Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

This week's data and event importance, from high to low, are: New Zealand Federal Reserve interest rate resolution, Federal Reserve meeting minutes, and Eurozone7monthCPIAnnual rate final value. Let's analyze and interpret one by one:

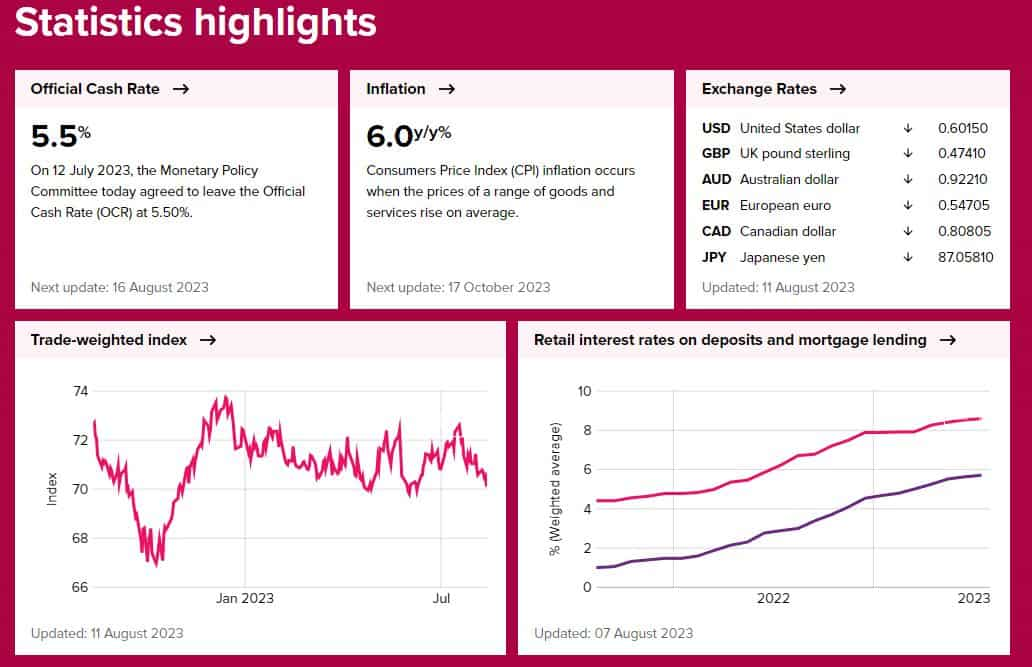

This Wednesday10:30The Federal Reserve of New Zealand will announce8month16The Federal Reserve's interest rate is determined by the benchmark cash rate, with a pre value of5.5%The expected value remains unchanged. New Zealand is one of the few countries that only releases quarterly inflation rate data, and currently the most recent available dataCPIThe year-on-year growth rate data is only available in the second quarter of this year6%And the first quarter's6.7%Comparatively speaking, New Zealand's inflation rate is in a rapid decline trend. In absolute terms,6%ofCPIThe growth rate is still relatively high and has the characteristics of malignant inflation, so it is necessary to continue tightening monetary policy. In the first quarter of this year, New ZealandGDPGrowth rate decreased month on month0.1%The macroeconomy is showing signs of recession, and the high interest rate policy has been criticized. Therefore, the market expects the Federal Reserve of New Zealand to stop raising interest rates this month. Unemployment rate in New Zealand3.6%, at a natural unemployment rate4%Below, the labor market has performed well. Consumer confidence index for the second quarter increased from77.7Ascend to83.1Consumer confidence has significantly improved, but still remains at a relatively low level, mainly due to the continuous impact of rising living costs and mortgage interest rates on household confidence.

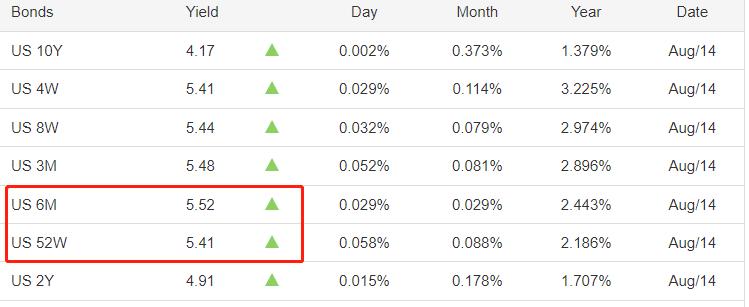

This Thursday2:00, the Federal Reserve will announce7Minutes of the monthly interest rate resolution meeting. The meeting minutes released last time helped the US dollar index improve from102.95Charge up to103.46Non US currencies have plummeted one after another. Due to7Monthly interest rate resolution exceeds expectations for interest rate hikes25The benchmark position of Thursday's meeting minutes is expected to lean towards hawkishness, and the US dollar index is likely to be boosted. Federal Reserve Chairman Powell once said in a speech, "We won't cut interest rates this year.",FOMCSeveral members said that interest rates are expected to be lowered next year. It is mentioned that those who support interest rate cutsFOMCThe opinions of the members are expected to be reflected in the meeting minutes. This part of the content will have an inhibitory effect on the US dollar index. The critical period for the yield inversion of the US long-term and short-term treasury bond bonds is still in6During the six-month period, it is expected that the interest rate cut will become a reality within six months. According to data from the Chicago Mercantile Exchange, the Federal Reserve9The probability of maintaining a constant monthly interest rate is approximately90%And next year5The first interest rate cut may be implemented on a monthly basis. Market participants are currently focusing on the issue of when the Federal Reserve will initiate interest rate cuts, and opinions are not yet unified.

This Friday17:00The Eurostat will announce7monthCPIAnnual rate final value, previous value is5.3%Expected to remain unchanged;7monthCPIMonthly rate, announced at the same time, previous value is-0.1%The expected value remains unchanged. According to last week's data, the United States7monthCPIAnnual rate from3%Raise to3.2%,7Maintaining month on month growth rate0.2%No change. Economic data from the United States resonates with the Eurozone, and it is expected that the EurozoneCPIThe monthly rate is expected to remain unchanged, butCPIThere is still a possibility of an increase in the annual rate.7In the month, international oil prices skyrocketed15.74%The energy prices in the Eurozone are bound to rise, and under the transmission effect of industry chain prices, the prices of other consumer goods will also be affected. On the other hand, the unemployment rate in the eurozone remains high6.4%Much higher than the natural unemployment rate4%Macroeconomics exhibits significant recession characteristics. At present, the European Central Bank is still adhering to a radical interest rate hike policy. Considering the current fragile macroeconomic environment, more fragile industries may experience liquidity crises in the future, with a focus on the banking and real estate industries.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-14

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|