Analysis of GBP and key points of conversation

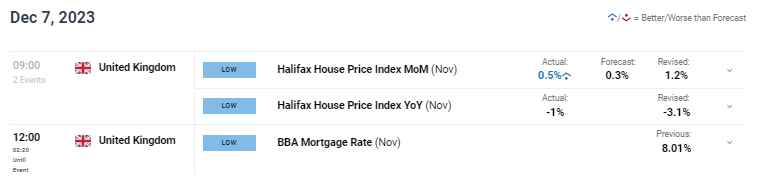

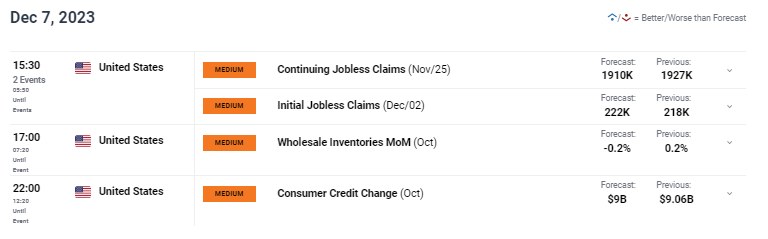

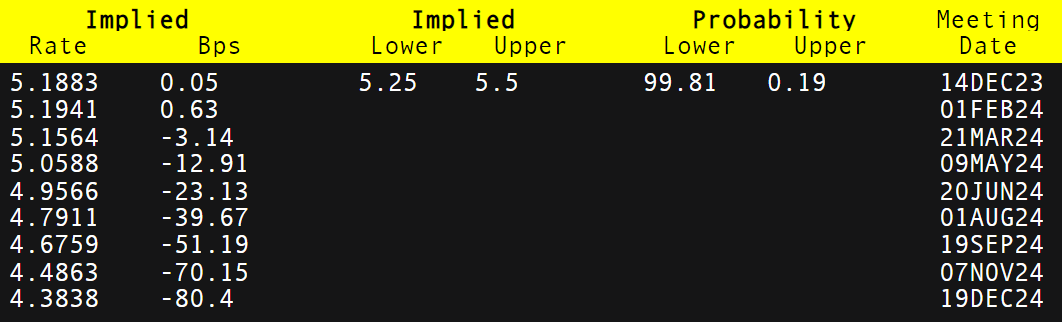

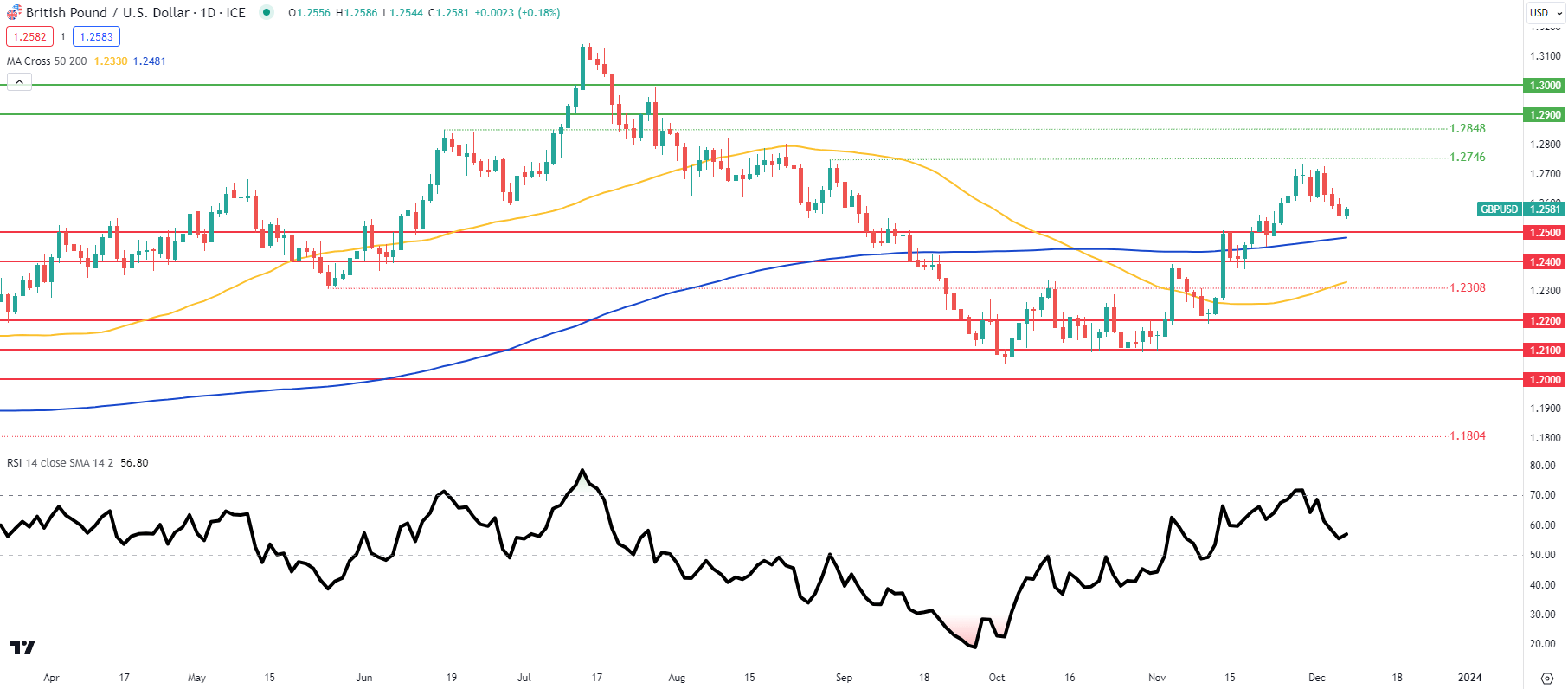

Background of GBP/USD FundamentalspoundStill sluggish, but attempting to seek support this morning after an unexpected month on month increase in housing prices (see economic calendar below)。foreign exchangeThe market is relatively calm, and tomorrow's non-agricultural employment (NFP)Before the report, there was almost no arrangement of high-impact economic data。Yesterday, the construction industry in the UK PMI Data is weak, andBank of England (BoE)President Andrew Bailey (Andrew Bailey) The impact is minimal, and now the focus is shifting to the United States seeking guidance. pound/dollarEconomic calendar(GMT +02:00)   Source:DailyFX Economic Calendar Later today, the unemployment benefit application data will be closely monitored, especially the number of first-time applicants, as this statistical data shows any new/The emerging unemployment situation.yesterday ADP The employment changes did not meet expectations, but considering their recent relationship with NFP The disconnection of data will result in the market largely ignoring its predictive ability. The Bank of England's money market pricing (as shown below) has been "moderately" repriced, andNext timeBefore the interest rate announcement, only the UKGDPAnd the UK employment report, these two data points will have a significant impact on future pricing. Probability of Bank of England interest rates  Source: Lu Fute technical analysispound/dollarDaily chart  Chart byWarren Venketas pound/USD per dayPrice trendApproaching critical support level1.2500 psychologyGateway/ 200 Daily moving average(blue), because the currency pair has detachedRelative strength index (RSI)Display the overbought area.The short-term directional deviation will come from tomorrow's non farm employment data, which is expected to rise and may continue the recent downward trend of the pound. Key resistance level:

Key support positions:

|