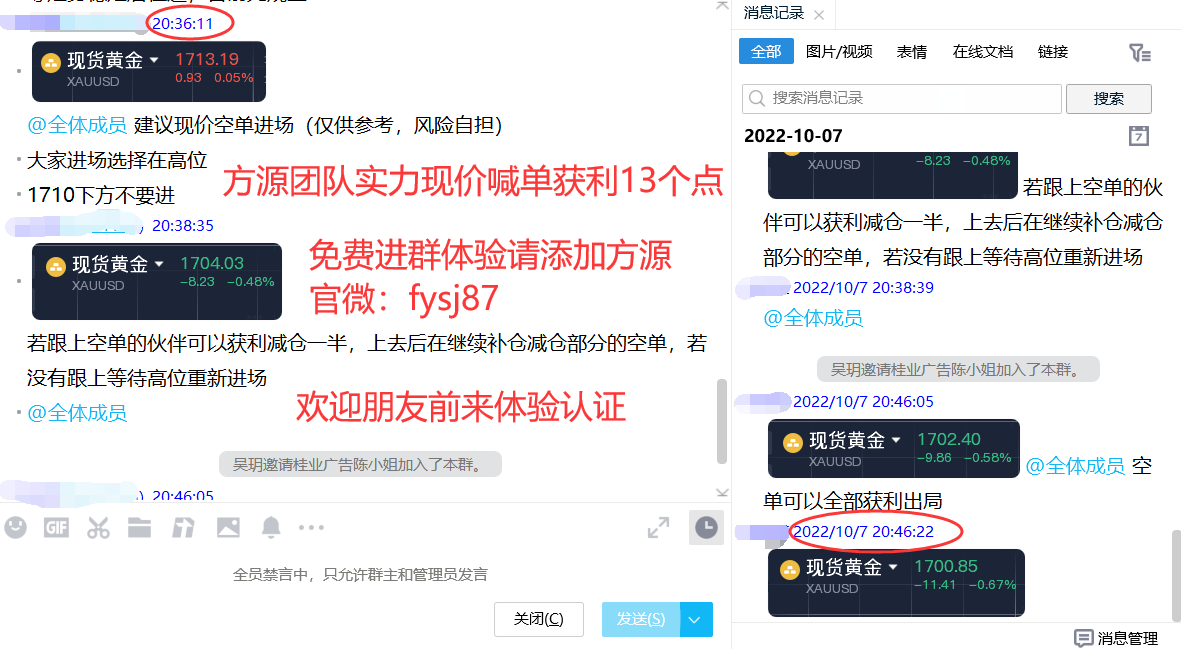

Here is my current price order within the group. Real time updates every day. I usually have real-time layout of current price orders for everyone to keep up with. As a straightforward person, I won't keep accurate market trends. As long as I have accurate orders, I will enter the group through current price orders! (Fang Yuanguan WeChat:fysj87)

Analysis of the trend of gold market;

行情回顾,上周五非农利空的情况下,黄金高位逐次回落,但是力度不是很大走势相对较小,在尾盘阶段形成了下行。上周五因非农数据超预期,美元指数三连涨,一度涨破112.90,创逾一周新高,收涨0.41%Report112.73。10年期美债收益率盘中拉升,非农公布后迅速升破3.90%;2年期美债收益率迅速站上4.3%。截止美股收盘,10年期美债收益率报3.88%,2年期美债收益率报4.31%。因美元与美债收益率携手走高,现货黄金短线大跌20The US dollar, once approaching1690dollar/盎司;现货白银盘中跌幅达3%。截止收盘,现货黄金收跌0.95%Report1694.52dollar/盎司;现货白银收跌2.62%Report20.11dollar/盎司。一旦破位整数关口之后,相对来讲短期下方依旧有一定的空间!

