Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

The data and event importance for this week, from high to low, are as follows:12The monthly Federal Reserve interest rate resolution12The Bank of England's interest rate resolution for the month12The European Central Bank's interest rate decision for the month. Let's analyze and interpret one by one:

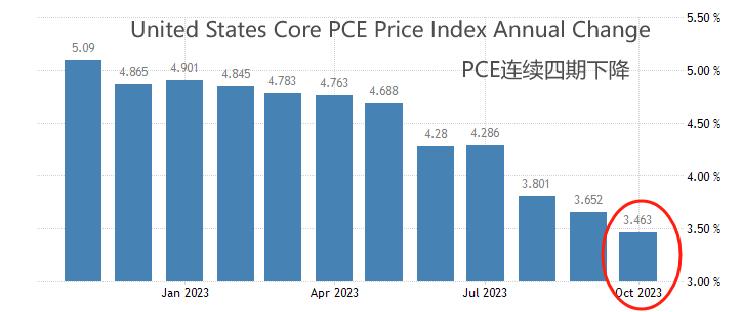

This Thursday3:00, the Federal Reserve will announce12The result of the monthly interest rate resolution is that the market generally expects the upper limit of the federal funds rate to be maintained at5.5%Unchanged, the Federal Reserve will suspend interest rate hikes for the third consecutive time. Last Friday's announcement11The monthly non-agricultural employment report shows that there are new non-agricultural employment population19.9Ten thousand people, far higher than the previous value1510000 people and expected value18Ten thousand people, and the unemployment rate has also increased from3.9%Descend to3.7%This means that the US macroeconomy has not experienced a significant recession due to high interest rates, but rather an exceptionally strong demand in the labor market. The unexpected non farm payroll data has increased the probability of the Federal Reserve raising interest rates, but due to the United States10Of the monthCPIThe annual rate has changed from3.7%Descend to3.2%, CorePCEThe annual rate has also been continuously declining for four periods3.463%The fundamental reason for raising interest rates - to curb high inflation - is no longer valid. So, even if11The monthly non farm payroll report performed well and will not change the mainstream expectation that the Federal Reserve will suspend interest rate hikes.

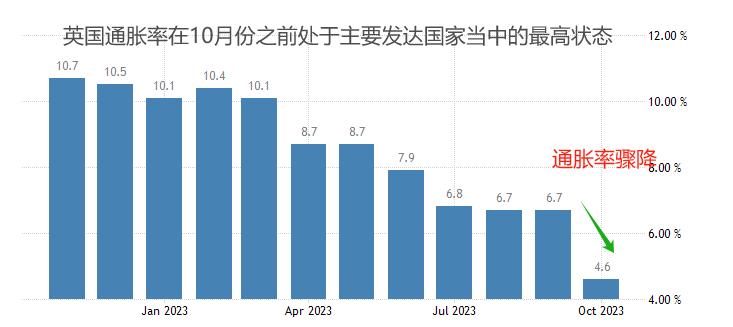

This Thursday20:00The Bank of England will announce12The result of the monthly interest rate resolution is widely expected by the market that the Bank of England will suspend interest rate hikes and maintain the benchmark interest rate at5.25%. There are two reasons for the expected suspension of interest rate hikes. One is that the Bank of England has suspended interest rate hikes for two consecutive periods. From a trend perspective,12It is also unlikely that interest rates will increase in the month. The second is that the high inflation situation in the UK has undergone significant changes.9Month UKCPIAnnual rate as high as6.7%At the highest inflation rate among major developed economies, however,10Month UKCPIThe annual rate plummeted to4.6%This means that the inflation rate is beginning to rapidly decline, and the expectation that high inflation will continue is shattered. For the Bank of England, suspending interest rate hikes, maintaining restrictive interest rates, and observing changes in major economic data are the best choices.

This Thursday21:15The European Central Bank will announce12The monthly interest rate resolution results, and the market generally expects that the main refinancing rate will be maintained4.5%Unchanged, the European Central Bank will suspend interest rate hikes for the second time this year. Due to the threat of Russia and Ukraine issues in the Eurozone, energy prices have remained high over the past year, and the impact of high inflation has been present. Therefore, the European Central Bank is hesitant to suspend interest rate hikes too early. As ECB President Lagarde said, "Inflation will further decrease in the short term, but energy prices are becoming increasingly unpredictable due to geopolitical factors.".10The interest rate resolution for the month announced the suspension of interest rate hikes for the first time this year.12There is significant uncertainty about whether the decision to suspend interest rate hikes will continue in the month. It should be noted that the unemployment rate in the eurozone is still high6.5%, much higher than5%The natural level of unemployment rate. Continuing to raise interest rates may lead to further increase in unemployment, so mainstream market expectations suggest that the European Central Bank will not hastily restart interest rate hikes.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-12-11

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|