Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

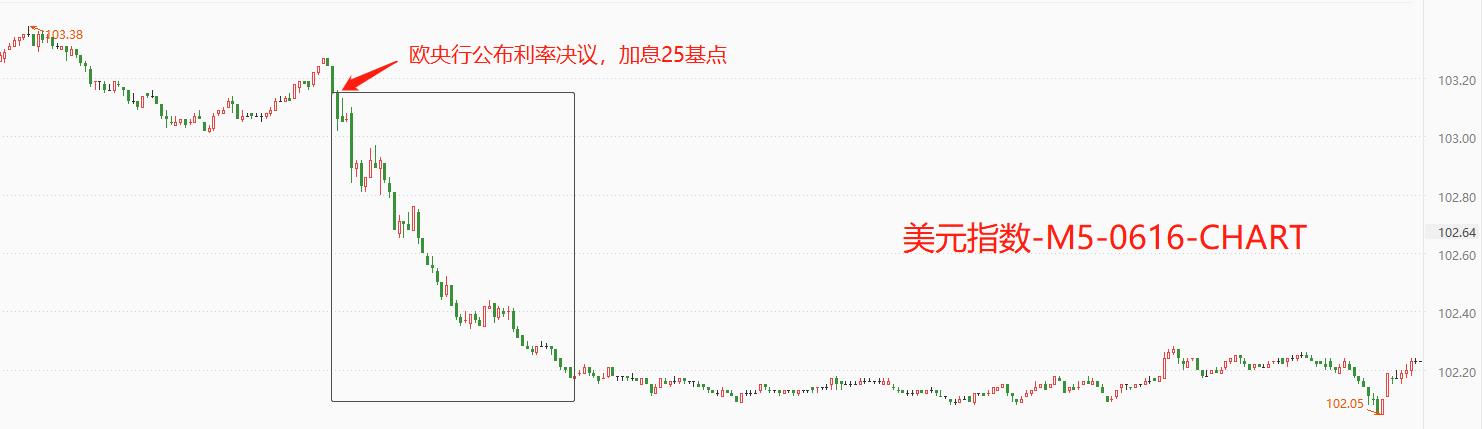

Overnight, the US dollar index plummeted0.83%, closing at102.16Point,

Same period: Euro appreciation1.05%Closing price1.0945Point;

Depreciation of the Japanese yen0.13%Closing price140.27Point;

GBP appreciation0.96%Closing price1.2785Point;

Appreciation of the Australian dollar1.3%Closing price0.6883Point;

Swiss franc appreciation1.03%Closing price0.8918;

NZD appreciation0.47%Closing price0.6236Point;

Canadian dollar depreciation0.77%Closing price1.3220Points.

Overall, the appreciation rate exceeds1%Among them are the Australian dollar, Swiss franc, and euro. Except for the Japanese yen, most non US currencies have experienced significant appreciation.

The Federal Reserve suspended interest rate hikes, and the US dollar index fell slightly on the same day0.29%; The European Central Bank raises interest rates25Basis point, US dollar index plummets0.83%It can be seen that the market has some expectations for the Federal Reserve to suspend interest rate hikes, but is quite surprised by the European Central Bank's continued tightening policies. Lagarde emphasized at a press conference, "Unless there is a significant change in the baseline, we are likely to7Continue to raise interest rates on a monthly basis. Such hawkish views drive the realization of the euro and Swiss franc1%The above increase is not surprising. The appreciation rate of the Australian dollar is as high as1.3%In addition to the boost from the decline in the US dollar index, iron orefuturesThe sustained surge is also an important influencing factor. While the US index has sharply declined, the Japanese yen has emerged0.13%The depreciation is related to the Bank of Japan's reduction of its holdings in super loose monetary policy. This morning, the Bank of Japan's interest rate resolution showed that it will continue to maintain0%10 year treasury bond bond yield target, maintain-0.1%The benchmark interest rate of. President Kazuo Uchida stated that he will continue to implement quantitative and qualitative easing policies until the inflation target is reached. In such a monetary policy environment, it is logical for the Japanese yen to exhibit a characteristic of being "easy to depreciate but difficult to rise".

yesterday20:15The European Central Bank announced interest rate hikes25After the basis point, the US dollar index will move from103.15Down to103.06The decline was not significant. However, in the following four hours, the US dollar index did not stop falling, and by zero on the same day, the cumulative decline had reached0.84%. From a technical perspective, the US Index has completely entered the downward trend, and without the influence of news, it is likely to reach a low point within the year100.78Fluctuation. Half way through this month, three data items that can have a significant impact on the US index - non agriculturalCPIThe growth rate and interest rate resolutions have all come to an end. In the second two weeks of this month, the US index, which has lost the impact of data, may exit a slow decline or volatile market, but the probability of a sharp decline is not high.

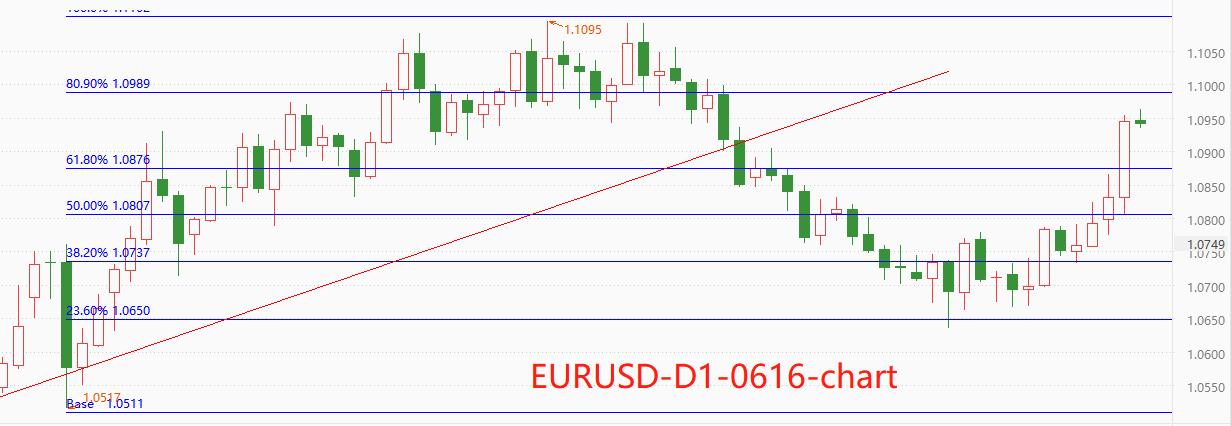

The Euro exchange rate is approaching1.1At the checkpoint, the euro broke through in April this year1.1This round of rising bands may createEURUSDA new high for the year. this year5In January, the euro exchange rate fell to its lowest point1.0635Reaching the initial increase0.764The important percentile indicates that the correction is sufficient, and the structure of this round of rise is relatively stable. Current market price1.0943Short term resistance level1.1000Short term support level1.0876. Switzerland has close economic and trade relations with the eurozone, so the exchange rate trends of the Swiss franc and the euro are basically the same. stayEURUSDWith the hope of reaching a new high,USDCHFIt is possible to hit a new low for the year. However, there have been multiple "Oolong Index events" in the history of the Swiss franc exchange rate at the upper levelUSDCHFBe vigilant when necessary. Current market price0.8908Short term resistance level0.9148Short term support level0.8820。

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-06-16

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|