Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

[blockquote]

Trump launches a tax war

[/blockquote]

Previously, the corporate income tax rate in the United States was approximately35%Now Trump is going to be reduced to15%The meaning is very clear - encouraging American companies to invest domestically, while also encouraging companies from other countries to invest in the United States.

If the United States really achieves such a significant tax reduction, it means that the profits made in the United States will be much higher than those made in China. This has a huge impact on China, which is known as the "world's factory".

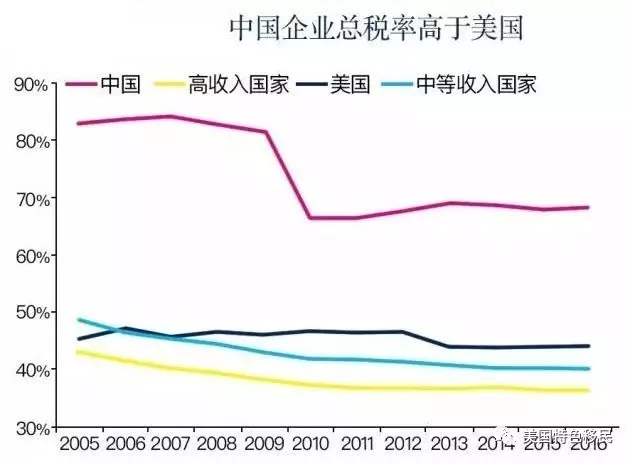

Last year, "Glass King" Cao Dewang pointed out that the comprehensive tax of China's manufacturing industry is higher than that of the United States35%And it is the highest in the world. When the United States cuts taxes again, the comprehensive tax burden on China's manufacturing industry is nearly higher than that of the United States50%Yes.

So, does China's manufacturing industry still have competitiveness?

As soon as Trump's tax reduction plan was launched, many Chinese people were scared and foolish. Let me break open Trump's financial nuclear weapons to show you.

1.The US government may be closing down again

4month29Number, is the first time Trump has taken office in the White House100For every US president, the first 100 days of his tenure in the White House are important days to showcase his New Deal achievements. However, on such an important day, Trump almost lost his job temporarily,Because the White House has hit the debt ceiling again and is about to close, this time the ceiling is19.9Trillion US dollars.

As a result, the US House of Representatives and Senate successively passed temporary funding bills, allowing the US government to continue obtaining financing until5month5Day, avoiding President Trump's inauguration100Tianyi is facing the embarrassing situation of government shutdown. However, in the coming week, both houses of Congress will continue to discuss whether to raise the debt ceiling1Trillion dollars, enabling the US federal government to continue operating until9month30Day. If the discussion fails, the US federal government will5month5It will be closed next Friday.

What exactly is the reason for the government's shutdown?

Simply put, the power of budget allocation is in the hands of the United States Congress. If Congress does not pass the budget, it means that the government cannot spend money, many departments that need to spend money are unsustainable, and employee salaries will be difficult to pay. Only by shutting down the doors will it be possible.To pass the new budget, the debt ceiling needs to be raised, as the US government's budget is largely maintained through borrowing.

2.Decompose the financial ceiling--A House of Cards in a Two Party Game

Since the US government has been relying on borrowing to maintain its operations for so many years, why bother to make the government shut down? Because the debt ceiling is an excellent leverage for the struggle between the Democratic Party and the Republican Party, it would be a pity not to use it.

For example,2013year10month1On the day, the Obama administration hit the debt ceiling and was forced to shut down, largely because the Republican Party in Congress used it to blackmail Obama to end spending on Obama's healthcare related funds. What does that mean? Obamacare is about providing subsidies to the poor to buy healthcare, and the Republican Party's demand to stop these subsidies is equivalent to killing Obamacare. Obama refused, and the Republican Party apologized. We didn't raise the debt ceiling through a bill, and as a result, the Obama administration shut down.

