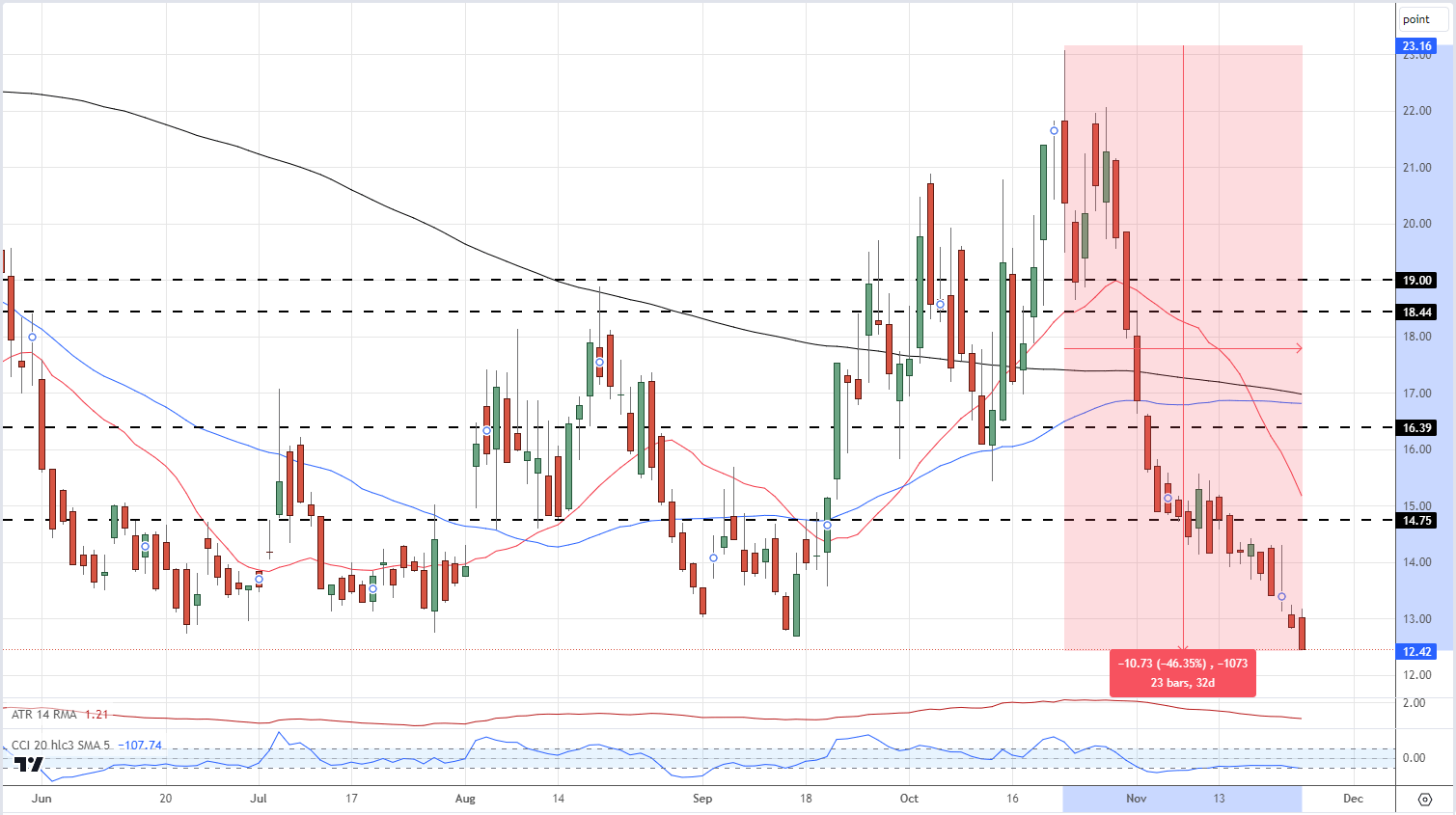

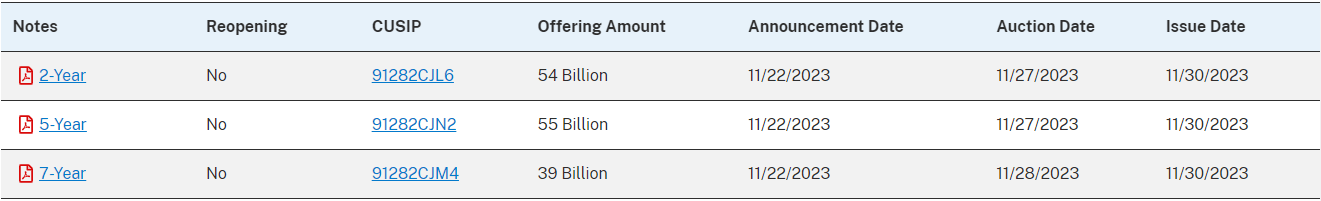

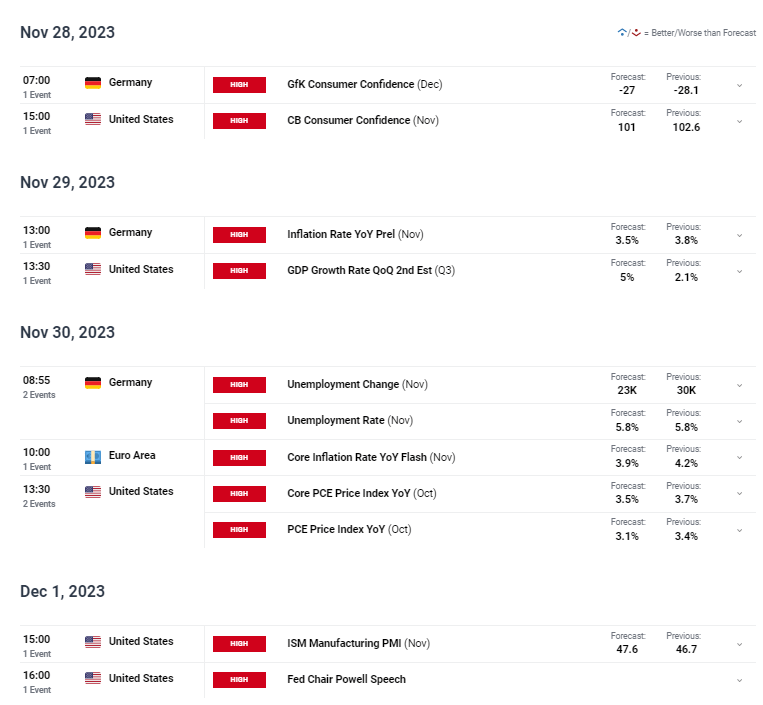

The market still faces risks, with a series of US stock markets reaching new highs in several months.VIX The most recent time the "fear indicator" was in 2020 The low point at the beginning of the year, compared to 10 At the end of the monthofThe peak drop exceeds 46%。The feeling of interest rates peaking around the world is becoming increasingly strong, which exacerbates people's positive feelings. It is expected that 2024 Interest rates will be lowered by the end of the second quarter of this year, and may further rise in the coming months.VIX Daily chart Although the yield of US treasury bond bondsSlightly rising, but the US dollar is still at a disadvantage, just one step away from reaching a new several month low。Large quantities will be sold next week 2 Term5 Period and 7 The one-year US treasury bond bond 1,480 Before the billion dollar bill went public, the market seemed to be pushing for higher yields.  Next week, some highly influential economic data will be released, with the most notable being domestically produced in the United StatesGross Domestic Product、eurozoneAnd the United StatesinflationThe second round of data.Federal Reserve Chairman Jerome Powell also delivered a speech this weekend.  |