Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Many investment friends always complain about why they always see others making money and losing money as soon as they enter the market. So what Teacher Fang Yuan wants to say here is that investment failure is nothing but two points: firstly, due to their own reasons, they lack experience, and blind operation will definitely cause losses; The second issue is the strength of the guidance teacher. The guidance teacher is not sure about the direction of the market, often shouting for a rebound, causing you to lose money. Fang Yuan personally believes that the most important aspect of investing is not platforms and products, but encountering a competent and responsible mentor. If your abilities are not enough to support your current situation, then you need a Bole to guide you through the maze, a military strategist to help you control the overall situation. One attempt is an opportunity! A choice is a turning point! Fang Yuan has been waiting for you here.

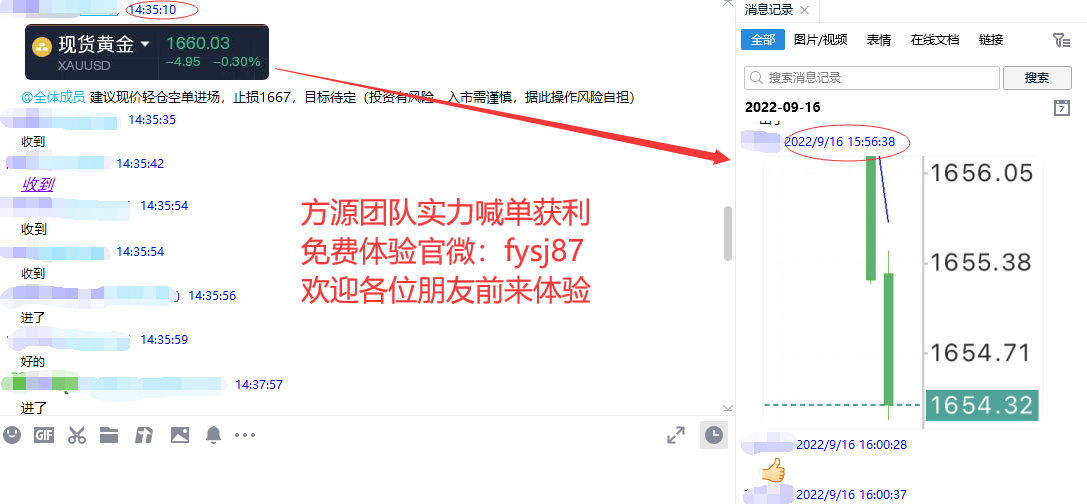

Experience benefits: For friends who have been added to Teacher Fang (official WeChat account:fysj87)The Fangyuan team provides free of charge3Call for orders at the current price to verify your strength.

Here is my current price order within the group. Real time updates every day. I usually have real-time layout of current price orders for everyone to keep up with. As a straightforward person, I won't keep accurate market trends. As long as I have accurate orders, I will enter the group through current price orders!

goldMarket trend analysis;

Monday(9month19day)Entering the European market session, the market remained cautious ahead of the opening of the key central bank week, with losses in European stocks widening and US stocksfuturesDeclining, the US dollar maintains a strong stance and returns once again110Above, gold continued to decline and fell again1670USD. The market is focused on this week's Federal Reserve resolution, which will determine the fate of gold bulls.

With the strengthening of the US dollar, gold has opened a crucial week with a new decline, and investors are paying attention to the Federal Reserve(Fed)Prepare for the interest rate decision, which may bring greater pressure to gold. Gold prices fell on Monday as investors prepared for a major central bank interest rate hike this week, especially the Federal Reserve, to curb high inflation. Spot gold fell more than expected within the day10The US dollar, once lost1660Pass, maximum decline0.9%Continuing the decline in the past month against the backdrop of the continuous rise of the US dollar. The market expects the Federal Reserve to raise interest rates75Basis points, but last week's hot inflation data prompted some to bet that the Federal Reserve will raise interest rates75Basis points.

Today's Monday opening, gold once again1680The high point has started to decline, and so far, the lowest point has reached1660low point. At present, I don't think gold should fall so early. If it starts to fall at the beginning of this week, there will only be an announcement of interest rate resolutions100Gold will continue to decline only when it is a basis point. On the contrary, if we continue to break through low points now1654So, when the interest rate resolution is announced, if it's still75There is a high possibility that gold may rise instead of falling by one basis point.