Who knew that this time it was the Republican Trump administration's turn to shut down,Before the Democratic Party in Congress could negotiate terms, Trump mistakenly demanded that Democratic lawmakers agree to an increase in the new budget bill300Billions of dollars in defense budget and billions of dollars in budget expenditures for immigration law enforcement agencies, as well as cuts180A full budget expenditure of billions of dollars, otherwise he will have the government stop spending on Obamacare.

So the problem is that even maintaining the government's operations would require reaching the debt ceiling. So, like Trump, implementing large-scale tax cuts and infrastructure (the entire scale can reach10With a debt ceiling of over trillions of dollars, shouldn't it become a big treasure every day.

Obama was a very frugal president, and during his tenure8The annual federal deficit affectsGDPThe proportion continues to decline, but even so, during his tenure10Reaching the debt ceiling for the second time,What about a president like Trump who is crazy about eating his own money?

since2011Since the third quarter of the year, Obama has been reducing military spending on a large scale to balance the budget, with the intensity and duration of the cuts being only seen after the war,You should know that military spending accounts for a significant portion of the total budget expenditure50%It is impossible to balance the budget without cutting military expenses.Trump, on the other hand, wants to significantly increase his defense budget, and the frequency of debt ceiling occurrences is definitely significantly higher than that of frugal Obama. The risk of the US government shutting down will be much greater than during the Obama era.

The most affected by the shutdown of the US government is its scale of up to15The US treasury bond bond market of trillion US dollars, with a scale of up to5The trillion dollar financing market with US treasury bond bonds as collateral is a very negative hidden danger for the US dollar index and financing costs.

The last time the Obama administration shut down, rating agency Moody's put the United States on a "negative watch list", which means that once the US government shut down, it cannot pay its debt costs (interest, principal, etc.), and the US debt rating must be downgraded. The bankruptcy of Lehman Brothers has brought about a global recession, and the scale of bankruptcy in the United States will be the same as that of bankruptcy23More than twice, the consequences will be unimaginable. Has Trump considered these things?

3.Trump's ideals and harsh reality

Trump's tax reduction plan will exacerbate the debt ceiling crisis in the United States.This tax reduction plan will be implemented in the future10Over the course of the year, it will add to the federal government2.4The trillions of dollars in cost, combined with various personal income tax reductions promised by Trump during his campaign, will have a significant impact in the future10Over the course of the year, it will add to the federal government9.5The total cost of trillions of dollars is11.9Trillion US dollars.

More than half of the tax cuts will make the United States wealthiest5%The family benefits, and2/3Left and right will make the richest1%Benefiting, its1/5Will make the wealthiest0.01%The benefits of. This large-scale tax reduction aimed at robbing the poor and helping the rich will definitely be targeted by the Democratic Party, and the best strategy for targeting is procedural obstruction of the agenda.

Procedural obstruction of proceedings is a peculiar system: the United States Senate allows members to speak without a time limit(The House of Representatives does not allow similar situations to occur)Unless an absolute majority of three fifths of the votes in parliament is passed to demand it to "shut up.". When a minority in parliament finds that they do not have enough votes to veto a bill they oppose, one strategy is to use lengthy and incessant rhetoric to obstruct the vote. This is not a completely negative move. In addition to negotiating with the authorities in exchange for time, we also hope to draw public attention to the reasons for the opposition of the legislators.

Simply put, it is a "drag" formula.I procrastinate, even if I die, I won't let you vote. It dragged on until everyone couldn't bear it, and in the end, the meeting had to be adjourned. Once, an old man picked up the phone during a debate and read aloud, only to hear everyone foaming at the mouth and a large area lying down in the Senate.

In order to prevent budget bills and other bills from being procedural obstruction and boycotted by the Democratic Party, Trump and the Republican Party have only one shortcut, which is to use the reconciliation process.

As long as the reconciliation process is used, even if all the Democrats oppose it, as long as the Republicans can gather a simple majority of votes on their own, the bill can still be passed, and due to20The hour limited meeting time makes it impossible for the Democratic Party to obstruct. But the problem is that the settlement process is subject to the constraints of the Byrd regulations, which require the bill under consideration not to increase the federal deficit outside the ten-year budget window.

