Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

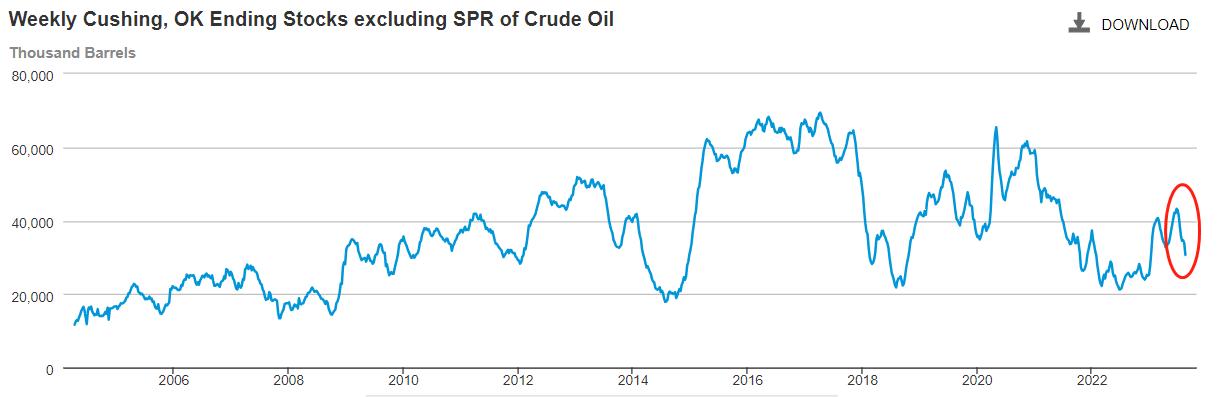

8month18Day and WeekEIAKuhin regioncrude oilstock3066.9Ten thousand barrels, compared to the previous value3380.2Ten thousand barrels decrease313.3Ten thousand barrels. From the inventory curve, it can be seen that since6month23Daily inventory increase4324.4After reaching a mid-term high of 10000 barrels, a downward trend immediately began, and support has not been found so far. From the perspective of supply and demand, a decrease in inventory means that the oil market is in short supply, and logically, crude oil prices should rise.

8month10Today, US crude oilWTIPrice from84.22Down to75.85Accumulated decline6.7%Deviation from inventory data performance. When spot data cannot explain spot prices, it means that the market's expectations for future data have changed.

The demand for crude oil is directly proportional to the economic volume. The United States, China, and the eurozone are the top three major oil demand countries/There is a resonance between the macroeconomics of the United States and the eurozone in the regionCPIBased on data and labor force data, the economic recovery momentum is strong, and the demand for crude oil is constantly increasing.

China's crude oil demand may decline. According to multiple reports released by the China Bureau of Statistics7Monthly national economic data. Growth rate of total retail sales of social consumer goods2.5%, lower than the previous value3.1%Far below the peak within the year18.4%; The sales area of commercial housing in China decreased year-on-year6.5%The previous value is a decrease5.3%; Value added of industries above designated size3.7%, lower than the previous value4.4%. Overall, all data have not improved, and the macroeconomic downturn continues.

ChinaGDPgross value17.963Trillion US dollars, ranking second in the world.2022In, China's total oil imports3655Billion US dollars, ranking first in the world. China is an important participant in the international energy market that cannot be ignored.1-7The performance of monthly macroeconomic data is poor, and the economic outlook is uncertain, with the possibility of a serious decline in crude oil demand. Based on this expectation, there may be changes in the future situation of oversupply in the crude oil market.

Saudi Arabia has already transferred10010000 barrels/The daily production reduction share has been extended by two months, and it is expected that9At the beginning of the month, it will announce another production reduction and extension. Led by Saudi ArabiaOPECBoth Russia and Ukraine, constrained by the Russia Ukraine issue, hope that international oil prices can stabilize at relatively high levels, so both continue to release production reduction news to boost oil prices. However, reducing production can lead toOPECAnd Russia's market share has been seized by other oil producing countries, especially forOPECFor small oil producing countries internally, the consequences of losing market share are very serious. We believe that,OPEC+The reduction in production can only boost crude oil prices in the short to medium term, and the long-term trend of crude oil still depends on changes in demand.

The high interest rate policies of European and American countries may lead to a deterioration in economic data before the end of the year. The roles of the two major industries, finance and real estate, are crucial in developed economies. High interest rates can lead to difficulties in credit issuance, reduced stock market valuations, and insufficient real estate demand. Especially in European and American countriesGDPThe growth rate is still sluggish, onlyCPIIn the case of high data. After the consumption of excess savings is completed, a cliff like decline in demand may lead to catastrophic consequences. For the crude oil market, the shift in monetary policy from tightening to easing in Europe and America means that the demand for crude oil has reached a turning point.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-24

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|