Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

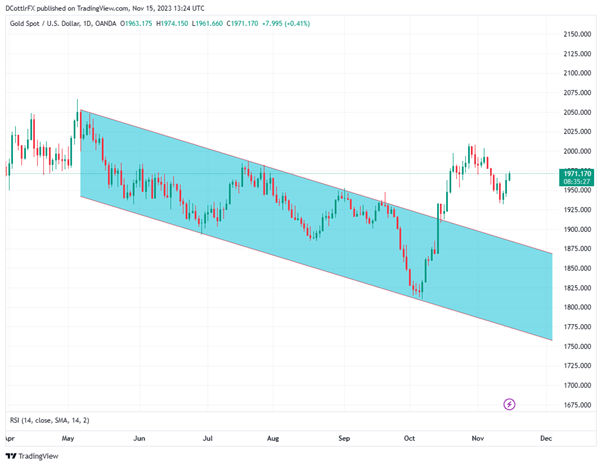

gold (XAU/USD) Price, analysis, and charts- britain10monthCPISet a two-year low

- Core indicators have also declined

- Gold price returns2000dollar

On Wednesday, gold prices continued to rise in Europe, but as the UK joined an increasing number of developed economies, the evil control of inflation seemed to be easing, and gold prices did indeed reduce their gains. Official data shows that,10 Overall consumer prices increased year-on-year in the month 4.6%. This is the lowest point in two years, compared to a month ago 6.7% Compared to a significant decline. It can be certain that the decline in oil prices is the reason for the decline, and it cannot be expected that oil prices will continue to decline. However, the core inflation indicators that completely exclude them from calculations also come from 6.1% Descend to 5.7%. Just the day before these data were released, similar data from the United States also showed a reduction in price pressure, which also boosted gold prices.

On Wednesday, factory prices in the United States also fell slightly, but its impact on the financial market is often less significant.

Nevertheless, investors have begun to sincerely hope that the world monetary authorities can win the battle against inflation, with the vast majority of monetary authorities significantly raising interest rates. The market is starting to look forward to interest rate cuts, perhaps in the first half of next year.

Although this yellow metal is touted as an inflation hedge, it has suffered losses due to rising borrowing costs. Investors tend to give up on it and other non income assets in order to achieve better returns in the bond market. This at least partially explains why weak inflation data can boost so-called safe haven assets such as gold and traditional high-risk bets on stocks.

Of course, the market may be a bit ahead of schedule. Despite recent relative weakness, inflation rates in most parts of the world are still far above central bank targets. At least in this case, interest rates will definitely remain unchanged. Besides, those who still remember 20 century 70 People in the era of inflation will also realize clearly that once inflation takes root, it is difficult to eliminate and may not disappear in the linear fashion market that seems to be expected now.

Nevertheless, the current gold price is still moving towards bullish gold, and the geopolitical situation in Ukraine and the Middle East is also bleak, providing support. More heavyweight price data will be released on Friday, including the final core consumer price index for the Eurozone (CPI) Highly anticipated. Expected to decrease slightly, starting from 4.5% lower 4.2%. It can be certain that the gold market will enjoy the expected results.

Technical Analysis of Gold Price

Gold has been removed from 1935 dollar/The level of ounces began a strong three-day rebound, which may not be coincidentally related to 200 The daily moving average is consistent. For bulls, maintaining this level is beneficial because the chart shows that falling below this level will bring the previously dominant downward trend channel very close to the market. However, it is still far away 1883.70 The US dollar is far away, and this level now provides support.

Currently,1935 The US dollar region may still be a short-term support, and bulls' short-term goals are psychologically important 2000 USD resistance level.

The relative strength indicator broke through on the previous trading day 50 Click on the checkpoint and stay above it. But currently there are clearly no signs of overbuying, indicating that the rebound may have enough strength to return 2000 USD and may reach 10 At the end of the month 2009 The peak of the US dollar.11 month 3 The daily closing price of the day is slightly higher than 1993 The US dollar may be the next key resistance level for this metal.

IG My own emotional data shows that traders are still bullish at the current price, among which 65% For net long positions, or expected price increases.

|