Trump's tax reduction plan has reduced the government's revenue by trillions, so the Republican team in Congress must reduce spending by trillions in other areas. In this way, offsetting each other does not increase the federal deficit. The question is, where should this expenditure be cut? Let's dissect:

Federal expenditures are divided into three categories: discretionary budget expenditures, mandatory expenditures, and interest expenditures. Full budget expenditures include military expenses, homeland security, and national parks. Mandatory expenses include all welfare expenses. Mandatory expenses and interest expenses are automatically spent, just like monthly mortgage payments that are automatically deducted from your bank account. The only thing Congress can do is to have full budget expenditures. The largest expenditure in the discretionary budget is military spending, which has accounted for most of the discretionary budget expenditure in the past decade or so50%Therefore, without reducing military spending, it is basically impossible to achieve restraint through the Byrd regulations.

4.Trump's economics is a super big foam

According to the American Tax Foundation, Trump's tax reduction plan alone could increase the federal deficit by as much as during his four-year term5.9Trillions of dollars, and military spending cannot withstand corresponding major cuts unless the United States abandons global hegemony, so his tax reduction plan is basically useless. But the market is an emotional animal, I don't think so much.

After the details of Trump's tax cuts were revealed, the US stock market opened and the Dow Jones rose more than240Point, breakthrough21000Point; Na's index rose0.56%Breakthrough6000Point, setting a new historical high; S&P rose0.59%. However, once the settlement procedure and Byrd's regulations are followed, the market will realize that Trump's economics with the tax reduction plan as the core is a super big foam. Nowadays, mainstream financial media are everywhere boasting about tax reduction plans, and it is estimated that they will be shipped. Look at the data graph below:

Global fund holdings in US stocks have fallen to their lowest level since the subprime crisis. Isn't this shipping?

Some people also refer to Trump's tax reduction plan as an economic nuclear bomb, without hesitation praising it:

The global economy ushered in a blockbuster. Trump launched the tax reduction plan promised during the election, which is a major battle for capital, talents and enterprises. In terms of corporate tax, Trump's tax reduction is from35%Descend to15%As a result, profits for American companies will increase30%The stock market may rise10%To20%Even more, the US stock market rose sharply as a result. Trump's tax reduction plan is no less than North Korea's nuclear bomb. The US tax reduction will lead to the outflow of funds from China.2017The exchange rate of the Chinese yuan has finally stabilized, and tax cuts will allow global funds to flow to the United States, causing confidence in the yuan to disappear in the blink of an eye.

According to research institutions, this amount is estimated to be approximately2.5Trillions of dollars, while Trump mentioned a larger amount, he believes that the United States has approximately2.5Trillion dollars to5Trillion dollars of assets are being hoarded overseas. Trump's team has clearly put a lot of effort into this issue. Among them, American high-tech companies such as Microsoft, Apple, and Google alone have over1.2Trillion dollars of assets reside overseas. The reason is that current US laws force large American companies to keep profits overseas, as if these companies bring their overseas revenue back to the US, they will face up to35%Tax rate. So, how can these funds flow back to the United States? Trump's plan is very simple: reduce taxes. How much did it drop to? To the extent that it can generate sufficient attraction for the return of funds to the United States! Trump's proposed plan is to reduce the tax rate on overseas income to10%!

If this plan is implemented, it can be imagined that the large amount of funds accumulated by the United States overseas will quickly flow back. The problem is that the world is currently in a period of great shortage of dollars. The US dollar holds a core position in the global economic and financial system.The United States is the locomotive of the world economy. Now, there is a serious mismatch between the pace of the United States and global central banks - while the United States is in a cycle of interest rate hikes, other countries are still on the path of easing.

On the one hand, the US monetary policy tends to tighten, and on the other hand, many economies are releasing more currency through easing. This has led to a mismatch of monetary funds and disrupted the supply balance of the US dollar financing market. Many countries have to pay high premiums in exchange for the US dollar, which will exacerbate the tight liquidity situation of the US dollar. At this critical juncture, Trump's policy of attracting capital inflows will lead to a sudden intensification of the US dollar tension in many economies, and many countries will suddenly collapse due to their inability to persist - from currency to finance to a comprehensive collapse of their economic systems. This is also the fundamental reason why the US dollar continued to strengthen after Trump's election.

