新西兰元的要点和分析

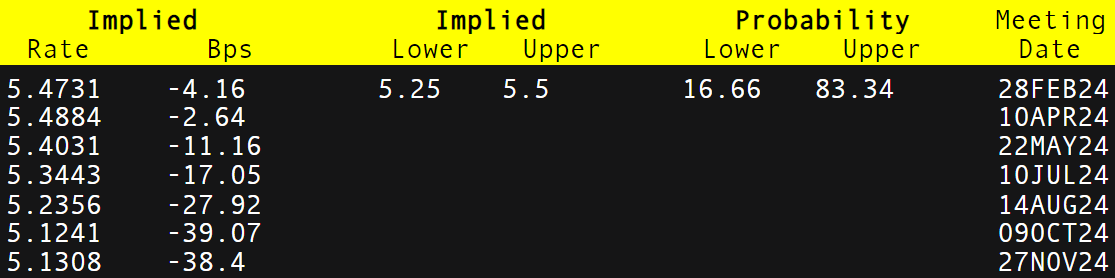

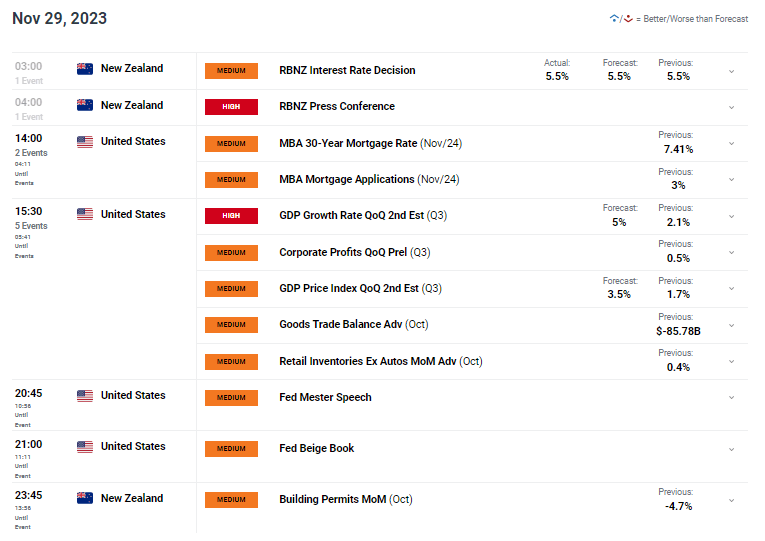

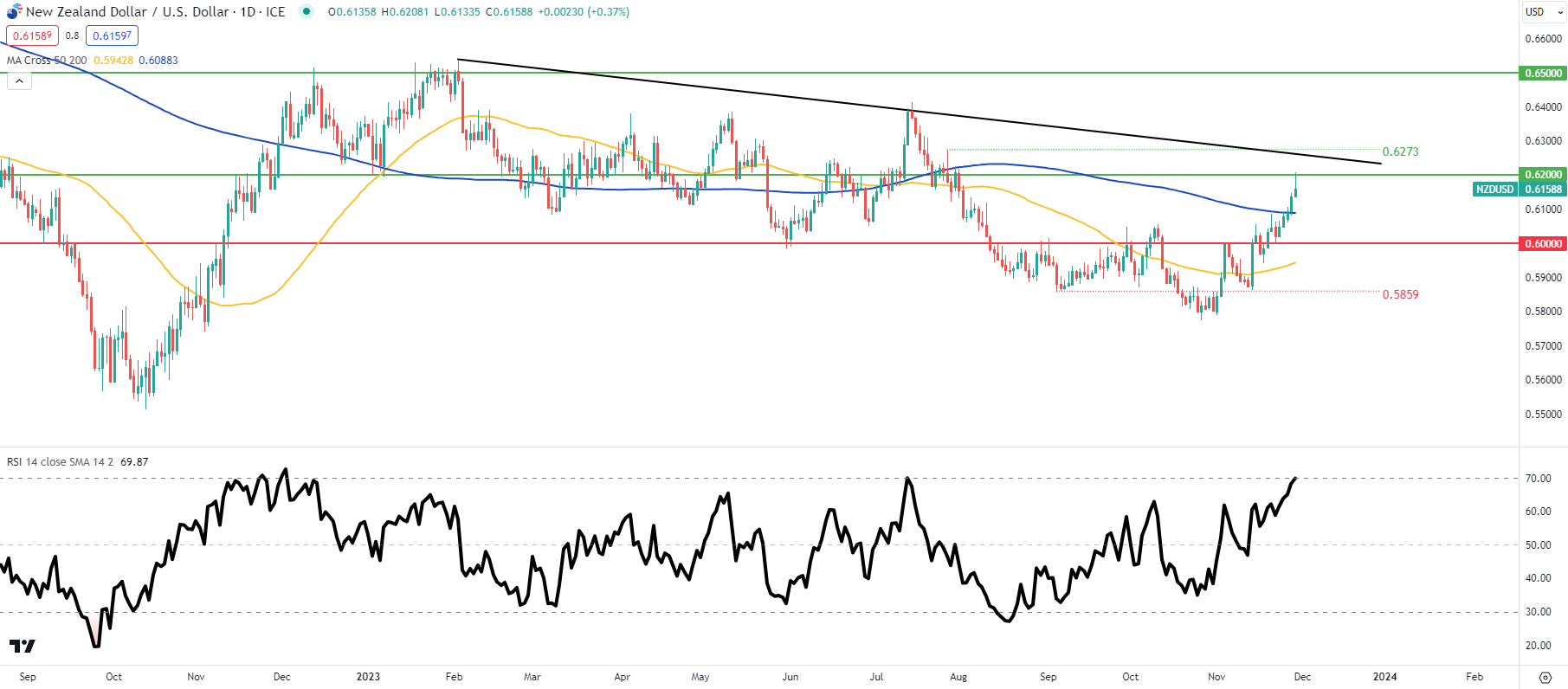

新西兰元基本面背景今天上午早些时候,在美元走软and新西兰储备银行(RBNZ)interest rate决定的推动下,新西兰元rise。althoughCentral Bank维持利率不变(见下文经济日历),但新西兰联储行长奥尔设定了相当鹰派和权威的基调。需要考虑的一些关键陈述如下所示: “我们很担心inflation长期以来一直处于区间之外。” “十年期inflation预期正在攀升。” “我们担心长期通胀预期正在攀升。” “全球利率对我们来说确实很重要,我们非常关注这一前景。” “我们说,未来一段时间内利率需要保持在如此高的水平,银行应该倾听。” “我们不受政策会议日期的约束,如果需要,可以针对冲击采取行动。” 显然,货币市场预计 2024 年不会再加息,但数据依赖将是一个关键驱动因素。如果通胀数据保持上升趋势,新西兰联储很可能会果断决定再次收紧货币政策。 新西兰联储利率probability  Source: Lu Fute Federal Reserve最著名的鹰派人物之一威廉姆斯转变为不那么激进的语气后,dollar昨天大幅下跌。威廉姆斯暗示,如果通胀继续下降,可能不会进一步加息和降息。隐含的联邦基金futuresDisplay,reach 2024 year 12 月,美国国债收益率将在整个曲线上延续跌势,从而温和地重新定价,累计降息约25 Basis points.今天晚些时候,美国国内Gross Domestic Product、其他美联储发言人和美联储褐皮书将在明天关键的核心个人消费支出(美联储首选的通胀指标)公布之前成为焦点。 Economic calendar(GMT +02:00)  Source:DailyFX Economic Calendar technical analysisNew Zealand dollar/dollarDaily chart  Chart by IG Warren Venketas prepare New Zealand dollar/USD per day价格走势显示,随着该货币对在相对强度指数 (RSI)上进入超买区域,近期上行货币对已脱离0.6200 psychologyResistance level.传统上,市场将寻求回调,特别是如果当前蜡烛以长上影线收盘,但如果进一步实行鸽派偏见,新西兰元可能还有进一步走强的空间。短期方向性偏差在很大程度上取决于美元走势,但从技术分析的角度来看,我倾向于纽元走软。 Key resistance level:

Key support positions:

|