Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

The data and event importance for this week, from high to low, are as follows: United States8monthCPIAnnual rate data, European Central Bank interest rate resolution, Apple's autumn new product launch. Let's analyze and interpret one by one:

This Wednesday20:30The United States Department of Labor will announce8Monthly and quarterly adjustmentsCPIAnnual rate, previous value is3.2%, expected3.6%;8Monthly and quarterly adjustment coreCPIAnnual rate, previous value4.7%, expected4.3%. Market expectation nominalCPIWill rise to3.6%Because8Monthly increase in international oil prices2.18%Accumulated increase in the past three months23.69%Driving a significant increase in inflation rate. Market expectation coreCPIDescend to4.3%Because this data is not affected by fluctuations in energy and food prices, it has been declining for four consecutive months, forming a clear trend. If the data release meets expectations, it indicates that nominal inflation in the United States is showing signs of rising, core inflation is continuing to decline, and expectations of high inflation will weaken. The Federal Reserve will9The probability of raising interest rates again in the month has decreased.7month18Since then, the US dollar index has maintained a strong upward trend, reaching its highest point last week105.16Point. If the coreCPIThe unexpected drop in data may trigger a round of adjustment in the US dollar index.

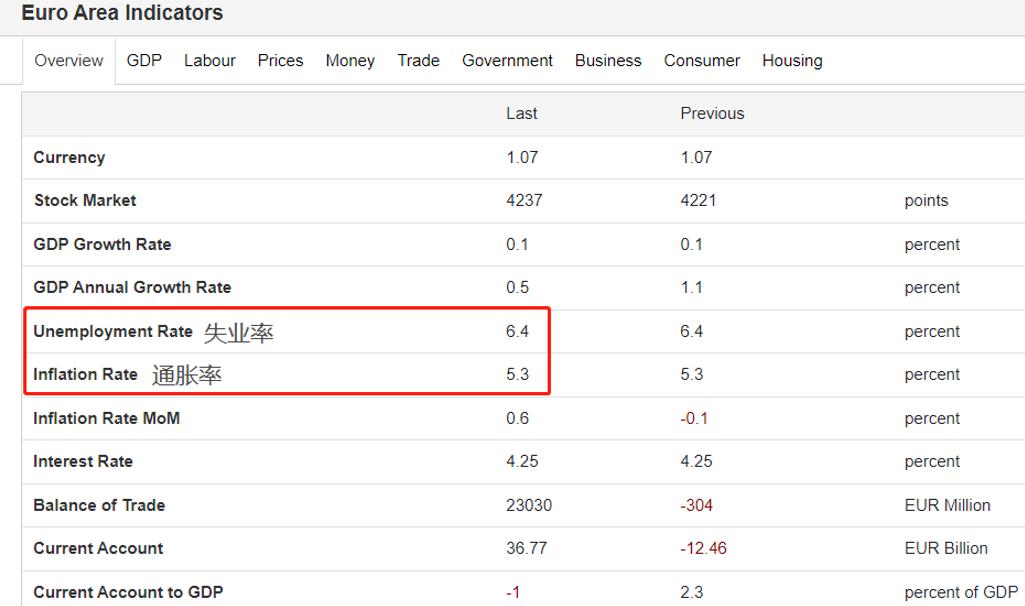

This Thursday20:15The European Central Bank will announce9The market generally expects the European Central Bank to maintain the monthly interest rate resolution results4.25%The benchmark interest rate remains unchanged, but there is still significant uncertainty in this regard. The latest inflation rate in the eurozone5.3%At a high level; Latest unemployment rate6.4%Higher than natural unemployment rate4%Standards. On one hand, there is high inflation, and on the other hand, there is high unemployment. The European Central Bank's interest rate hike will lead to a deterioration of unemployment data. Stopping interest rate hikes will not effectively control high inflation, making it a dilemma. The reason why the mainstream market expectation is that the European Central Bank will9The main reason for the month's inaction is that the Federal Reserve of Australia and the Bank of Canada, which have already made interest rate decisions, have maintained their benchmark interest rates unchanged, while the monetary policies of European and American central banks often have convergence. Additionally,9month21The Federal Reserve of Japan will also make interest rate decisions, with a high probability of keeping the benchmark interest rate unchanged.

This Wednesday morning01:00Apple will hold an autumn new product launch event, which is expected to be released iPhone 15、iPhone 15 Plus、 iPhone 15 Pro and iPhone 15 Pro MaxFour models, as well as the latestApple WatchandAirPods. There are rumors that the charging interface of Apple's series products will be upgraded from the previous oneLightingTransforming into more efficienttype-cInterface (also known asUSB-CInterface). Actually, in2022At the autumn launch of the new product, market participants had expected that Apple's charging interface would switch, but their expectations ultimately fell through. The expected resurgence of this market is mainly due to EU regulations: if Apple series products cannot be2024Starting from the autumn of this year, it will be converted toType-CInterface, then Apple products will not be able to be sold in the EU. Part of Apple's brand value is "technology leadership", and if forced to switch to a charging port, it may to some extent affect its stock price trend.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-09-11

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|