Trump's tax reduction policy is causing the world to collapse, with many people collapsing underfoot. Although you cannot see any foundation for collapse, and you do not believe there is a foundation for collapse, this does not mean that it will not collapse. The global Great Depression is rapidly approaching, and Trump is activating this big button.

Some people were frightened and claimed that a global tax war was underway:

From the perspective of other countries, tax cuts in the United States are actually provoking a tax war. As a response, some powerful countries will join this competition, either competing to reduce taxes, begging their neighbors, or setting up tax havens.At present, this sign has emerged in developed countries such as the UK and France. In addition, the US tax reform will directly harm some export-oriented countries that are unable to engage in tax competition.

So essentially, Trump economics, with tax reduction plans at its core, is the super stock market of the eight year old bull market in the US stock market, and the mainstream financial media that follows suit are also super stock markets. After a professional analysis of the old hen who laid eggs, we found that Trump couldn't lay as many eggs as he promised in the past four years.Whether it's a tax reduction plan or an infrastructure plan, the various procedures and regulations of the parliament will have to be greatly discounted along the way. Just like insurance companies hiring salespeople and saying monthly salary4Wan, it wasn't until you went that you discovered the base salary4000。

5.There is only one path to becoming a war president

Dreams are full, reality is bone deep, this is the fate of Trump's economics over the past four years. It is too difficult for Trump to achieve his ambitions economically in China. The imposition of restrictions on counter-terrorism is said to be unconstitutional, and economic activities are restricted by legal procedures. How can we achieve the great rejuvenation of the United States.Since domestic affairs do not allow for proper handling, then the only way is to cause trouble overseas. So Trump has only one way to become a war president, whether it's against North Korea or Iran, the game must continue.Look at the data graph below:

As shown in the above figure, the United Statescrude oilAt present, our reserves can be used for more than three years, which means that it's okay for the United States not to import crude oil for more than three years. Therefore, the United States doesn't mind fighting a big war in the Middle East. On the contrary, China's oil reserves can only last for three months. The United States has spent6For more than a year, even Syria, a small country, has not been able to deal with a bullet. If Iran, which dominates the region, will have to fight for several years. This will inevitably have a huge impact on China, which has weak oil reserves and is not strong enough.

Due to the improvement and strength of American style democratic regulations, there is no fish in the clear water of the United States. Trump's kind of rhetoric can deceive voters. If you want to fish in the troubled waters of a democratic system, you may not even have a chance. You have to find a breakthrough in the turbulent world.

Revitalizing the manufacturing industry is hard to say, but with the current strong crude oil industry in the United States, once a war breaks out in the Middle East, petrodollars can be made a lot and weapons can be sold. Perhaps the crude oil and military sectors can drive the US stock and US dollar indices to continue the bull market. The Middle East only makes money when it comes to fighting, but there are too few benefits in North Korea, which is extremely poor and economically uneconomical. So the place where Trump ultimately made a big move must still be the Middle East. It's hard to imagine what would happen to China's inflation rate, exchange rate, real estate, and capital flight if there were a major upheaval in the Middle East and a sharp rise in oil prices.

[blockquote]

If Trump engages in a financial war, will China be vulnerable

[/blockquote]The United States' containment of China may become centered around financial warfare, with trade and military frictions as its wings. Due to the decline of the US economic power far exceedingGDPThe greater the trade war between China and the United States, the more the United States loses, as indicated by the numbers. Due to the hollowing out of American industries,GDPThere are20%All rely on the injection of Indian dollars into the economic cycle to inflate the virtual economyGDPBut this is not all about the decline of the US economic power.

