Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

WeWork Inc. I never figured out how to make money. But the founderAdam NeumannStill a billionaire, even now bankrupt, still worth 17 USD100mnWeWorkhave190Billion US dollars in liabilities and150A billion dollar asset. Long term investors, including SoftBank Group and Vision Fund, will further increase their significant losses in the joint venture.WeWork Inc.On Wednesday, the company made its first appearance in bankruptcy court, initiating months long proceedings and being unable to repay more than40A loan of billions of dollars.

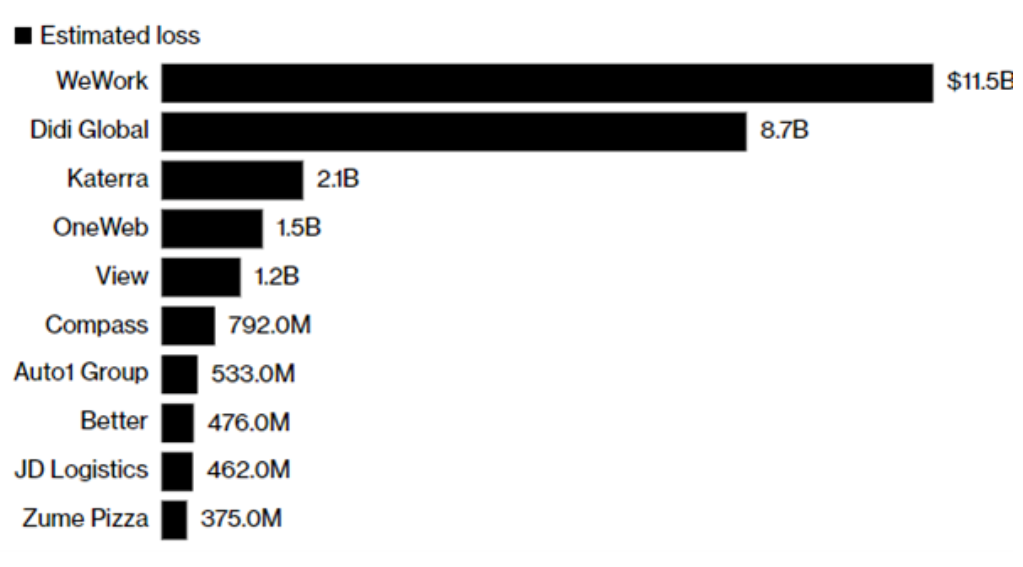

2019In the year, the company's valuation reached470Billion dollars, becoming the most highly valued startup company in the United States at that time. However, the services he provides are not very scarce. Commercial property office leasing. Moreover, this model requires a large amount of cash flow, and once the cash flow is negative, it is easy to go bankrupt.2021Year,WeWorkrevenue25.7Billion US dollars, with a net loss of approximately44.4USD100mn2022Annual revenue approximately32. 5Billion US dollars, net loss of approximately22.9USD100mn before WeWorkWhen merging and going public with an acquiring company, Neumann owns23 A wealth of billions of dollars, of which nearly one-third holds WeWork Stocks. But afterwards, their decline has exceeded 99%。 We don't know why the institution is so optimistic about this company, or is it just a game of beating drums and passing flowers. Big fish eat small fish, SoftBank aims to create a prosperous environmentIPOproject In these years of economic downturn,WeWorkThere are many large expenses, including 1.85 A non compete agreement worth billions of dollars1.06 A settlement payment of billions of dollars and Neumann's subsidiary We Holdings The proceeds from selling stocks to SoftBank 5.78 USD100mn Meanwhile, Sun ZhengyiWeWorkProvided high loans and guarantees.WeWork The bankruptcy of SoftBank, founded and led by billionaire Sun Zhengyi, has caused about 115 A billion dollar equity loss, in addition to 22 A debt of billions of dollars is pending. A business lost billions of dollars. Sun ZhengyiWeWorkI lost money on my body106Billions of dollars, he also lost on Didi110USD100mn His continuous large losses have also raised doubts about his investment ability. Loss situation of Sun Zhengyi's funds:

And for the founderAdamSpeaking of which, from2022year8Starting from the month, the focus will be on new projectsFlowAbove, we will operate multiple residential properties with the aim of cultivating a sense of ownership and community. Returning from commercial real estate to residential real estate. And successfully obtained10Billion US dollars in venture capital.

As a listed company,WeWorkNever achieved profitability, total net loss 30 USD100mn His starting point is to promise to provide a fun space to spend time with colleagues, offering bottled beer, table tennis, and plenty of comfortable leisure space for people to drink and brag. But obviously, for social attributesWeWorkThere are not many companies paying the bill.

In Australia, there are also severalWeWorkThe location was not fully booked by the company. andWeWorkThere are also many competitors, many of whom have gone bankrupt or run away. The reason is that after the epidemic, the popularity of commercial properties has decreased. Many people and businesses are starting toWork from homework from home At the same time, remote work became popular. The reason why this matter is difficult to rely on is that there is only one situation of success, and every change in factors can lead to rapid losses for the company: economic recession, working from home, rising interest rates, and competition. And these four factors quickly emerged after the epidemic. As the "second landlord"WeWorkHe bears the brunt of everything, but not necessarily his clients, who still have sufficient rent to continue inWeWorkOffice. becauseWeWorkThe target group is not large to medium-sized companies, which all have their own independent offices. such asGO MarketsThere are two levels of offices in Melbourne and an independent sea view office in Sydney. Because large and medium-sized companies do not know how toshareSharing office space requires a certain level of confidentiality and formality. What kind of person will be inWeWorkWhere is the office?sole traderperhapsITService related services will be available atWeWorkOffice work, which is already possiblework from homePeople will chooseWeWork. But after the epidemic, working from home in Australia can be used to offset taxes, and the rising rent or interest rates make people unwilling to use their spare money to rent another workstation or small office. Many times, talking about things can be done in a coffee shop. So,WeWorkThe bankruptcy of the company is a matter of time, unless there is continuous funding and blood transfusion.

When we invest in stocks, we prioritize investing in businesses with positive cash flow for future growth. Sun Zhengyi's failure also stems from his excessive reliance on valuation games and neglect of the core of investment itself: the company is meant to make money. Source:GO Market

|