Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Yesterday, the US dollar index rose0.12%, closing at104.14Point, same period: Euro depreciation0.18%Closing price1.0693Point; Depreciation of the Japanese yen0.05%Closing price139.63Point; GBP depreciation0.08%Closing price1.2424Point; Appreciation of the Australian dollar0.83%Closing price0.6672Point; Depreciation of Swiss franc0.15%Closing price0.9076; Appreciation of the New Zealand dollar0.15%Closing price0.6078Point; Canadian dollar depreciation0.31%Closing price1.3402Points.

The main reason for the significant appreciation of the Australian dollar is that the Federal Reserve of Australia raised interest rates beyond expectations25Base point, raise the benchmark interest rate to4.1%, creating2012A new high since the beginning of the year. The Federal Reserve of Australia stated that the purpose of raising interest rates is to reduce household spending, thereby reducing inflation rates. After the decline in energy and food prices, nominalCPIThe price subsequently decreases, but the coreCPIThe price remains strong at a high level due to strong demand. The practice of the Federal Reserve pushing up benchmark interest rates to curb aggregate demand for commodities was a common choice among global central banks before the outbreak of the US banking crisis. However, as signs of the collapse of the First Republic Bank of the United States and a global economic recession intensify, central banks in major economies around the world are considering stopping interest rate hikes. Against this backdrop, the Australian Federal Reserve's firm interest rate hike surprised the market. New Zealand has close economic and trade relations with Australia, and the New Zealand dollar is showing signs of appreciation following the Australian dollar. The Japanese yen and pound sterling showed strong resistance to depreciation yesterday.

The strong rise of the US dollar index far exceeded expectations, and there was still no significant depreciation trend during the turning point when the Federal Reserve was about to stop raising interest rates.4Month hits the second lowest point within the year100.78Afterwards, it rebounded all the way and has since stabilized104Gateway.6month15The latest Federal Reserve interest rate decision will be announced today, and the market generally expects it to remain unchanged5.25%The upper limit of interest rates remains unchanged. If the US dollar index can still close with a positive line on the same day, the bearish effect of the Federal Reserve's monetary policy shift on the US dollar index will be reassessed. From a long-term perspective (monthly line),2022year9The US monthly index rose to114.79The price is already within the historical high range. From the perspective of cyclical changes, the future direction of the US is towards a low range(100The probability of running is relatively high.

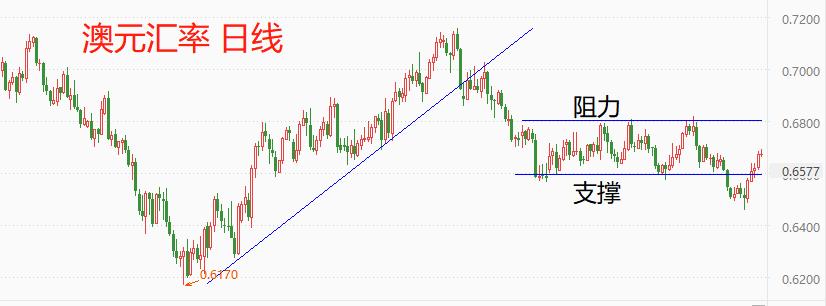

The Australian dollar is a commodity currency, and its value is related to iron orefuturesThere is resonance.5month26Since then, the price of iron ore futures has continued to rise significantly, with a cumulative increase of over13%This has significantly boosted the value of the Australian dollar.6month1From now on,AUDUSDThe achievement of a four consecutive positive trend is closely related to the strong rise of iron ore. From a technical perspective, the short-term support for the Australian dollar exchange rate is0.6600Location,5month24After breaking through the support under the sun,6month2The daily return above the support price level resulted in a false breakthrough. The market price is within the range of support and resistance levels, and it is highly likely that the market will continue to operate in a volatile pattern (daily level) in the future.2011year7Month to2020year2Of9The Australian dollar exchange rate has been in a bearish trend throughout the year,2020year3The month has reached its lowest point0.5509This price range is the bottom area for decades. From the perspective of cyclical changes, the Australian dollar exchange rate may have started a long-term upward trend,2021year2The downward trend band from month to date (at the monthly level), with the lowest point reaching0.618At the percentile, there is a higher probability of stopping the decline and rising in the future market.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-06-07

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|