Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

According to the US Department of Labor, the United States7Monthly and quarterly adjustmentsCPIAnnual rate, latest value3.2, higher than the previous value3%, lower than expected3.3%This marks continuity12The decline of months has stopped;7Monthly and quarterly adjustment coreCPIAnnual rate, latest value4.7%, lower than the previous value4.8%, lower than expected4.8%; to5month5Number of initial claims for unemployment benefits in the current week, with an increase in announced values24.8Ten thousand people, higher than the previous value22.710000 people higher than expected2310000 people.

2023year7Monthly, energy costs decrease12.5%Below6Of16.7%The reason is7monthWTIPrice surge15%Energy costs have increased month on month. Looking at other sub categories, electricity prices have risen3%Below6Of the month5.4%Food(4.9%yes5.7%)Housing(7.7%yes7.8%)And the new car(3.5%yes4.1%)The inflation has slowed down. The cost of medical services has decreased1.5%(The previous value is-0.8%)Declining prices of used cars and trucks5.6%(The previous value is-5.2%)。

beautiful7Monthly inflation rate data basically meets expectations, coreCPIStill in a downward trend. Federal Reserve9The probability of monthly interest rate hikes has decreased, and the US dollar index fell first and then rose in the intraday, ending with a long downward shadow. The number of initial applicants for unemployment benefits is higher than the previous value2.1Ten thousand people, and signs of high fever in the labor market have eased. Under the dual factors of easing inflation and cooling the labor market, the US index's medium to long term trend is biased towards a bearish outlook.

Another scenario is that the US dollar index remains stable for a long time100~105Within the interval. Because both optimistic and pessimistic macroeconomic expectations in the United States have relatively reliable logic, no one can significantly dominate. For optimistic expectations, the strong non farm employment report indicates a soft landing for the US economy. For pessimistic expectations, high interest rates will inevitably lead to a decrease in investment and a contraction in consumption, making economic recession inevitable. Both sides have opposing views, forming a balanced effect on the US Index.

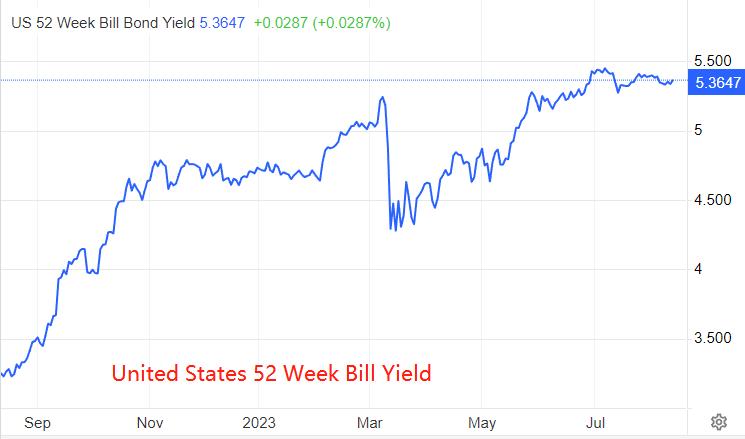

Yields on one-year US Treasury bonds5.3647%There were no significant fluctuations before and after the data release.6Since the end of the month, the one-year US Treasury yield has remained at5.25%~5.45%Within the range, we failed to reach new highs.7Since the end of the month, the fluctuation range has narrowed to5.35%~5.45%. The US dollar index during the same period exhibits similar volatility characteristics as the yield of one-year US bonds. The passivation of yields means that the bond market is no longer betting on the Fed's aggressive rate hikes. If the yield of one-year treasury bond falls back, the US index is expected to fall in resonance.

10The yield of one-year US Treasury bonds is still in an upward trend and has not shown any signs of passivation, indicating that long-term interest rates on US stocks are still on the rise.6The yield of one month US Treasury bonds and1The yield of one-year US Treasury bonds is inverted, and it is expected that the Federal Reserve's monetary policy will shift from interest rate hikes to interest rate cuts within six months.

2023year6In June, the US trade deficit increased from5Of683Billion US dollars narrowed to655$100 million, a three month low, in line with market expectations650The billions of dollars roughly match. Import decline1%, to3130100 million US dollars, for2021year11The lowest level since the beginning of the month, mainly for computers, finished metalscrude oilThe purchase of art and other collectibles, gemstones, diamonds, and tourism has decreased. Due to the drag of crude oil, fuel oil, natural gas, pharmaceutical preparations, civilian aircraft, and transportation sales, exports have slightly decreased0.1%, to2475Billion US dollars, compared to last year3The lowest level since the beginning of the month.

2022year3Since the beginning of the month, the magnitude of the US trade deficit has been continuously narrowing, reaching its peak1025.36Billion US dollars shrink to655USD100mn The trade deficit helps the US dollar flow to the world and alleviates the problem of high inflation caused by the surplus of the US dollar in the domestic market. Looking back at historical data, it was found that the United StatesCPIThe time when the annual growth rate peaked almost coincides with the time when the trade deficit began to rebound.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-11

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|