Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

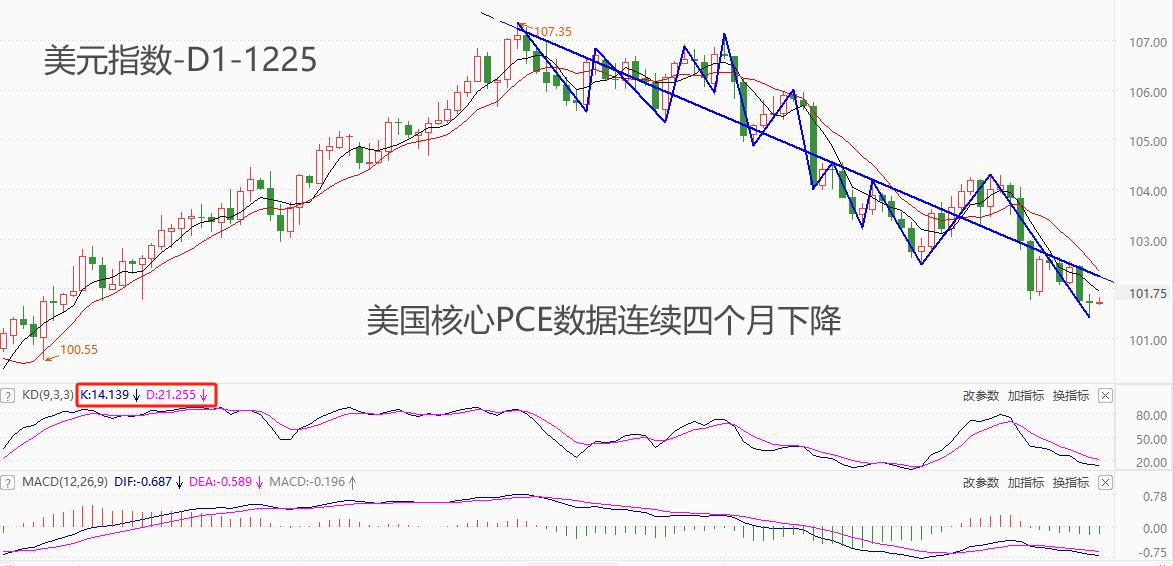

According to data from the US Department of Commerce, the United States11Monthly CorePCEAnnual rate of price index3.2%, lower than the previous value3.4%For four consecutive months of decline; United States11Monthly CorePCEMonthly rate of price index0.1%, unchanged from previous values, slightly lower than expected0.2%. After the data was released, the US dollar index closed at a five minute level with a long bullish candlestick, indicating that market funds believe that the data is bullish on the US dollar index. Logically speaking, the core of declinePCEThe data will lead to increased expectations of interest rate cuts, and the US dollar index should be affected by bearish sentiment. So, from data release5After minutes, the US dollar index quickly gave up the gains of the Changyang line. From both year-on-year and month on month data, the inflation rate in the United States is steadily decreasing, and high inflation is no longer the main problem restricting the recovery of the US economy. Although the problem of high inflation no longer exists, the problem of high interest rates is still constraining the US economy. Initially, the Federal Reserve continuously raised benchmark interest rates with the main purpose of reducing consumer price levels by curbing the demand side. Nowadays, maintaining high interest rate policies is more like inertia. Although it is no longer appropriate, the Federal Reserve will not initiate interest rate cuts until it is absolutely necessary.

The problem of the upside down of the yield of long-term and short-term treasury bond bonds in the US bond market still exists.6The yield of one month US Treasury bonds5.3%One year term (i.e52Weekly US bond yield4.86%The one-year yield is actually smaller than the six-month yield, and the absolute difference is significant. This means that within the next six months to a year, the Federal Reserve will initiate interest rate cuts that exceed market expectations, and the magnitude of a single rate cut will be larger and the duration will be longer. According to the current benchmark interest rate5.5%Upper limit calculation, distance4.86%have0.64One percentage point, which is64Base point, based on a single occurrence25Based on the standard rate cut rhythm of the basis point, there will be at least three rate cuts in the next year, which is bearish for the US dollar index.

From a technical perspective, the US dollar index is in a medium to long term bearish downward trend,10month4There has been no significant rebound trend so far. The short-term moving average system is still a bearish arrangement. The market price is below the blue regression line, with the last threeKThe line has not yet formed a bottom fractal support structure. Awesome Oscillator KDThe reading is in the20Below the oversold line, there is currently a bearish arrangement, indicating that there are no obvious signs of market rebound.MACDThe bar line is below the zero axis, but the absolute value is relatively small, and the downward momentum is insufficient. Overall, most technical indicators support the continued weakness of the market.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-12-25

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|