Driven by intelligent cloud services, Baidu's revenue in the second quarter slightly rebounded compared to the first quarter, benefiting from cost optimization measures and a significant rebound in the group's net profit.

8month30On the th, Baidu released a report as of2022year6month30Unaudited financial report for the second quarter of the year. Overall, Baidu's performance in the second quarter was better than market expectations.

The financial report shows that driven by intelligent cloud services, Baidu's revenue in the second quarter decreased slightly year-on-year, but slightly rebounded compared to the first quarter. Thanks to cost optimization measures, the group's net profit significantly rebounded, achieving a turnaround from losses to profits.

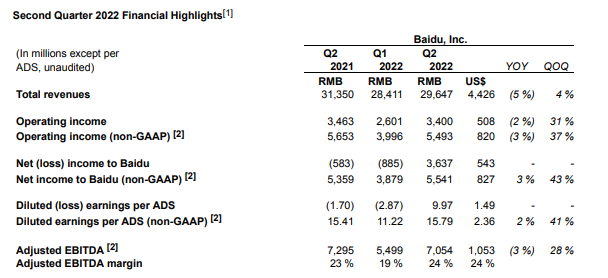

Year-on-year decrease in revenue5%

2022In the second quarter of this year, Baidu achieved revenue296.47100 million yuan, a year-on-year decrease5%, month on month growth4%Exceeding expectations294.11RMB100mn ;

The net profit attributable to the listed company is36.37100 million yuan, with a loss of the same period last year5.83RMB100mn Net profit attributable to the listed company(Non-GAAP)Reaching55.41100 million yuan, year-on-year growth3%, month on month growth43%Exceeding market expectations;

Adjusted EBITDA70.5RMB 100 million, a year-on-year decrease3%, month on month growth28%Higher than expected54.7100 million yuan:

AdjustedADSprofit15.79Yuan, year-on-year growth2%, month on month growth41%Higher than expected9.81Yuan.

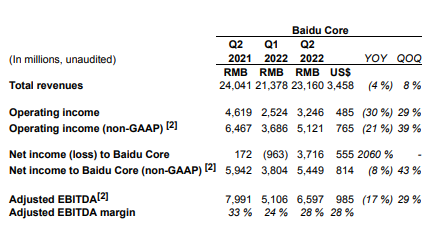

Core business revenue decreased year-on-year4% Intelligent cloud revenue increased year-on-year31%

Baidu's core revenue in the second quarter231.6100 million yuan, a year-on-year decrease4%Higher than expected225.9One billion yuan, with online marketing revenue of171100 million yuan, a year-on-year decrease10%。 Non marketing revenue is61100 million yuan, year-on-year growth20%Mainly driven by cloud services and other factors. The proportion of Baidu's core R&D expenses to Baidu's core revenue is continuous7More than quarters20%。

The revenue from iQiyi in the second quarter is67100 million yuan, a year-on-year decrease13%。

At an analyst conference held in the evening, Baidu stated that its advertising business significantly decreased in the second quarter due to the impact of the macro environment. among4Month and5The month was severely hit, involving tourism in the retail industry, local services, and healthcare. Subsequently6Since the beginning of the month, it has rebounded rapidly. But looking ahead to the second half of the year, the macro environment is still full of uncertainty, and advertising revenue continues to be under pressure.

In addition, Baidu's core operating profit margin in the second quarter(Non-GAAP)Da22%Compared to the first quarter17%rise5Percentage points. In response, Baidu Chief Financial Officer Luo Rong stated that the increase in core operating profit margin is due to the company's achievements in reducing costs, increasing efficiency, and improving operational efficiency.

From a specific business perspective,

In the second quarter, Baidu AI Cloud's revenue grew year-on-year31%, month on month growth10%。stayAIPublic cloud domain, according toIDCIt is reported that Baidu AI Cloud has obtained theAIThe market share of public cloud services ranks first.