Actually, in the United StatesGDPThere are still many useless waste heat, and the formation of the tertiary industry is mostly harmful to societyGDP. For example, litigation is rampant in American society, and the pharmaceutical industry has exceptionally high profits. Extremely unfair lawyer fees and medical expenses allow Simpson to legally kill his wife, reduce life expectancy in the United States, and not to mention the financial industry's windfall profits that contribute to itGDP. Therefore, it is impossible for the United States to obtain products from so many illusionsGDPThe demand for our products far exceeds our market demand, and the real economy of China US trade is our seller's market.

Our only concern is finance, which is the last area where the United States still has absolute strength leading us. The worst plan for dealing with Trump is to prepare him for the right battlefield and launch a financial war. No matter where Trump's first shot is fired, he will immediately realize that China has very hard nails to deal with both militarily and economically, except for finance. Even if he is an opportunist with no foresight, the financial war will escalate as a result. On the contrary,The financial system has always been our weakness, and even if there is no war in the future, our financial system has come to a point where innovation and upgrading are urgently needed.

Data chart

There are two major principles to deal with this crisis:

The first is to firmly resist tactics, which meansWhen the United States carries out a financial war against China with the strongest determination, there must be a reliable real-time countermeasures planWe must base ourselves on the reality that the United States may have a great victory on the financial battlefield, and try our best to persuade it not to fight.

Secondly, it is strategic.The strategic change that can truly effectively confront Trump cannot be based on confronting Trump, but requires a return to the fundamental proposition of the great rejuvenation of the Chinese nation.Regardless of whether it was to be attacked or not, Mao Zedong faced an advantageous enemy with the saying "you hit yours, I hit mine". The saying goes that only with great skill and no work can victory be achieved. We need to establish a currency financial system that can both confront US strategy and avoid US style economic virtualization; Not only has it revitalized our tactical choices and doubled our effectiveness in the face of US attacks, but it has also truly become a reliable service provider for the long-term healthy growth of the Chinese economy and the great rejuvenation of the Chinese nation.

Our response has three strategies, which depend on the length of our historical perspective and are worth considering.

The best strategy is a financial system reform led by the central bank's monetary innovation. In fact, it is the central government's coordinated promotion of the central bank's balance sheet adjustment and optimization, creating a new investment system that "reduces leverage, uses production capacity, and promotes growth"; This is primarily driven by self-development needs in strategy, rather than against the United States, but it will give us enormous tactical space for confrontation.

The central strategy involves commercial and state-owned financial institutions, funds, and others cooperating with the central bank to prepare for a trading war in the international financial market on the scale of the three major battles of the Liberation War. In the face of speculators from all over the world, this can at most lead to a disastrous victory.

The bottom line is to gradually open up the capital market on the basis of the current mechanism where the central bank is responsible for exchange rates and foreign reserves. Some people have already discovered the difficulties in the situation and proposed a choice between "protecting foreign reserves" or "protecting exchange rates". However, the reality is that as long as the United States is determined enough, neither foreign reserves nor exchange rates can be preserved under the current system. Opening up the capital market, believing that the entry of international capital will have the function of stabilizing the market. This is in line with the textbook's toy economics, but not in line with the facts.

Below, we will first analyze the strategic tactics of the United States in attacking China, and then discuss in detail our possible strategic and tactical responses.

Trump's Financial War Against China is Imperative

Strategically valuing the enemy means formulating contingency plans based on the most serious scenarios. Firstly, we cannot believe that the United States cannot find the right direction and will only resort to blackmail rather than engaging in minor financial wars. We believe that the United States will have concerns about smashing its own economy. On the contrary, Trump knows that blackmail alone does not solve the problem and requires a bayonet to turn red.

