Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

WednesdaygoldFalling, hitting a new low in a month1830The dollar, we suggest that you continue to rally and short on the same day. This is the the fourth day day in a row that we have been bearish on gold1857USD and1867For the two short pressure levels of the US dollar, the following targets are given respectively1843USD1833USD and1825USD.

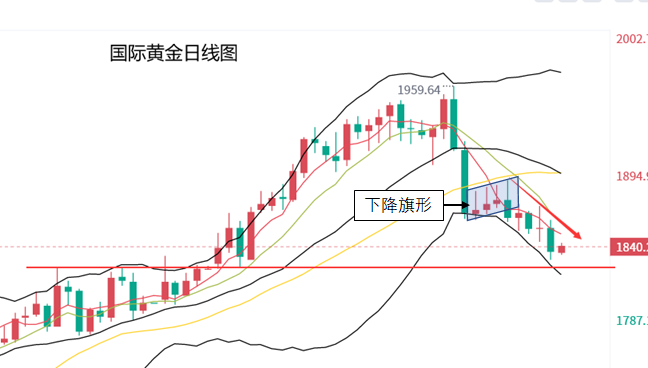

Last week, Fang Yuan emphasized multiple times that after the sharp decline of gold, the trend shows a downward flag shape, which is a typical downward trend. Due to the large short-term decline, gold prices have been counterattacked by multiple parties, and during the consolidation period, gold will show signs of rise. Therefore, during this period, our suggestion is to mainly buy long on dips, and the trend of gold is also constantly exploring new highs.

When gold appears in a downward flag shape, the price of gold often breaks through the lower support position of the downward flag shape after a period of time, and then further develops a downward trend. In a few cases, it breaks through the upper pressure position of the downward flag shape and accelerates upward movement. Last Thursday, gold encountered resistance as it rose and fell from a high level30The US dollar, breaking through the downward support of the falling flag, is a clear signal of short selling. Since then, we have been suggesting that everyone should focus on rebounding and short selling, while the trend of gold is also constantly exploring new lows.

In addition to lowering the flag and displaying bearish signals, the daily level and moving average indicators have a dead cross downward, and the Bollinger band is downward,MACDThe high dead cross of the indicator is downward,DKJAndRSIThe dead cross of indicators, and the fact that gold happens to encounter resistance and fall at the upper position of the weekly and monthly Bollinger Bands, both suggest that there is a risk of further decline in gold.

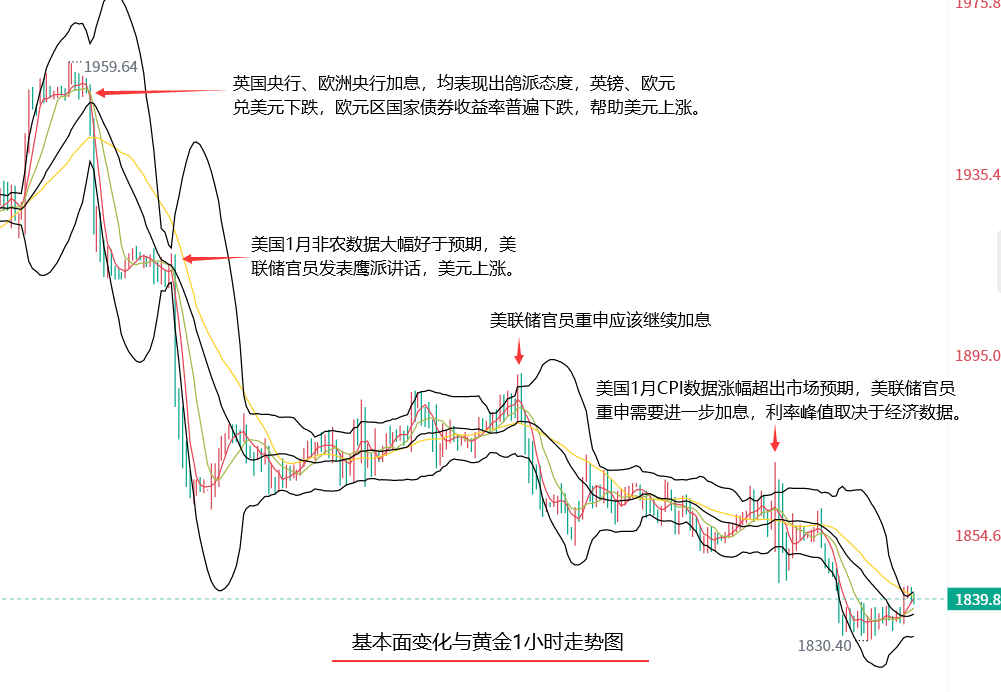

Gold is bearish on the technical side, and the fundamental situation is also not optimistic. Earlier, gold continued to rise, hitting a nine month high, mainly due to market expectations that the Federal Reserve would slow down its rate hikes and bets that the Fed may cut rates within the year. In addition, concerns about the geopolitical situation and economic recession also provided support for gold prices.

get into2The United States announced at the beginning of the month1The monthly non farm payroll data performed significantly better than expected, which directly weakened the market's expectation for the Federal Reserve to cut interest rates within the year and strengthened the market's expectation for further interest rate hikes. After the data was released, Federal Reserve officials also repeatedly made hawkish speeches, reiterating that the Federal Reserve should continue to raise interest rates until inflation returns2%The target level.

Announced by the United States on Tuesday1monthCPIThe data, both year-on-year and month on month increases, exceeded market expectations, reflecting significant uncertainty in US inflation. After the data was released, Federal Reserve officials continued to deliver hawkish speeches, reiterating the need to continue raising interest rates to curb inflation, and the peak interest rate depends on future economic data.

With changes in fundamentals, the market expects the Federal Reserve to further raise interest rates and maintain high rates for a longer period of time, which helps the US dollar rebound from a nine month low and hit a new high in the past month, while gold fell from a nine month high during the same period and hit a new low in the past month.

Gold intraday reference: technical and fundamental bearish, gold still faces significant downside risk, and it is recommended to continue to rebound and short in operation. Pay attention to upward pressure1843dollar(Tuesday low point)、1850dollar(Daily line5Daily moving average)Follow the target below1830dollar(One month low point)、1825dollar(Low point within the year)、1819dollar(Daily Bollinger Belt Lower Track)。

Note: This article is provided by Fang Yuan. I interpret world economic news, analyze global investment trends, andcrude oilThere is in-depth research on commodities such as gold and silver. Please indicate the source when reprinting. Kind reminder, investment carries risks and caution is required when entering the market. Due to the latency of online publishing, operational suggestions are for reference only. Specific locations will be provided based on actual data. Please take risk control measures yourself.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|