技术面上,黄金自前一周周三开始形成破低后的探底回升上涨攀升,10月份开局继续延续这一波上涨的行情,直至上周三开始转为箱体震荡运行,周五非农更是将箱体区间向下切换扩大区间。那么,对于后续的行情来说,守低就尤为重要,毕竟在此之前,整体节奏均是以守低向上扫荡式攀升的,能够守住这个节奏,后续再看向上突破加速,现在最为关键的位置便是上周的起涨点也是低点1660-1659区域,以此作为后续行情切换的分界线。

而非农过后的第一个交易日,首要关注非农高低点和延续性。非农数据公布后的阻力点1713-1714承压破低跌至1690区域,再度反弹确定阻力1707区域后又继续承压,现在价格临近低点区域。而且刚好两个阻力点与前期的红色通道线下轨以及紫色趋势线位置相互重合,共同成为后续行情空间切换的分界线。在此之下,关注下方低点得失进行切换寻找下一个阻力前期顶底转换的1679-1680区域,然后就是起涨加速点1670在此之上,重回通道区间内,继续保持守低向上攀升的节奏,往上关注1725-1727的阻力点,然后再突破再寻找红色通道线上轨区域。

因此,对于今日的黄金来说,关注非农阻力点与紫色趋势线和通道线相互重合的阻力区域,一个是1707One is1713-1714Below support attention1690Secondly1680-1679。文章只能给你一时的方向和思路,需要实时进出场点位及每日策略分析指导可以添加方源《官-tinyfysj87》指导Q:1706407347获取实时帮助

crude oilMarket trend analysis;

原油上周一路上涨,连续一周五天收阳,多头强势上涨,当周最低81, highest93.3,周线大阳收于93.2,从周线看本周还有上涨的空间,上方重点关注96一线,从日线看,油价连续上涨处于上轨,多头强,但大涨后还需谨慎多,另上周上涨主要受减产消息影响,固本周思路看多不追多,日内,从四小时线看,油价呈震荡上行,小时线,今早冲高回落,MA5AndMA10形成死叉有回调,下方关注91and90,日内操作先看回调,以回调多为主。操作建议:90.1-90.3Multiple, stop loss0.4, Objective91-92

Teacher Fang Yuan summarized the following reasons for the loss

1Without the guidance of the teacher, I looked around for group orders and small cycles, chasing back and forth, and losing back and forth.

2I have strong opinions and never trust anyone alone. I rely on the analysis of various teachers and make my own comprehensive orders. I saw it right, but I didn't enter the arena because I didn't have confidence. I saw it wrong,

I've done it all, but I've lost and I'm extremely unhappy. I feel like the sky and the earth are dark.

3Under the guidance of a teacher, always placing heavy orders and always looking backwards.

4When you look right, earn a little money and you'll get out. When you look wrong, you'll set or lock orders, and always end up cutting at the lowest point or cutting all the links between heaven and earth.

5The volatile market is doing well, but one day after heavy positions were chased back and forth, I developed a sense of fear towards the market and felt that every day was unilateral and I didn't dare to make orders, but in reality, every day was volatile

(Click on the avatar to view information and join the group. Apply for free and directly join the group to experience the experience. Order at the current price every day)3-5Single)

Group welfare:tinyfysj87 QQ1706407347

① Daily updates: market trends, intraday reminders, and opportunities to build positions.

② New fan welfare: trading tactics《KThe King of Online Trading,Teach you how to do a good job in the short term

③ Welfare delivery: golden short line opportunity layout, continuous tracking (band opening)

④ Special column: private chat, Q&A, solution τ, Analyze the trend of the day.

Luck is the culprit for increasing risk, while hesitation is the culprit for missing opportunities. If the long line is gold and the short line is silver, then the band operation is diamond. Patience is the key to victory, confidence is the guarantee of success. Those who are willing to fight will not be good at it, and those who are good at it will not be good at it. I hope Fang Yuan's article can bring you benefits and ensure smooth sailing in your future investments. If you have any questions, you can talk to me. I am not only a guidance teacher, but also a friend worth making in your life. With rich experience, precise perspective, and sharp judgment, Fang Yuan captures the ever-changing market!

This article is provided by Fang Yuan. I interpret world economic news, analyze global investment trends, and conduct in-depth research on commodities such as crude oil, gold, and silver. Technical Director Fang Yuan provides online solutions, returns losses, and provides one-on-one real-time guidance on WeChat. The above content belongs to personal suggestions. Due to the timeliness of online publishing, it is for reference only, at your own risk. Real time ideas are provided at current prices. Please indicate the source when reprinting.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|