Trump (data chart)

The first is that a financial war must be fought.Due to the United StatesGDP的增长几乎完全是金融体系贡献的,如果不开打金融战,特朗普的经济承诺一个也实现不了,金融战是美国实体经济还能缓口气的唯一选择。

第二,特朗普已经在筹备金融战的路上了。他的嘴炮可以姑妄听之,但他的人事任命已经完成了一个可以发动金融战的班子。

特朗普提名高盛的交易大鳄史蒂芬·姆钦(Steven Mnuchin)任财政部长,此人在国际市场上做投机交易历史悠久,自己有对冲基金,是金融进攻的行家;提名国务卿的是石油大亨雷克斯·蒂勒森,这人搞外交的话不会懂打仗,但对如何搞事情影响石油价格进而影响资本流向不会陌生;国内资产价格由史蒂芬·姆钦和金融监管改革特别顾问伊坎共同操控;制造军事热点交给“疯狗”将军马蒂斯——这些都是最重要的人事任命。还有钢铁产业投资者威尔伯·罗斯任商务部长和领导新的白宫国家贸易委员会的彼得·纳瓦罗等人负责贸易摩擦。这些人选就是金融为主战场,贸易摩擦和军事摩擦为侧翼的进攻团队架构。

第三,美国有人和,世界的投机者都看好美国赢,已经准备好跟进了。

自去年以来,央行为了人民币国际化做了不少管制革新,例如允许人民币汇率更大幅度的波动。结果,无一例外引来国际做空者诱发人民币大幅贬值,再加上国际资本开始外流,外储也持续减少。这些都是国际投资者用钱在中美之间选边站的结果,预期美国会赢的人用钱支持美国,美国的赢面就增大。国际投资者预期的引导,主要是美国说了算,目前我们没有效引导预期的基础。

第四,特朗普尚未登台,金融战实际已经露头,这就是美联储的加息。

次贷危机后,美国货币政策主要是让国内金融部门低成本拿钱抬拉金融资产价格,因此是零利率加定量宽松(QE)政策。现在美国金融资产已经到了高位,加息可以吸引全世界资金去高位接盘,并令其它国家资产贬值,美国用套现本国资产的钱去抄底。之后如果美国套现顺利,就再进入降息周期,让国外资产涨价国内资产跌价,美国人卖出国外资产大赚一笔后再回头抄国内资产的底。

那么,美国能追求的战略回报具体有什么?从低到高有三个层次。

首先就是制造国际金融资产和大宗商品的价格波动引导国际资本流向。这并非只针对中国,而是剪全世界羊毛,只不过中国羊最肥。

第二个更大,是搞乱人民币的国际地位并打乱中国的国际发展战略,尤其是“一带一路”这个全球性战略。

第三是最大的,寻求直接攻破中国,突破人民币汇率和中国外储,获得地价吞噬中国资产和财富的机会。国际形势从来都只是危机,机会和危险从来都是一体,中国目前已经有可以被攻破的条件了,其中最大的就是人民币加入SDR。

人民币国际化的问题涉及资本管制的诸多变化。最根本的矛盾是,人民币有这么多foreign exchange占款都是以美元为储备发行的。那么到底是人民币加入SDR,还是美元又加入一次?这个人民币的内在战略矛盾极为复杂,远超汇率是否盯住一篮子货币这种问题,不能指望由技术性的战斗解决问题。更何况随着人民币变为储备货币,其国际交易会更自由,央行很难再用关门的办法御敌于国门之外。

这些多层次的战略回报是互相交联的,美国很可能是逐渐升级规模。最初大概率是从追求最低层次目标出发,在美联储的不断加息中不断评估并调整行动。假设美国发现剪全世界羊毛的货币政策和金融操作确实起到了拉动全世界资本流动的效果,同时对华贸易战和军事遏制却踢到了钢板,接下来可能就是金融战的加码。当然金融战加码对美国来说也是有条件的,但留给我们的时间有限,要未雨绸缪。

索罗斯(资料图)

中国金融居于劣势,下策和中策走不远

战术上,我们目前处于完全的被动挨打的地位。由央行负责汇率和外储的同时开放资本市场是下策。问题首先就是外汇占款,这在中国作为产品出口国时是优势,但在国际金融战时是劣势;其次是我们战术选择极其有限。投机者进攻时,战术秘诀是超高杠杆的交易,一两个大鳄就能借到天量的货币,搞垮一个中等大国。

