The domestic pig prices in the first quarter of this year were relatively low, while they rebounded in the second quarter, resulting in a significant narrowing of the loss margin of Muyuan Group in the second quarter compared to the first quarter. Overall, Muyuan Group's net loss in the first half of the year66.8100 million yuan, while the net profit for the same period last year95.26RMB100mn

In the first half of this year, pig prices fluctuated, and the main business of "Pig Raising Brother" Muyuan Co., Ltd., pig farming, experienced significant losses.

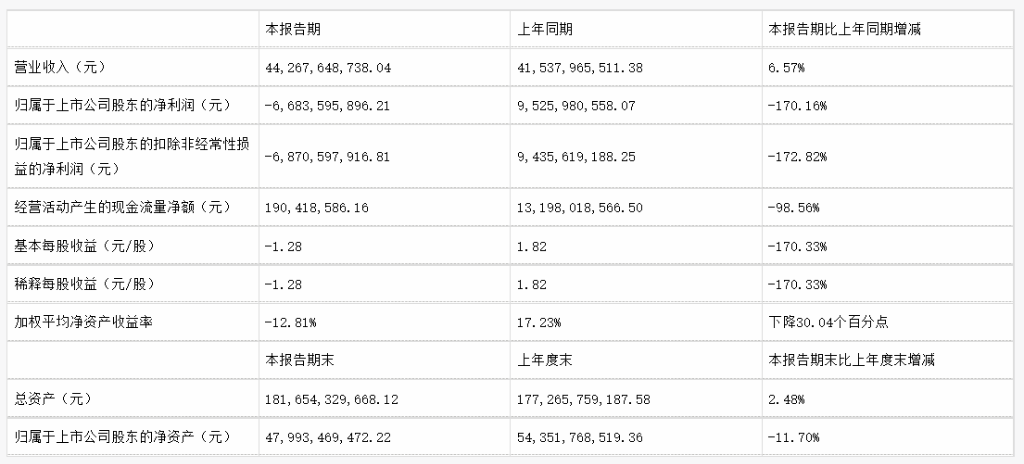

8month30On the th, Muyuan Shares announced its semi annual performance report. According to the financial report, the company2022The operating revenue achieved in the first half of the year is442.68100 million yuan, year-on-year growth6.57%。

It is worth mentioning that during the reporting period, the company's net profit attributable to the parent company was-66.84100 million yuan, a year-on-year decrease170.16%And the net profit for the same period last year was95.26RMB100mn Deduction of non net profit-68.71100 million yuan, a year-on-year decrease172.82%; Basic earnings per share-1.28RMB, basic earnings per share for the same period last year1.82Yuan.

Among them, the second quarter single quarter revenue of Muyuan Group is approximately260100 million yuan, with a month on month growth of nearly43%; The net loss attributable to the parent company in the second quarter is approximately15One hundred million yuan, a month on month decrease exceeding70%。

Regarding the reasons for the losses, Muyuan Shares stated that during the reporting period, the prices of live pigs significantly decreased compared to the same period last year, while the prices of feed and raw grains increased significantly.

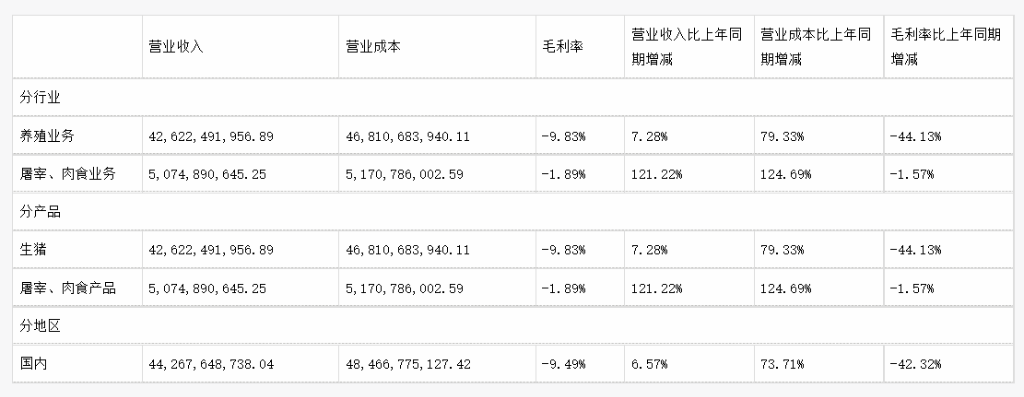

The main business of Muyuan Group is pig breeding, sales, and slaughter. Among them, the proportion of revenue from pig farming business is as high as96.28%。 Therefore, the operating situation of Muyuan Group is greatly affected by the cyclical fluctuations in the pig industry.

In the first half of this year, the pigs of Muyuan Group sold live pigs together312810000 units, with sales increasing compared to the same period last year79.39%Among them, commercial pigs2697.7Ten thousand piglets409.3Ten thousand, breeding pigs21.1Ten thousand heads.

In terms of pig prices, in the first quarter of this year, domestic pig prices were at a low level,4After the month, it gradually showed a rebound trend, which led to a significant narrowing of the loss margin of Muyuan Group in the second quarter compared to the first quarter. Its net profit attributable to the parent company in the first and second quarters were-51.80100 million yuan and-15.03RMB100mn

In terms of pig farming costs, Muyuan Stock stated that in the first half of this year, due to factors such as the continuous rise in grain prices and the impact of winter epidemics, the cost of pig farming increased year-on-year79.33%Gross profit margin decreased year-on-year44.13%。

Faced with the dual pressure of pig prices and costs, Muyuan Stock stated that the company will adjust its formula in a timely manner based on the changing trends of the grain market, adopt flexible procurement strategies, and exchange raw materials between different varieties to reduce procurement costs.

Risk Tips and Disclaimers

There are risks in the market, and investment needs to be cautious. This article does not constitute personal investment advice, nor does it take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, viewpoints, or conclusions in this article are in line with their specific situation. Invest accordingly and take responsibility.