Baidu stated that the rapid growth of intelligent clouds is driven by enterprises and public service sectors. Chinese public sector enterprises are in the early stages of digital and intelligent transformation, and the demand for high-performance intelligent systems will further increase in the future. The company is confident that cloud revenue from the enterprise and public service sectors will continue to grow in the future. However, there are still some uncertainties in the short term.

In terms of autonomous driving, the operation scale of Baidu's autonomous driving travel service platform, Radish Run, continues to expand, and in the second quarter, it provided28.7Ten thousand ride services, a year-on-year increase of nearly500%。 by2022year7month20Day,The cumulative order quantity of Radish Run has reached10010000 orders。

In terms of cost reduction, Baidu stated that the company has reduced the number of features and configurations specifically designed for drivers and placed more emphasis on passenger experience in design. In the future, as China's autonomous driving industry continues to develop, the cost of Baidu's autonomous driving robots will continue to decrease.

In the field of intelligent transportation, as of the end of the second quarter, calculated based on orders with a cumulative contract amount exceeding RMB 10 millionBaiduACEThe intelligent transportation solution has been51Adopted by cities, with a coverage range greater than that of a year ago20Cities continue to improve.

During the conference call, some institutions pointed out that the contract growth for autonomous driving solutions in the second quarter was weak compared to the first quarter. In response, Baidu stated that autonomous driving is an unstoppable development trend for cars, and the company will collaborate with more car manufacturers to launch market solutions for more and more car models within the next two years. At that time, autonomous driving solutions will begin to generate a lot of revenue.

On the user side, BaiduAppThe user scale has steadily increased.6Month, BaiduAppThe number of monthly active users has reached6.28100 million, year-on-year growth8%Proportion of daily login users84%。

Baidu stated that in the futureContinue to increase investment in areas such as artificial intelligence cloud and intelligent drivingThese businesses have grown rapidly in the past three quarters. For mobile ecosystems, we will constrain investment.

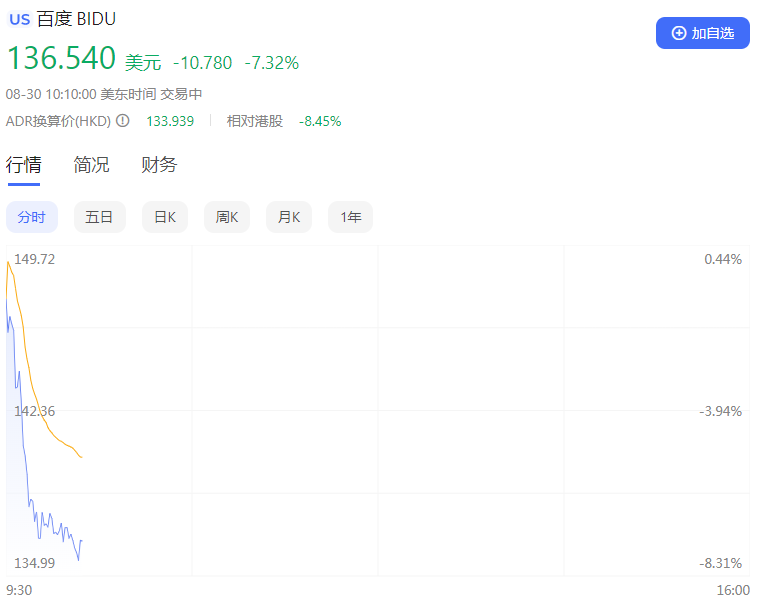

After the financial report was released, Baidu's US stock price rose first and then fell, with a current decline of7.3%Report136.5The US dollar briefly rose before trading5%。

Risk Tips and Disclaimers

There are risks in the market, and investment needs to be cautious. This article does not constitute personal investment advice, nor does it take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, viewpoints, or conclusions in this article are in line with their specific situation. Invest accordingly and take responsibility.