Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

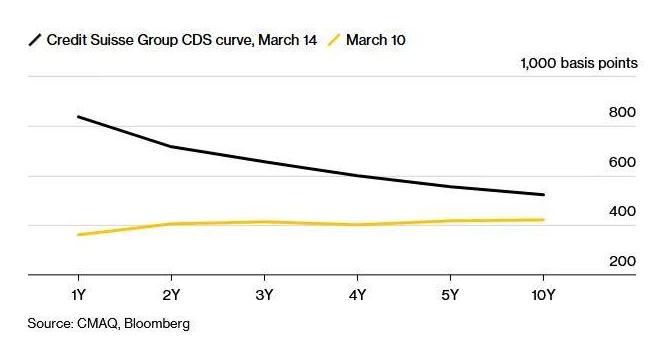

The risk exposure events in the banking industry can be described as one wave after another. Firstly, Silicon Valley Bank in the United States was run on by depositors and investors, resulting in bankruptcy and bankruptcy. Fortunately, there are the US Treasury, Federal Reserve, and Federal Deposit Insurance Corporation(FDIC)The joint rescue, promised by US President Biden, will enable all depositors to receive their own savings. The incident of Silicon Valley Bank has not yet subsided, and Credit Suisse, the second largest bank in Switzerland, has seen waves rise again. Yesterday, Credit Suisse suddenly announced that it would apply to the Swiss National Bank, the Swiss Central Bank500A loan of one billion Swiss francs is used to supplement one's own liquidity. The credit swap market has sent a dangerous signal as early as this Tuesday: one-year credit default swap of Credit Suisse bonds(CDS)Quote at closing835.9Far above the normalized level, it means that the likelihood of bond default is extremely high.

Affected by this news, Credit Suisse's share price plummeted on Wednesday13.94%, minimum to1.75USD. What is worrying is that the market is unable to understand what is causing the surge in default risk of Credit Suisse. According to Credit SuisseCEOSaid: "Our credit risk exposure to Silicon Valley banks is not large, and the number of our fixed income securities is absolutely not significant. In addition, our risk exposure to interest rates has also been fully hedged." This statement shows that Credit Suisse's liquidity risk is very different from that of Silicon Valley banks, and the former does not hold excessive U.S. bonds. The Swiss Central Bank has accepted the loan request of Credit Suisse, and the tension in the stock market has been greatly relieved. However, only when it is clear that the root cause of Credit Suisse's problems can the rescue effect of the Swiss Central Bank be evaluated.

Since Credit Suisse has a huge influence in the European financial system, after its exposure of liquidity problems, the value of the euro has been greatly impacted. The single day decline of the euro against the US dollar is as high as1.46%The market quotation once fell below1month9The lowest point since the beginning of the day. From a technical perspective, the pullback band of the euro against the US dollar has become the epicenter of volatility1Overlap is a typical signal of a turning trend. If the market price falls belowS1:1.0483The formation of a bearish trend will be confirmed.

The results of the European Central Bank's interest rate resolution will be announced today21:15publish; Half an hour later, European Central Bank President Lagarde held a press conference on monetary policy. The current mainstream expectation in the market is still that the European Central Bank will aggressively raise interest rates50If the announced value meets expectations, the euro will receive a certain degree of boost. European Central Bank President Christine Lagarde's speech is the top priority. The focus of the market is how to evaluate the liquidity of Credit Suisse. If he believes that the event will not affect the monetary policy path of the European Central Bank, then the exchange rate of the euro against the US dollar will rise significantly. In addition, Lagarde's views on inflation and unemployment rates in the eurozone will also have an impact onforeign exchangeThe impact of market formation needs to be focused on.

Risk reminder, disclaimer, special statement:

There are risks in the market, and investment needs to be cautious. The above content only represents the analyst's personal views and does not constitute any operational suggestions. Please do not consider this report as the sole reference. At different times, analysts' perspectives may change, and updates will not be notified separately.

2023-03-16

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|