euro/USD analysis

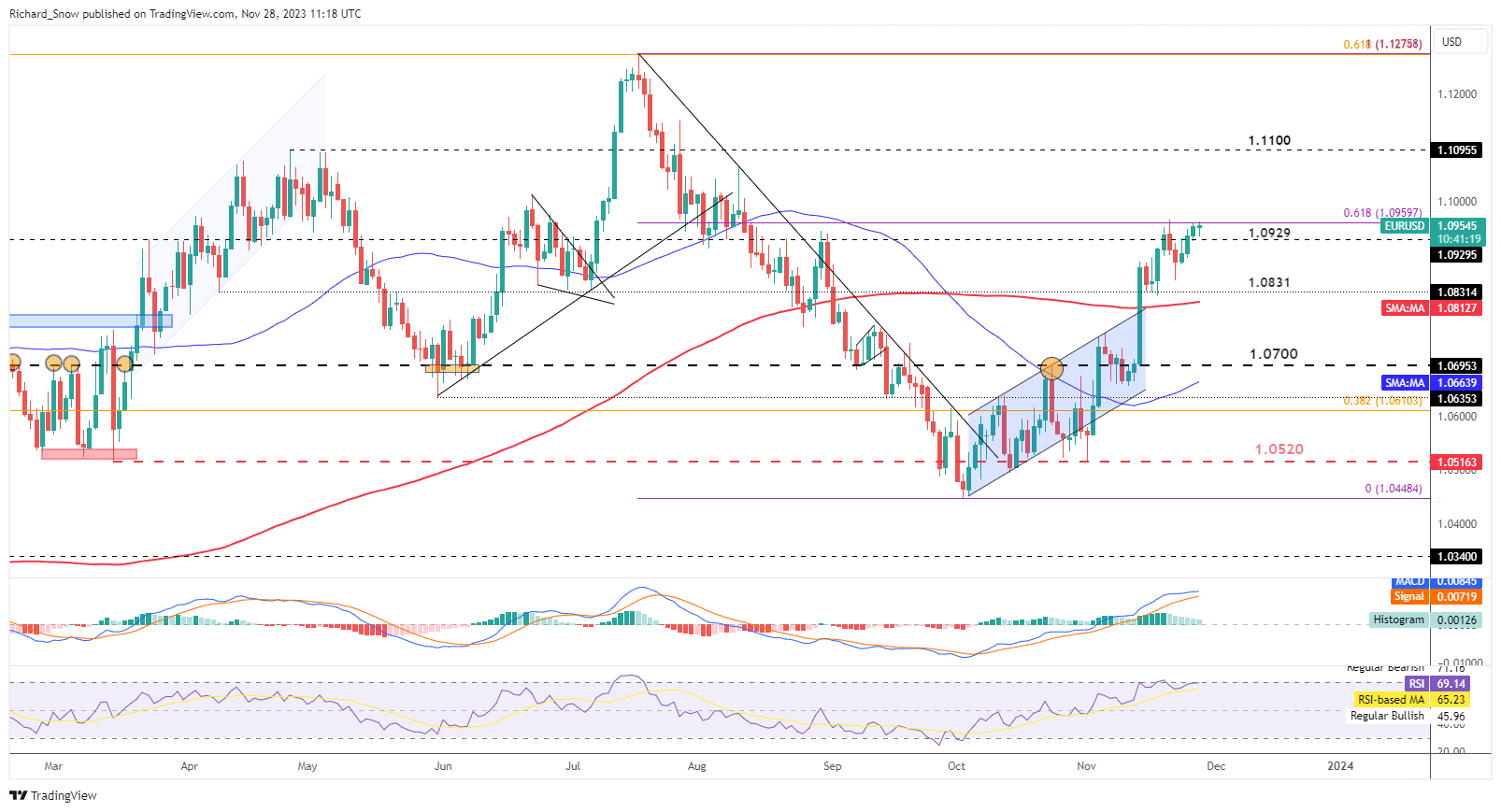

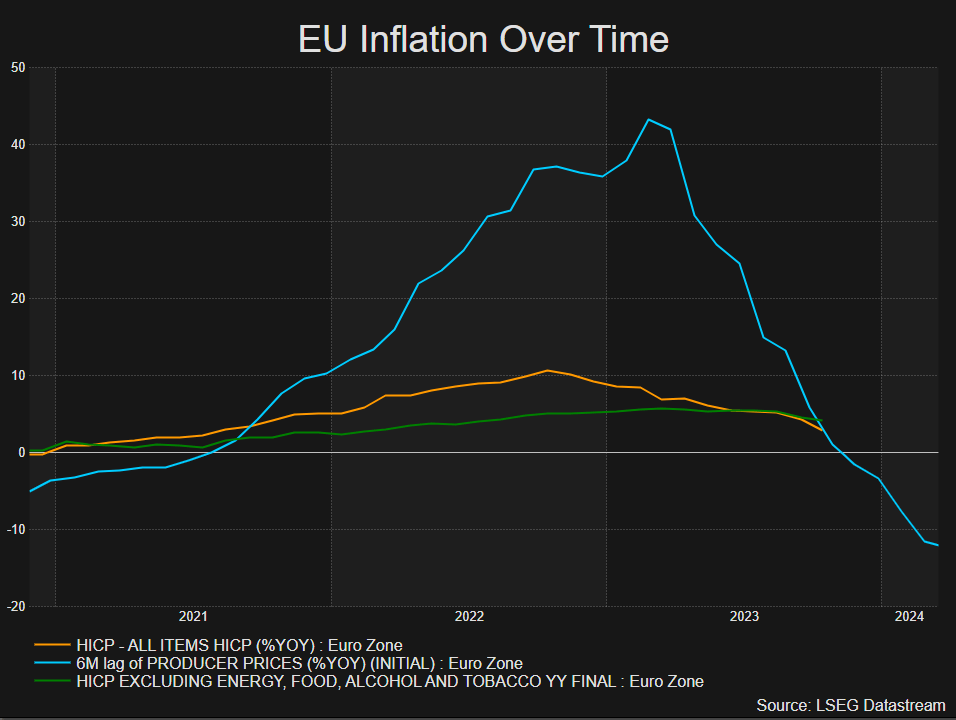

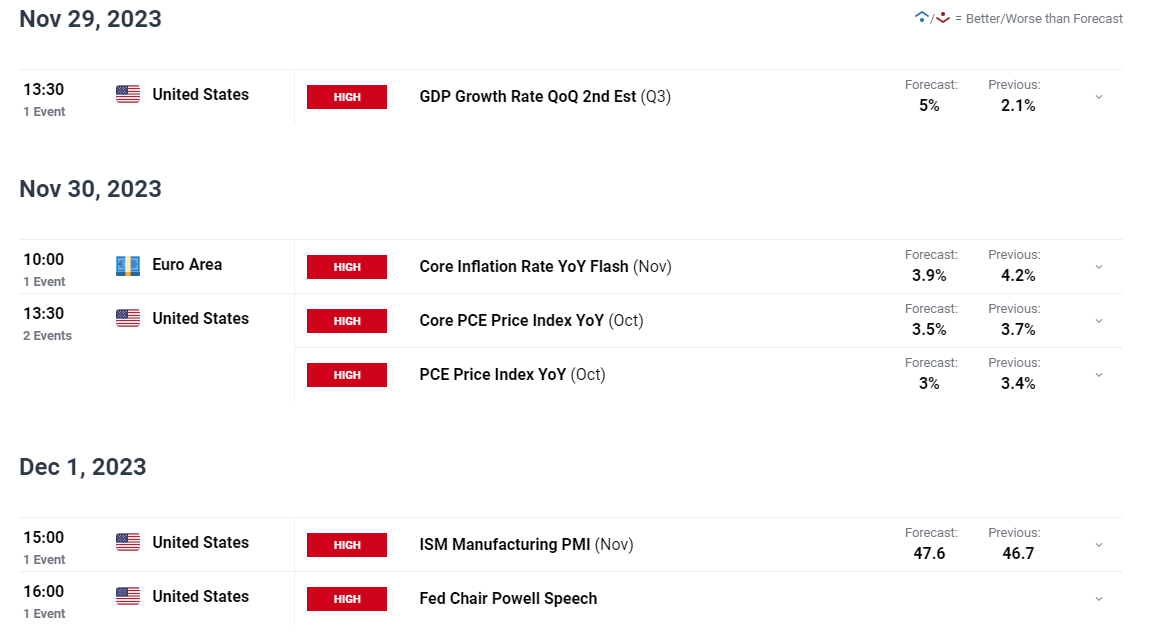

euro/The US dollar found temporary resistance before important data was releasedeuro/dollarCurrently testing 11 month 21 Day high and continue to trade on 200 Daily Simple Moving Average (SMA) upper.Later this week, the bullish trend may faceU.S.AGDPAnother test of the data (second estimate), as the estimate shows that the world's largest economy performed stronger in the third quarter, which may weigh on the euro in the near future/The bullish trend of the US dollar. Better than expected EU inflation data (lower than expected) may also provide a catalyst for a pullback, whileRSIEntering the overbought area soon andMACDOther signs of slowing momentum due to bearish crosses.However, it must be pointed out that neither of these conditions has been met, and in this case, the upward level still exists.Resistance level 1.0960 Rising all the way to 1.1100There is almost no change in the middle.Supporting position1.0831and200Moving average. euro/USD daily chart  Event risk for the remaining time of this weekAccording to advanced data, the annualized growth rate of the US economy is as high as 4.9% Afterwards, in the third quarter of the United States GDP A second estimate will be made.Despite a slowdown in economic data in the fourth quarter, consensus forecasts show slightly higher levels as more data permeates 5% It is predicted that the increase in the third quarter will be limited.If we see an upward correction, the euro/The US dollar may encounter temporary resistance, but consolidation is expected to be brief as more current (weaker) data provides more accurate economic indicators. estimate 11 The monthly EU inflation data will be displayed 11 The month saw another encouraging decline, both in overall indicators and core data (inflation minus volatile energy and food prices).The following chart suggests that compared to other developed countries, the EU's inflation decline rate may be the fastest.Producer price inflation measures the upstream price trend at the factory entrance, ultimately resulting in a value of approximately 6 The lag time of one month permeates into a wider range of economic sectors.PPI Severe negative values (deflation) indicate that more widely followed inflation measures may soon emerge, which will force the European Central Bank to seriously consider lowering interest rates to revive a weak economy.In the long run, as the interest rate spread widens, this result will lead to a weakening of the euro. EU Inflation (Title HICP Inflation, Core HICP Inflation and PPI)  Source:TradingViewRichard Snow (Richard Snow)write  |