Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

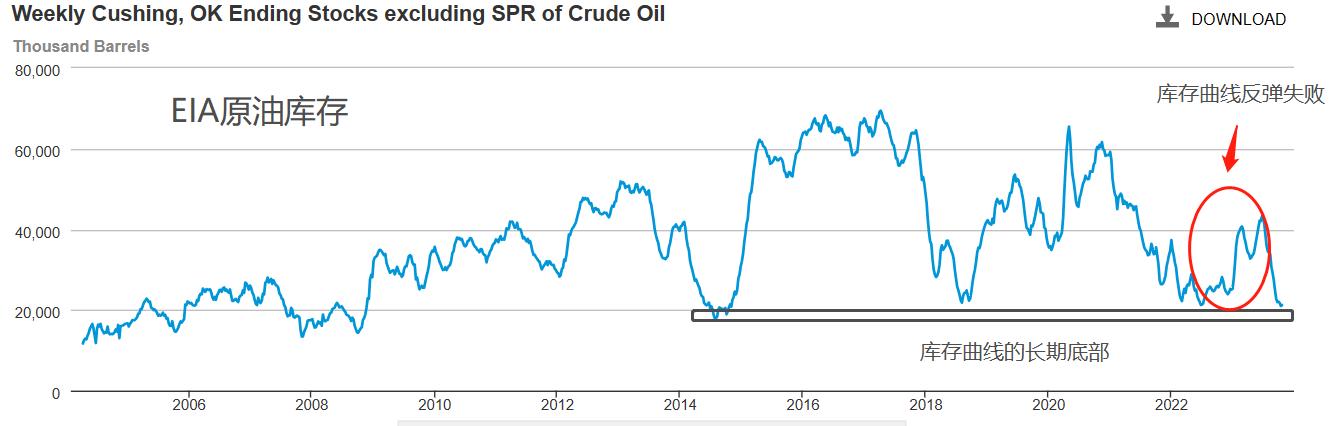

According to the United StatesEIAstay25Data released daily: to10month20Day and WeekEIAcrude oilInventory increase137.1Ten thousand barrels, higher than expected23.9Ten thousand barrels, the previous value is a decrease449.1Ten thousand barrels; to10month20Day and WeekEIAIncreased inventory of crude oil in Cushing, Oklahoma21.3Ten thousand barrels, the previous value is a decrease75.8Ten thousand barrels.EIAWithin five minutes of data release,NYMEXCrude oil slightly decreased, followed by23:00~23:05The price of crude oil plummeted sharply, but it closed at the Changyang line in the following five minutes and did not maintain an upward trend for the remaining time of the day. fromNYMEXJudging from the reaction,EIAThe impact of data on the market is very limited, and a week of inventory data changes cannot shake the mainstream expectations of the market.

The above graph shows the total crude oil inventory curve in the Cushing area of Oklahoma.2022year7The monthly curve touches the long-term bottom area2000About ten thousand barrels, followed by a rebound. The market had originally expected that this round of inventory increase would directly impact the long-term top area, about6000A scale of ten thousand barrels, but the curve is rising this year7The month came to an abrupt end and once again hit the bottom area downwards. Last week, inventory in the Cushing area increased21.3Ten thousand barrels, the increase in the total inventory curve at the bottom is too small to change the mainstream expectation of inventory continuing to decline.

The conflict between Palestine and Israel occurred duringOPECThe oil intensive production areas of the group have intensified market expectations of potential shocks to oil supply, which is bullishNYMEXThe rise of crude oil.10At the beginning of the month, Russia and Saudi Arabia announced the continuation of their previous production reduction plans, causing a "human factor" decline in crude oil supply. In addition, macroeconomic data in the United States has consistently performed well, with non farm payroll reports andCPIThe data shows no signs of recession, and the demand for crude oil remains stable, providing support for the rise in oil prices.

From a technical perspective,10month5From now on,NYMEXThe rebound of crude oil has always been affected byMA30The pressure is suppressed, but the decline cannot be broken through81At the US dollar level, the market has shown an atypical volatile trend in the past month. Awesome Oscillator KDIn the oversold range, if a golden cross appears, it means that crude oil prices will start a new round of rebound. Once the market price stabilizes and stands upMA30, it means that the bullish trend is restarting, in theEIAUnder the influence of a strong decline in inventory curve, it is expected to have an impact100The US dollar barrier.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-10-26

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|