euro/USD analysis

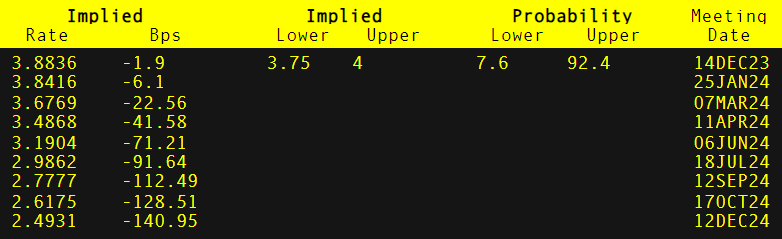

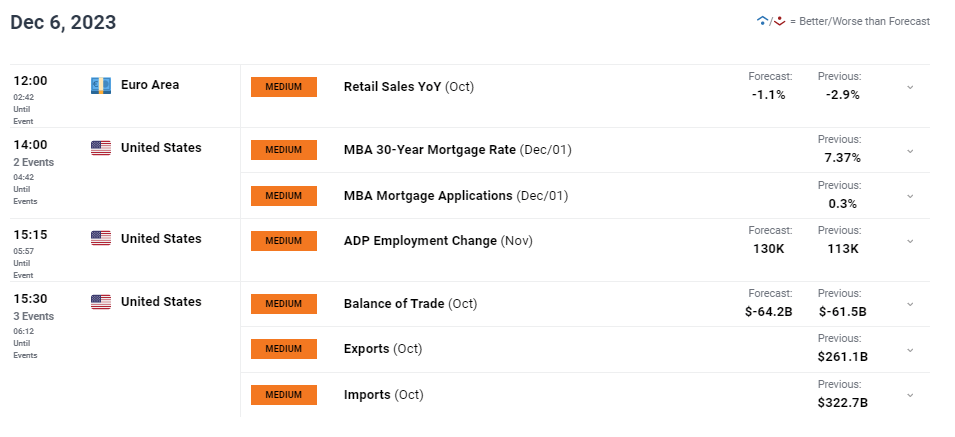

Background of Euro FundamentalseuroAfter several consecutive days of closing decline, it opened flat this morning。Weak economic data in the Eurozone, including yesterday's comprehensive and service sectorsPMIStill in the contraction zone, andnext 12 Monthly economic negativeThe growth is intensifying day by day(European Central Bank (ECB)Investigation).The factor exacerbating the decline of the euro is that the United States ISM Service industry PMI Unexpected upward trend, despite JOLT The opening did not reach the target 2023 Annual minimum level. European Central Bank officials have recently become increasingly dovish, reflected in the rate path of European Central Bank money market pricing (see table below): Probability of European Central Bank interest rates  Source: Lu Fute Market forecast for the first roundInterest rate reductionWill be on 2024 year 3 Around the month, if the economic data in the eurozone continues to be weak, it may have a real negative impact on the euro.This major repricing was announced by the European Central Bank's Schnabel (known as the hawk)“inflationAfter the encouraging development and significant decline in core prices. Later today, retail sales in the Eurozone will become the focus, and the main driving factor for volatility may come from Friday's non farm employment data ( NFP ) Previous ADP Employment changes.Neger of the European Central Bank also plans to give a speech and provide some additional insights on the ECB's ideas. Economic Calendar (GMT+02:00)  Source:DailyFX Economic Calendar technical analysiseuro/dollarDaily chart

Chart byWarren Venketas , IGmake Aboveeuro/USD DayThe line graph shows that the currency pair is below200 Daily moving average(Blue) and1.0800 psychologyGateway.Relative strength index(RSI)Now it is indicated that there is a tendency towards a downward trend, taking into account 50 Daily moving average (yellow)1.0700And trend line support (black). Resistance level:

Support level:

|