Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

The data and event importance for this week, from high to low, are as follows: United States12Monthly CorePCEPrice index annual rate, Bank of Japan's first interest rate decision at the beginning of the year, Bank of Canada1Monthly interest rate resolution. Let's analyze and interpret them one by one:

This Friday21:30, The US Department of Commerce will announce the United States12Monthly CorePCEAnnual rate of price index, previous value is3.2%, expected3%Expected to decrease0.2One percentage point. At the same time, the United States will also be announced12Monthly nominalPCEAnnual rate of price index, previous value is2.6%Expectations will remain unchanged. the United StatesPCEData often appears in the minutes of Federal Reserve meetings and plays a crucial role in adjusting the Fed's monetary policy. The expected one-year inflation rate for the United States, released last Friday, is3.1%Descend to2.9%, Decrease0.2Percentage points.1month11Published on12Monthly and quarterly adjustment coreCPIAnnual rate, from4%Descend to3.9%, Decrease0.1One percentage point. Both forward-looking inflation rate indicators suggest that the United States12The inflation rate for the month will decrease, so market expectations12Monthly CorePCEThe data will also decrease, and it is expected that the accuracy will be higher. The decrease in inflation rate means that high inflation is cooling down, and the Federal Reserve will lose some basis for maintaining high interest rates. The expectation of interest rate cuts may rise, which is bearish on the US dollar index.

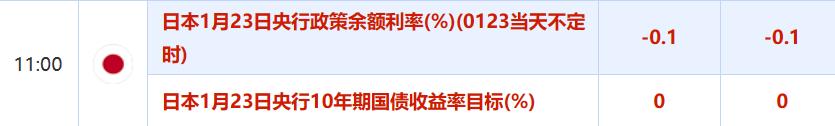

this Tuesday11:00The Bank of Japan will announce the results of its first interest rate decision at the beginning of the year, and the market generally expects the benchmark interest rate to remain unchanged-0.1%unchanged,10The yield target of one-year treasury bond bonds will be maintained0%unchanged. In the afternoon of that day14:30Bank of Japan Governor Kazuo Ueda will hold a monetary policy press conference, focusing on his speech on inflation rate, employment, and monetary policy. Japan announced last Friday12Monthly CoreCPIAnnual rate from2.5%Fallback to2.3%The consecutive two month decline means that Japan's moderate inflation may not be sustainable. Japan's super loose monetary policy has been in place for over a decade, with strong stability due to policy inertia. Bank of Japan Governor Kazuo Ueda has repeatedly stated that "if stability and sustainability are achieved2%The possibility of an inflation target has significantly increased, and the Bank of Japan is likely to consider changing its monetary policy. ”. There is no clear answer to the specific criteria for "stability and sustainability" mentioned in this sentence. That is to say, if the Bank of Japan believes that inflation is not "stable and sustainable" enough, it can choose to continue maintaining loose monetary policy. Due to the market's expectation of the Bank of Japan raising interest rates, if the current interest rate decision remains unchanged, it is expected to have a negative impact on the yen.

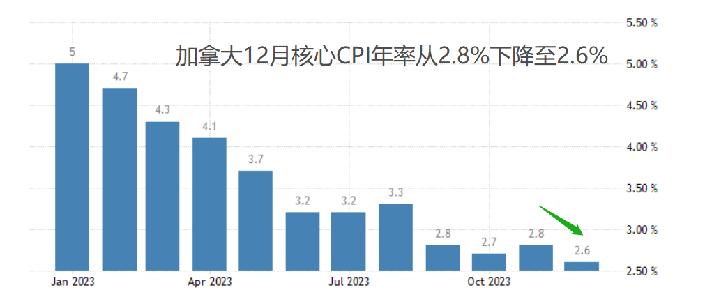

This Wednesday22:45The Bank of Canada will announce1The monthly interest rate decision results indicate that the market expects the benchmark interest rate to remain unchanged5%unchanged. that day23:30Bank of Canada Governor MacLehose will hold a press conference. Due to its close economic and trade relations with the United States, the monetary policy of the Bank of Canada often resonates with that of the Federal Reserve. Before the Federal Reserve initiates interest rate cuts, the possibility of Canada cutting interest rates is also low. Additionally, Canada12monthCPIthe annual rate3.4%Although higher than2%Moderate inflation, but still relatively low compared to the previous two years.12Monthly CoreCPIAnnual rate from2.8%Descend to2.6%Excluding energy and food prices, there is still a weak trend in the price level. The decline in core inflation means that demand for goods is excessively compressed, and the Bank of Canada's expectation of interest rate cuts will be strengthened.1If the central bank's decision remains unchanged in the month, it will provide a certain positive boost to the Canadian dollar.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2021-01-22

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|