Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Global Futures Market Summary——

last week,WTIfall0.42%Settlement price81.94dollar

goldfall0.22%Settlement price1970dollar

Rebar drop0.56%Settlement price3732element

Overall, the futures market has generally declined, with energy and chemical industries, non-ferrous metals, and ferrous metals all spared.

Market supply and demand analysis——

crude oilThe main line of thinking about fluctuations is stillOPEC+Member countries continue to reduce production. Production reduction measures can directly affect the supply of crude oil, and crude oil prices often fluctuate and increase significantly. However, if the scale of production reduction cannot be continuously scaled up and only relies on extending the production reduction time, there will eventually be a positive effect of diminishing marginal utility.

8Since the beginning of the month,WTIAlthough prices are still showing an upward trend, the increase is not as significant as before. Maximum price83.3USD, lowest price78.69The US dollar has experienced an increase in volatility. During this period, there were two large-scale declines, with a decline of nearly2%Bull confidence is showing signs of loosening.

Last week's announcementEIACrude oil inventory data for the Cushing region of Oklahoma, from3573.9The inventory of ten thousand barrels has been reduced to3448Ten thousand barrels, decrease125.9Ten thousand barrels. The inventory curve that continues to decrease isWTIThe basic guarantee for sustained price strength.

On the other hand, Fitch's downgrade of the US Treasury rating has led to increased risk aversion in the international market, exacerbating the risk of a global economic recession. Based on experience, every year's6、7、8Month is the peak season for fuel demand, due to increased driving during the summer peak.9Starting from January and autumn, fuel demand drops sharply, and upstream crude oil inventories may increase. Under such expectations, crude oil prices are bound to come under pressure.

The Russia Ukraine issue has gradually faded out of public view, and the risk aversion caused by geopolitical issues has weakened, leading to a sustained decline in gold prices. Breakthrough in 10-year US Treasury yields4%Under the expectation of interest rate hikes, bond market yields may refresh2022year10A new high since the beginning of the month. Bonds are second only to gold as a safe haven, and an increase in yield means that bond prices continue to decline, which is mutually verified by the decline in gold prices.

The next bull market for gold is waiting for the Federal Reserve to end its rate hike cycle and start a rate cut cycle. The timeline cannot be determined yet, and a general judgment is expected to be made by the end of this year or2024At the beginning of the year.

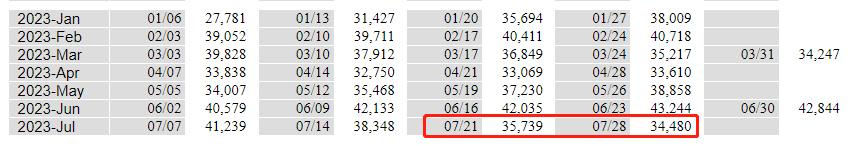

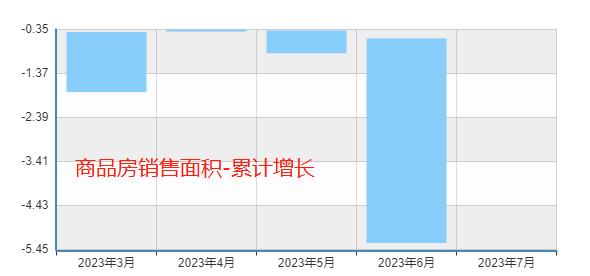

Threaded steel is an important raw material for the development of the real estate market, and there is a close connection between the two markets. In the past two weeks, policies have been intensively voiced to support the stable and healthy development of the real estate market. Multiple departments have also introduced various policies to support residents in purchasing houses, including reducing the down payment ratio, increasing the proportion of provident fund loans, and supporting the replacement of existing housing loans with lower interest rates. From a policy perspective alone, rebar may experience an upward trend. However, the fundamental performance of the real estate market is still poor, and there has been no substantial change in the issue of insufficient trading volume.

According to data from the Bureau of Statistics,6Monthly sales area of national commercial housing13074.7Ten thousand square meters, a year-on-year decrease18.2%The decline is evident. The policy bottom often appears earlier than the economic bottom, and if the sales area of commercial housing can recover in the coming months, the bull market for rebar can be expected.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-08-08

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|