Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Last week, the US dollar index plummeted1.21%, closing at102.3Point,

Same period: Euro appreciation1.78%Closing price1.0942Point;

Depreciation of the Japanese yen1.77%Closing price141.83Point;

GBP appreciation1.93%Closing price1.2824Point;

Appreciation of the Australian dollar1.97%Closing price0.6877Point;

Swiss franc appreciation1.01%Closing price0.8940;

NZD appreciation1.75%Closing price0.6236Point;

Canadian dollar appreciation1.07%Closing price1.3198Points.

Overall, when the US dollar index plummeted, all non US currencies appeared1%The above increases were the largest in the appreciation of the British pound and Australian dollar, but did not significantly differ from the appreciation of other currencies.

Federal Reserve suspends rate hikes and European Central Bank raises rates25Base point, the combination of two bearish factors, led to the US Index's appearance last week1.21%The lowest drop reached102Point. Previously, the market expected that the US dollar index of the Super Central Bank may fall below this week100Integer level, due to Powell's claim6Monthly interest rate hikes are only suspended rather than stopped, and the dot matrix shows that interest rates will rise to5.75%(Implying two interest rate hikes), so the Federal Reserve's interest rate resolution did not result in a significant depreciation of the US index.7The Federal Reserve's interest rate decision in January is extremely crucial as it determines the Federal Reserve's6Is the so-called "pause in interest rate hikes" in the month true. Second quarter in the United StatesGDPThe annual growth rate needs to be focused on, if it is lower than the previous value1.6%This indicates that the US macroeconomic situation is in recession. United States5The unemployment rate for the month ranges from3.4%Raise to3.7%This means that there are signs of weakness in the labor market. The inflation rate in the United States has dropped to4%Below, and5Sudden drop in months0.9Percentage points. Such a rapid decline in inflation may mean that the US macroeconomic situation is not as healthy as the Federal Reserve believes. The Bank of England and the Swiss Central Bank will announce the results of their interest rate decisions on Thursday, and the market is widely expected to raise interest rates25Base point. After the implementation of interest rate hikes, there is an upward momentum for the pound and Swiss franc, and the US dollar index is likely to decline under pressure.

From a long-term perspective, the US dollar index2022year9Touching a high point in the month114.79We have completed a round of appreciation cycle and will enter a long depreciation cycle. From a short-term perspective, the bearish characteristics of the US dollar index trend are extremely significant,5month31Since the beginning of the day, the cumulative decline has reached1.61%It is expected to continue the decline this week. market price102.36, running on0.618From a technical perspective, there is a possibility of rebound at the quantile. Short line support position101.72Short line resistance level102.75Points.

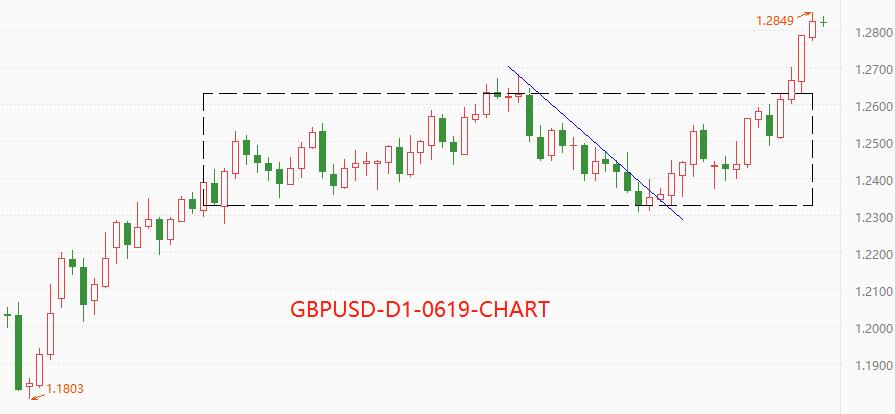

6The depreciation trend of the US dollar index since January, with the performance of the pound far stronger than the euro, with the former reaching a new high in a year, while the latter is still below5The high point of the month.5month26From now on,GBPUSDThe increase exceeds4%The decline in the US dollar index during the same period was only1.8%Less than half of the appreciation of the pound. It can be seen that trading pounds has a greater profit margin than trading other currencies. At the weekly level, last year9The mid term rebound band from month to date has reached its highest point0.618The key point is that the market may experience volatility or correction in the near future. market price1.2819Short term resistance level not yet available, short term support level1.2680Points.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-06-19

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|