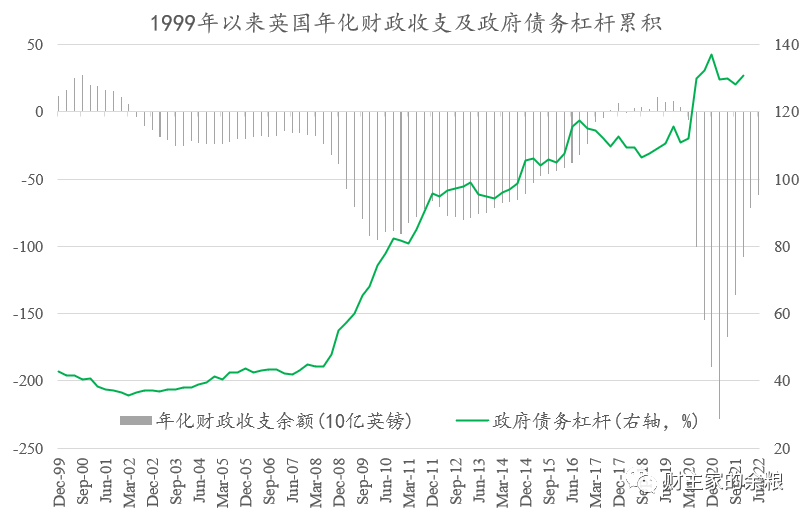

Last week'sThe exchange rate between the pound and the US dollar has reached a record high200The worst record of the year. Why is the current UK economy so poor?Why is the current pound so miserable? The reason is actually2Article:1)Government fiscal deficit;2)Import and export trade deficit. As for Truss's tax cuts and the Federal Reserve's interest rate increase, they are just two stones that have been hit successively while the pound fell into the well.since2007-2008Since the US subprime crisis and the global financial crisis in, the UK economy has never actually slowed down!2008Since the financial crisis in, in order to rescue financial institutions, coupled with the prevalence of the concept of Big government, the British government's fiscal expenditure has grown rapidly, far exceeding the growth rate of income, running high deficits year after year, which has resulted in the continuous accumulation of government debt.

Data source: Dongfang WealthChoice The money collected by the government's finances is far from enough to spend. They always borrow money, but in the end, they can't print money to solve it?On the other hand, since1999Since the beginning of the year, the UK has had a trade deficit for the majority of its import and export trade, with more imports and less exports, and has been particularly severe recently.Data source: Dongfang WealthChoice especially2021Since the end of the year, with the rise in overseas energy and commodity prices, imports from the UK have generally become more and more expensive, and the trade deficit has even reached new highs, which is stabbing the UK economy!To put it in our particularly popular words,If you earn less and spend more, and the currency does not depreciate, then there is no reason.Some people may say, isn't the United States always like this?The government's expenditure far exceeds its income every year, borrowing money every month and year;Trade imports and exports have always been running in deficit, spending more every year than earning, and still increasing.Why doesn't the US dollar depreciate and continue to appreciate?The answer is simple,The US dollar is the world currency, and there are always buyers who want it. More importantly, the United States also has the largest, deepest, and widest financial market in the world,50Trillions of dollars in US stocks,50With trillions of dollars in US bonds, as well as a large amount of commodity and derivative trading, countless people (including many British people) need to exchange their money for dollars in order to enter the US financial market.On the other hand, despite the soaring energy prices in Europe, the United States is still one of the world's energy exporting countries.Simply put, the balance of payments statement includes two accounts:Current account: including the import and export of goods, labor services, investment income and unilateral transfer of companies;Capital and financial projects: including capital transfer (investment donations and debt cancellation), purchase and sale of land and intangible assets, direct investment, securities investment, international credit, prepayments, etc. Don't look at the huge trade deficit in goods in the United States every year, but they have a huge surplus in services, capital, and financial projects every year. Most of the dollars earned by foreigners have returned to the US financial market. This sustained strong buying ensures that the US dollar will not depreciate too much.Can there be such a large financial market in the UK?Can there be such strong buying power in pounds?Simply put, the current problem with the UK economy is:Without the life of a prince or princess, but with the illness of a prince or princess.Originally, the British economy did not2008In the financial crisis of the year, it came to an end2020In, the epidemic crisis came again, and the federal government of the United States did not speak martial arts and tried hard to make money to the citizens, which made other developed countries have to follow suit, and the United Kingdom also gritted its teeth and followed suit, leading to2020At the end of the year, UK government debt/GDPSkyrocketing to137%。get into2022In, global inflation began, and the outbreak of the Russo Ukrainian War further fueled the fire. The prices of various goods that Britain needed to import rapidly increased, spending more money than before but buying fewer things. In order to maintain the appearance of developed countries, the British people still insisted on buying and selling. In the past few quarters, Britain's trade deficit has been continuously maintained at historical highs.The castle on the sand pile was almost pushed by hand.Data source: Dongfang WealthChoice from2022year4In January, as inflation intensified, the Federal Reserve began a violent interest rate hike, especially recently3Second, all of them are interest rate hikes75A basis point, and the dot matrix after the recent Federal Reserve interest rate meeting shows that,2022At the end of the year, the benchmark interest rate for the US dollar will be raised to4.25%……by comparison,9month22On the day, the Bank of England put on a show of controlling inflation, but stingily only added50The interest rate difference between the United States and the United Kingdom exceeded everyone's expectations. At the same time, the Truss government announced its huge tax reduction plan. The superposition of the two factors broke the psychological defense of investors.From treasury bond to stock market, selling suddenly surged out.The value of the pound naturally collapsed!However, if I analyze the value of the pound from the perspective of the yield difference of treasury bond, I think the current pound US exchange rate is also too absurd.According to the latest data, the yield of 10-year British treasury bond bonds is3.83%, the yield of 10-year US treasury bond bond is3.69%The difference between the two (beauty-English-0.24%According to historical data from the past few decades, the difference in yields between the UK and the US, corresponding to the pound US exchange rate, should also be at its lowest1.3about.The current pound US exchange rate has fallen to1.08It's really a bit outrageous.Data source: Dongfang WealthChoice If you ask, what profound troubles are there in the British economy?

In fact, one word can summarize:Debt.Not only is this a problem for the UK, but the recent depreciation of the yen is also a similar issue, and because the Japanese government's debt is higher, it is even less likely to raise interest rates.Whether in the UK or Japan, abnormally high government debt2022In the zero interest rate era before, it didn't seem like a big problem because everyone was close to0The interest rate of. But once the United States starts raising interest rates, the interest rates of the US dollar will suddenly rise, while the interest rates of your pound and yen are still so low. How can you do without depreciation?Of course, this is not the first time Britain has encountered such a problem. Since the end of World War II, Britain has always had this problem, with huge government spending, debt burden, and economic downturn. At that time, there was even a term called "British disease", which specifically refers toThe high government debt and inability to reduce social welfare have led to the inability of the economy to function properly.For example, from1943From the end of the year to1947At the end of the year, the proportion of total debt in the UKGDPThe proportion of250%Ascend to400%With such a high debt leverage ratio ratio, if the currency does not depreciate, the fairy will not be able to become British Prime Minister.The above article content only represents the author's own viewpoint and is not related to Huiyi Interactive. If there are infringement issues with the content of the work, please contact Huiyi Interactive in a timely manner. |