1992年索罗斯狙击英镑的战役就是这么打赢的,当时英国人根本想不到他一个对冲基金就能聚集多达一百亿美元;但央行抵御进攻却没办法到处借钱,只有动用手中的外储。1997年亚洲金融危机中的东南亚小国加起来也不够英国的体量,在攻击之下迅速崩溃;央行施救香港能够成功,胜在战术上的突然性加上做空者没有准备好相应的资源和决心。

衍生品市场,包括汇率衍生品在内,不但用来投机的筹码是无上限的,而且还是杠杆交易,只要有钱就可以创造天量的盘口做空人民币。再加上现在全球货币比二十年前不知道多了几百倍了,与美国国家战略合作,任何做空人民币的资金要借到美元肯定容易得不能更容易了,三万亿美元的外储原则上不可能抵御散布全球的天量美元集体进攻。

这种形势下靠央行引导全球资金不针对中国不会有效果,而开放金融市场引入外国金融资本是开门揖盗。假设我们还像以前一样投资黑石那样的外国基金,一方面是屈就美国设计的剪全世界羊毛的资本流动,更严重的是这样等同于为美国的金融进攻提供弹药。

央行牵头友军组织战斗是中策,美国战斗意志不够坚决的时候中策会有一些效果。问题是:友军水平有限,中国在国际金融市场败绩太多,我们也不可能把自己的金融市场搞成美国式的投机市场来练兵。可谓是实体经济不死,我们的金融“水平”提不高。更重要的是,友军弹药有限,对抗美国的金融战怎么可能在世界上融到资?更别提美国一贯操控金融资产的信用评级。金融战时下调我们的评级,断绝我们的融资渠道是很容易的。最后还是央行利用手中外储去对抗,只是多点“花活”而已。

货币金融体系创新是上策,阻绝美国的遏制冲动

上策是不打交易战的金融战,跳出美国给我们圈定的金融战场,我们自己选定一个战场较量。

this首先要搞清楚为什么美国就是不能好好搞生产?观察者网专栏作者史正富教授指出,根本原因在于资本主义市场经济的以市场导向、企业利润驱动的逐利型投资要求的是周期较短、规模不大、收益归己,并且具有顺周期的特点。因此产业空心化的现实下,美国老老实实生产做不了,金融战暴涨暴跌的特点倒是能满足美国大资本的逐利要求。因此美国选定的战场是货币市场、大宗商品这样的交易市场。

中国现在一方面产能过剩,但是很多基础战略性投资却因为社会主义市场经济也存在这种投资的逐利性而得不到满足。只要跳出这种短期逐利性的投资逻辑,就立刻有解决问题的方案,我们应该建立一个“一带一路”建设的国际投资市场,其中的资本金来源,是央行置换外汇占款后释放的美元。

要解决外汇占款的问题,首先要立足于国内的长期战略性资产积累投资,需要中央统筹推动央行的资产负债表调整优化,打造“降杠杆、用产能、促增长”的新投资体制。

目前国内短缺但因私营经济的逐利性难以投资的产业部门主要是指水、土、空气等优质生态资产,能源交通等基础设施,前沿科学技术、战略性新兴产业的核心技术、研发人才和高技能工程队伍等国家战略性基础资产,国内文教体卫基本设施和全球化文化传播的基础资产等。史正富把这些短缺部门的投资划分为“宏观-战略性”投资,虽然未来收益可观但体量特大、周期特长,不可能再通过贷款的方式融资,需要超大规模的资本金,不但私人不会投,国家独力也只能投一小部分。

如果用央行货币创新为这些领域投资,就能满足这个高达百万亿的投资资本金需求。不但能打造中国长期增长的物质基础,将过剩产能用起来,创造天量的投资需求;还可配套升级金融体系,解决“一带一路”的外汇需求。通过发展全球实体经济创造一个新的国际资本市场,使资本按逐利逻辑背离美国设计的流动方向,使我们打金融战有资源、有战术选择,甚至让美国“打不过就入伙”我们的大战略。

