Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

In the fourth quarter, the Federal Reserve also has two interest rate resolutions and one press conference, scheduled for11month1Rihe12month13Day. In last month's interest rate resolution, Federal Reserve Chairman Powell mentioned that "we are prepared to further raise interest rates in appropriate circumstances and maintain them at a restrictive level.". The market expects two resolutions in the fourth quarter, at least once announcing interest rate hikes25Base point. Under expectations of tightening monetary policy, the US dollar index continues to soar, reaching its highest point this month107.35Set a new high for the year. However, Atlanta Fed Chairman Bostic stated yesterday that "the current monetary policy is restrictive enough to bring inflation rates back to normal."2%The goal is to. The Federal Reserve should stop raising interest rates This statement has caused the US dollar index to decline0.29%Even the consistently strong 10-year US Treasury yields have emerged0.127%The short jump fell. From Bostic's speech, it can be seen that the main factor in stopping interest rate hikes is the decrease in inflation rate, which means that as long as the inflation rate remains at2%Nearby, tightening monetary policy can be terminated.

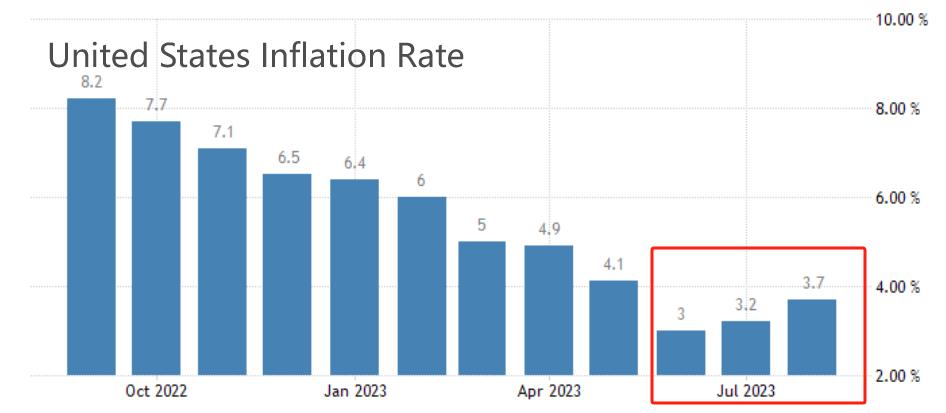

This Thursday, the US Department of Labor will announce9Monthly and quarterly adjustmentsCPIAnnual rate, previous value is3.7%Market expectations will decrease0.1Percentage points to3.6%. Since this year6Since the beginning of the month, the inflation rate in the United States has already been at4%Below, compared to the historical peak, it has already been "halved". The problem of high inflation has been substantially alleviated, and on the surface, the necessity of continuing to raise interest rates is no longer high. However, the "decrease in inflation rate" and the "inflation rate reaching2%”Different, even if the market expects to achieve2%But as long as the current inflation rate is still higher than the target2%If the Federal Reserve chooses to raise interest rates, it cannot be considered as exceeding expectations.

On the other hand, the reason why the Federal Reserve continues to convey interest rate hikes to the market is because the monthly non farm payroll report data always performs well. For example,9Non agricultural employment population after rose adjustment33.6Ten thousand people, far higher than the previous value18.710000 people, higher than expected17Ten thousand people, reaching a new high since January this year. The impressive employment data indicates that the US macroeconomy is still in a state of rapid expansion, and the destructive effects of high interest rates are far lower than previous market expectations. Continuing to raise interest rates will not lead to an economic recession.

From a technical perspective, the US dollar index has been falling for five consecutive trading days, with the medium to short term moving averages crossing downwards and a significant short-term decline. However, due to the possibility of the Federal Reserve raising interest rates in the fourth quarter, the medium to long term bullish trend of the US dollar index has not changed, and the medium to long term moving average still shows a divergence of bullish positions. Therefore, this round of decline can be classified as a correction, and the upward trend can be restarted once effective support is found.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-10-11

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|