Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

The first week of April,goldCharge up to2049.2The US dollar fell all the way down, and today its market price has dropped to2000dollar/Less than ounces. In the first and second weeks of April, international oil prices were affected byOPECThe impact of production reduction continues to rise sharply, reaching the highest point83.53dollar/Bucket. At that time, some market participants speculated that,WTIThere is a possibility of impact100The US dollar barrier. However, the situation backfired, and from the third week onwards,crude oilThe price has shifted from rising to falling, and today the market price is already at80Below the US dollar.

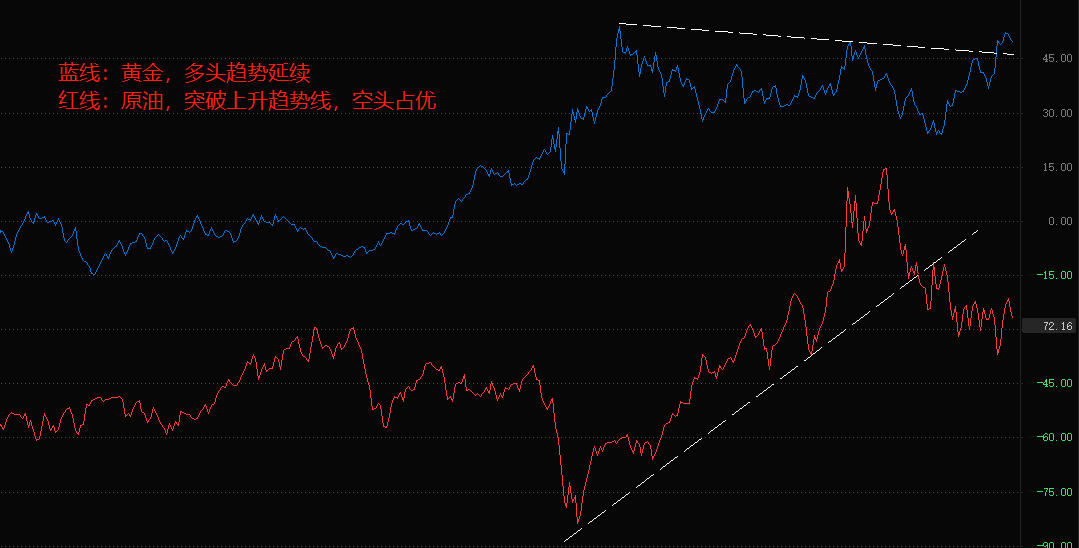

Although both gold and crude oil prices are declining, the trend direction of the two is different. The decline of gold has a short-term attribute, as the medium to long term volatility range is already within the3The month has been broken through, and there is still great potential for further growth after stepping back in place in the future. Crude oil is not the case,2022year6The month has already formed a double peaked structure, and the downward trend has continued10Over the month, bearish forces dominate the market trend.OPECAlthough reducing production is a positive factor, it has only occurred once, making it difficult to sustain a single tree and unable to have a sustained impact on the medium to long term trend.

Logically speaking, gold and crude oil should have a reverse fluctuation relationship. The higher the oil price, the better the global economic recovery. The higher the gold price, the higher the panic sentiment in the financial market. Recovery and panic are opposite, opposing each other, and will not occur simultaneously. Since the main trend of gold is still upward, the main trend of crude oil must be downward. From a macro perspective, the single minded increase in interest rates by the Federal Reserve and the European Central Bank could ultimately lead to a global economic recession. The Silicon Valley banking incident is a sign that the virtual economy cannot withstand such intense interest rate hikes, let alone the real economy. Famous American companies such as Google, Amazon, and Twitter are constantly laying off employees, which is also one of the evidence of the decline in economic growth potential in the United States. The data in the non farm employment report is strangely in a state of strong demand, and we view this situation as a 'lag in data'. Over time, the non farm employment report will ultimately reflect data performance that is consistent with macroeconomic recession expectations.

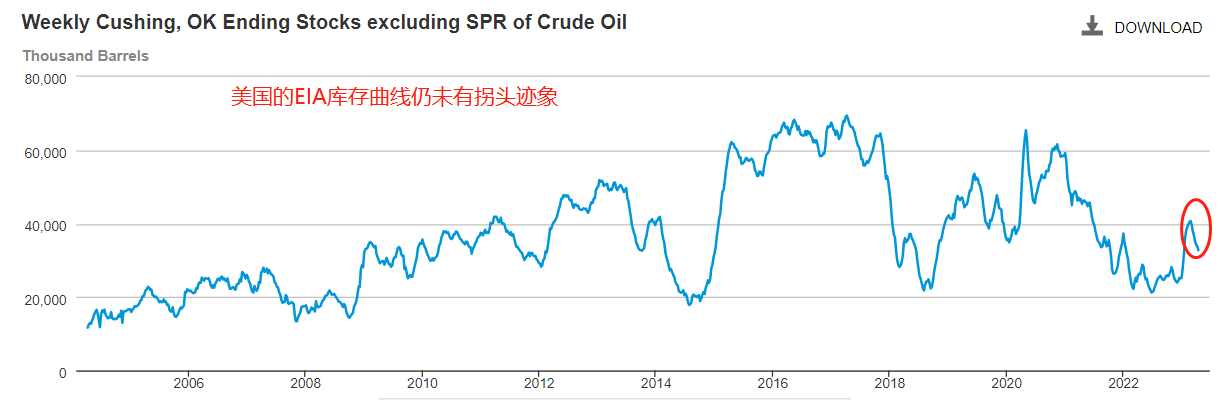

Although the pullback in crude oil may evolve into a trend downward trendEIAThe crude oil inventory data is still indicating a shortage of supply in the short term.2month24Starting from the beginning of the day, the inventory trend began to decline, until4month14It has been going on for over a month and a half. To be cautiousEIAParticipation is not recommended until the inventory curve turns upwardsWTIShort selling direction to prevent the impact of two opposing factors, the Federal Reserve and the non farm employment report.

The role of gold prices is similar to that of US Treasuries, and their trends also converge. The yield of 10-year US Treasury bonds has formed a double peaked structure with a large cycle, and a long-term decline has become a foregone conclusion. Although the Federal Reserve is still in the path of raising interest rates5The month may become the last interest rate hike of the year, so the expectation of long-term interest rates is actually decreasing. As yields decline, bond prices will rise, and gold prices will also resonate with them.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-04-24

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|