Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

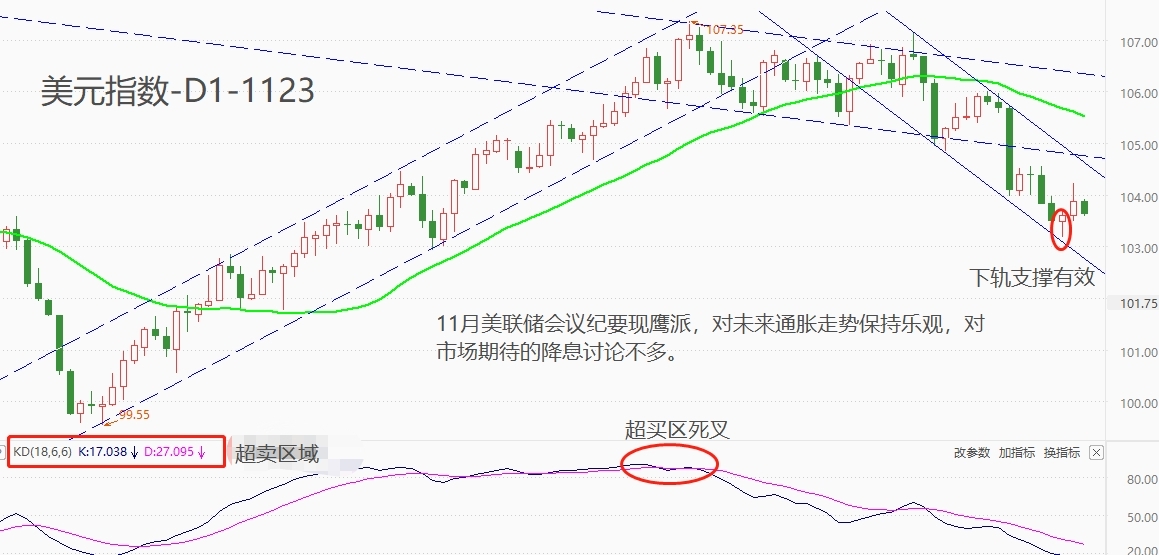

11month21Published on11The minutes of the monthly Federal Reserve interest rate resolution meeting mentioned that although inflation has eased in the past year, it is still unacceptably high, far higher than the committee's current level 2% Long term goals; Driven by a surge in consumer spending, the actual situation in the third quarter GDP Surprisingly strong growth; Expected fourth quarterGDPThe growth rate will significantly slow down compared to the third quarter, but in the second half of the year GDP The average growth rate will be slightly higher than the first half of the year; The supply and demand of labor force continue to balance; The tightening of financial and credit conditions for households and businesses may put pressure on economic activity, employment, and inflation. The discussions among Federal Reserve officials are generally in line with market expectations and maintain an overall optimistic attitude towards future economic development. suffer11The release of monthly meeting minutes has had an impact. Yesterday, the US dollar index closed positive on a daily basis, with an increase0.25%, highest touch104.22, reaching a new high in nearly three days.

From a technical perspective, the US dollar index is in a medium to short-term correction phase of a medium to long-term upward trend,11month14Daily sharp decline1.5%Afterwards, there were signs of acceleration in the pullback. Accelerated pullback in the market11month21After hitting the downward trajectory of the new downward channel, it closed positive for two consecutive days, verifying the effectiveness of the channel. It is expected that the market will continue to operate within the channel in the future.11month6Solstice14The day rises first and then falls, forming a pair ofMA30The retracement action of the medium-term moving average indicates that the current correction stage has the basic characteristic of a trend of "turning long and turning short". Awesome Oscillator KDThe reading is in the oversold area, indicating a rebound demand in the short term. In addition, the market price is supported by the downward trend of the channel, and the probability of a short-term rebound will be higher.

Compared to traditionalCPIData, the Federal Reserve places greater emphasis onPCEThe performance of data.9monthPCEAnnual growth rate3.439%, higher than the previous value3.445%. Last four monthsPCEThe annual rate data is gradually increasing, but the increase is relatively small. stayPCEThe annual rate data did not reach2%Before the target, the probability of the Federal Reserve stopping interest rate hikes for the long term is not high, and maintaining a high interest rate state is currently the optimal solution between economic data and monetary policy. However, high interest rates have a suppressive effect on investment and consumption, and over time, it is highly likely to lead to a sudden recession in the US macroeconomy. If the futurePCEThe annual rate data is not slowly declining, approaching2%But rather, due to certain factors, it will plummet sharply, and the Federal Reserve will inevitably hastily initiate interest rate cuts. The US dollar index will also enter a bear market cycle from the perspective of monetary policy.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-11-23

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|