So, there is a high probability that the current rise and fall of gold this week will affect future interest rate decisions. However, the overall trend of gold is in a downward direction, so I am optimistic that interest rate decisions will continue to lower gold. So, conversely, it is speculated that gold only has room to fall when it rises. If it doesn't rise now, then only100Only when one basis point comes out, there is a possibility of further decline. On the contrary, if it rises now, even if75A basis point will also continue to lower the low point. In summary, I personally believe that gold will continue to rise before the interest rate resolution, which is highly likely1680Not at the current high point. From now on1654-1680Looking at this trend, we can see that1660It happens to be nearby19.1%Position support.

So, there is a good chance that gold will move from1660A trend of bottoming out and rebounding. according to123seek4From a perspective: the final 100% goal can be seen1685Nearby, and1685This happens to be1654-1735The trend of this wave382Suppression point. Next, I think there is a high probability that gold will1660Starting to rebound, we also suggest that you can1660-62Go long near the entry, defend and stop loss1654Below, above target looking towards1670Secondly1680-85。

Operation suggestions: Gold rebound1680Empty, stop loss8US dollars, look1660-1650First line (for reference only, specific point locations will be provided on a firm offer)

gold1660Multiple batches, stop loss8US dollars, look1680-1690frontline (For reference only, specific locations will be provided on a firm offer)

crude oilMarket trend analysis;

The weekly decline in oil prices has raised concerns that a significant interest rate hike will suppress global economic growth and demand for fuel. Oil prices rose slightly last Friday, following a slight increase in Basra, Iraq(Basra)The spill at the dock seems to be limiting the supply of crude oil. Investors are preparing for a significant increase in US interest rates, which could lead to an economic recession and reduce fuel demand. People generally expect the Federal Reserve to9month20-21The policy meeting on the day will raise its target overnight interest rate75Basis points. Energy service company Baker Hughes said that the number of active oil and gas rigs increased last week, the first time in three weeks.

Last week, there was not much turbulence in crude oil, and the overall situation was in a wide range of fluctuations. It has also launched a double dip trend as scheduled, and there have been no signs of stabilization so far. The weekly closing line also appears as a cross star with a long shadow. At the beginning of the week, the trend began to rebound by following last week's trend, and finally, from123.6reach81.2Whole round decline23.6%Golden Section Integer Gate90Under pressure nearby. In terms of news, the US ambassador stated that the oil price ceiling set for Russia will be discussed at the United Nations General Assembly. And stated that there are no plans to meet with the Russian side during the United Nations conference. After the increase in production in the Middle East region and the shift of Russian exports from Europe to the Asia Pacific region, the export volume began to rise, as supply concerns intensified as winter approached, overcoming the impact of weak demand expectations. Negotiations on the Iran nuclear agreement are still possible, and it is expected that oil price fluctuations will become more severe. At present, the weekly and daily trends are not very friendly to bulls, and crude oil may continue to hit a bottom this week, which cannot be ruled out as it directly sets a new low. Suggest short-term attention from above in terms of crude oil operation strategy today87.0-88.0One line of resistance, pay attention below82.5-82.0Frontline support.

(Click on the avatar to view information and join the group. Apply for free and directly join the group to experience the experience. Order at the current price every day)3-5Single)

Real time benefits within the group:

1Daily updates: market trends, intraday reminders, and opportunities to build positions.

2New fan welfare: trading tactics《KThe King of Online Trading,Teach you how to do a good job in the short term

3Welfare delivery: golden short line opportunity layout, continuous tracking (band opening)

4Special column: private chat, Q&A, solution τ, Analyze the trend of the day.

The most important thing in investing is not how much you can earn in a week, but whether you can make stable profits. Short term fluctuations, medium term bands, and long term trends are not good or bad methods. As long as they are suitable for oneself and can achieve stable profits, they are all good methods. As the ancients said, "Don't do small things for good, and don't do small things for evil. The answer to all questions is never unique and unchanging. Whether the market is going up or down, you cannot control it yourself. Only by keeping up with the pulse of the market can you avoid being eliminated. The market cannot always go up or down, and what is certain is that it will always go right.

This article is provided by Fang Yuan. I interpret world economic news, analyze global investment trends, and conduct in-depth research on commodities such as crude oil, gold, and silver. Technical Director Fang Yuan provides online solutions, returns losses, and provides one-on-one real-time guidance on WeChat. Due to the delayed nature of online push, the above content is my personal suggestion. Due to the timeliness of online posts, it is for reference only and at my own risk. Real time ideas are provided at the current price. Please indicate the source when reprinting.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|