(GBP USD)30Minute chart)

What is Wolf Wave?

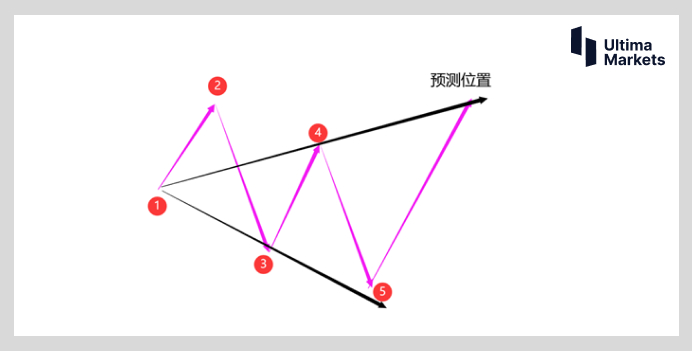

This structure may not be very clear to most traders and is called a Wolf wave. Usually, Wolf waves appear in the image above5After the wave, you can focus on future bearish trends and potential first target points4Horizontal zone, second target viewing point1And points4The connecting area of.

Although the Wolf Wave and Elliott Wave theories are not directly related, their purpose of creation is similar, which is to help traders identify the current market structure and speculate on future market trends. From the name, this structure was founded by Wolf.When volatility is high, Wolf waves are very noticeable. With a little practice, you can find the following two tradable structures on the intraday chart。

(Watch the Wolf Wave Structure)

(bearish Wolf wave structure)

Searching for Wolf Wave StructuresAt first glance, the above two structures may seem completely disoriented, but in fact, with just five simple steps, one can quickly get started with this high winning intraday structure. Step 1: Find the following forms: "√" and "ヘ". Step 2: After you find the check mark "√" and the check mark "ヘ", you can mark the points one by one from the starting point of the left band1、2and3。

Step 3: Waiting point4The occurrence of callbacks requires attention to effective points4Must enter point1And points2Within the price range of the connection.

Step 4: When4Only after all the points have been formed can we start searching for potential trading points for Wolfwave5。

Connection point1And points3, point1And points4. If it is a valid Wolf wave, then point5A blocked turn signal will appear on the connection line of the former.

Step 5: Enter the transaction and set the stop loss at the point5Near the endpoint, the target looks towards the other side of the ray position.

matters needing attention

In actual transactions, simultaneously meeting5The structure of individual points is not commonly seen, but once a clear Wolf wave is discovered, it is usually a high probability trading opportunity.

However, there are still three precautions for beginners.

1、 Before there is a clear fluctuation endpoint in the market, we should not rush to divide and judge.

2、 When connecting two rays, it is not always necessary to use a point4And points3The lowest price of/Connect at the highest price, as short-term price fluctuations may amplify, causing the upper and lower hatches to interfere with the connection division. Connection points can be connected by eliminating short-term price noise1And points3(or point4)The closing price of.

3、 By other oscillation indicators or nakedKStructure to assist in determining points5The end of.

Fund management is an effective prerequisite for the success of any trading strategy. Therefore, do not blindly enter with confidence when you see potential Wolf waves. Strict risk control is the key to consistently outperforming in this fun filled market。

Disclaimers

The comments, news, research, analysis, pricing, and other information contained in this article can only be considered as general market information and are provided solely to assist readers in understanding the market situation and do not constitute investment advice.UltimaMarketsReasonable measures have been taken to ensure the accuracy of the data, but the accuracy of the data cannot be guaranteed and can be changed at any time without notice.UltimaMarketsWill not incur any losses or losses that may arise from the direct or indirect use or reliance on such information(Including but not limited to any loss of profits)Responsible.