央行资产负债表的调整优化,实际上就是指央行出资“宏观-战略性”投资后,对应的权益资产可以作为央行货币发行的基础资产之一来代替美元,成为人民币发行的储备;由此形成以gold、国债、战略基金权益和外汇储备为主的多元复合的央行基础资产,也只有这么做能为这些投资提供足够的资本金。

货币作为金融和经济的源头,通常要求有实在的储备才能发行货币。这些资产的基础性决定它们的体量将足够大,更可贵的是这些资产不但像黄金一样保值,还因为它们直接对经济发展有重大贡献、像土地一样自身产生租金和收益,还能增值,又不像国债一样增加财政赤字,因此是比黄金、国债、外储更好的货币发行储备,可以产生长远重大的战略收益。

我们设计了相应的操作手法,可以在置换外汇占款的同时维持央行资产负债表规模不变,总体健康,也就是高能货币总额不变,不影响国内金融市场的热钱但能定向注入货币到实体经济。

置换外汇占款,是将央行的外汇储备和外汇占款这一对资产负债关系转出货币体系,变成商业金融机构的外汇和普通的商业信贷这种资产负债关系。它的重大作用在于:首先国内金融机构可以持有外汇,在面对金融战时采取上面所说的中策就有了物质基础。更直接的是,这些外储由此可以交由“一带一路”的海外投资基金使用,配合人民币在全球创造新的资本市场。因此这一战略虽在根本上不以任何人为对手,但使我们也能调动资本流向。

前面说过,光打外汇、股权、国债等金融战的话我们的机构是没有能力大规模做融资的,真大规模融资我们也控制不了,去年的股灾就是教训。但是在国外做实体投资和资产并购这样离实体很近的金融运作时,我们融资就会容易的多。

由于有资本金有抵押,还有未来收益,还能深化到股票债券发行和金融衍生品等领域,又影响对能源等大宗商品的需求,最终创造出的资本市场将体量巨大而有吸引力,完全可以极大削弱美国加息带来的资本吸引力。只要全世界大资金在其中也有了瓜葛,中国在金融正面战场的话语权和资本就会极大增加,这才能最终缓解外汇占款的矛盾。

More Than This,这是人民币国际化最好的平台,手里有实在资产选择计价货币就自由多了,可以极大扩展人民币的海外储备。我们愿意与人民币有关的国际资产负债和外国人民币储备更多来自于与“一带一路”投资有关的金融市场和直接投资,而不愿意它们来自于单纯的货币交易或者是我们的贸易赤字。二战后美国用马歇尔计划对欧洲投资,其它国家因此形成的美元储备对美国是有利的;后来美国变为贸易赤字,其它国家的储备越多,美国就越衰落。

在这种战略下,机制配套也就容易得多。为了使“宏观-战略性”投资和“一带一路”的海外投资高质量运行,史正富建议设立担负国家战略使命的准市场型战略投资基金体系,形成国家战略引领、国家资金牵头、多元资本混合的长期投资基金;市场化挑选基金管理人,完善管理激励体制;国家引领但融入市场体系,完全可以把投资绩效做好。投资绩效好,在海外就能拥有高质量资产,这也会提升我们的资产评级,增强商业金融机构的融资能力。

要特别说明的是,从财务上来说,清除部分外汇占款本身就是一场信用评级战,但这已经是我们而不是美国选择的战场了。比如央行只是直接持有外储的减少,但账面可以完全不是这样;而因为其持有上述投资基金的权益,央行实际可以调动的外汇则更可能反而增加。这也体现了货币创新带来的战术提升空间。

这是比亚投行更大的战略共赢空间,美国已经发现抵制亚投行是个战略错误,未来的大趋势是应该是“一带一路”人民币和石油美元、赤字美元一起在国际市场上共舞。但在实际操作进程中,还是要时刻对抗美国贸易和军事的侧翼进攻。美国也无力在全世界挑起军事冲突来全面破坏“一带一路”投资的估值基础。

中国经受住近期的凌厉进攻,就有机会最终缩小中美金融差距,彼时中国经济、军力也会继续大发展,就能全面断绝美国的遏制企图。 |

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|