Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Tesla was once a great company, which not only pioneered new energy vehicles and intelligent driving, but also made great contributions to human exploration of space. These achievements can not be achieved without the soul character of Musk. He is an idealist and a workaholic. He has no intention of saving his own property, but only wants to lead mankind to "emigrate to Mars". This noble pursuit has won the admiration of countless people, and also created Tesla's trillion market value.

However, Tesla's performance in the past year has surprised us: the stock price has dropped by 70%109The US dollar is highly likely to fall below the 100 yuan mark within the month. So, what is the reason why Tesla's stock is no longer popular?

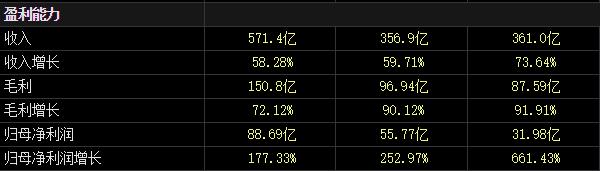

chart1Tesla's cumulative performance data for the first three quarters

Firstly, it is definitely not a performance issue. Tesla achieved total revenue in the first three quarters of this year571.4100 million US dollars, year-on-year growth58.28%Strong growth potential. Net profit attributable to the parent company88.69100 million yuan, year-on-year growth177.33%Nearly doubling, there is no doubt about profitability. Lengthen the cycle, Tesla2020Starting from the beginning of the year,2021The annual net profit has more than doubled,2022It is expected to achieve good results again this year.

The core of value investment is the ability of listed companies to generate cash flow. Tesla's performance data is impeccable, and the superposition of new energy vehicle tracks still has a very high degree of prosperity. Therefore, Tesla's intrinsic value is probably rising, rather than falling like the stock price.

It should be noted that although Tesla is still a leading brand in the field of new energy vehicles, its ability to update and iterate products is being lost, especially“SEXY”After the release of all four models, there have been almost no subsequent changes or updates.

In fact, there are two fundamental reasons for the decline in Tesla's stock price: firstly, the top three companies in the United States during the same periodstock market indexIt is obvious that Tesla's decline is normal when the market is generally weak and both are falling; Secondly, 'success and failure are both small and small.' Musk's popularity for Tesla is also due to Musk's own actions that make the market want to abandon Tesla.

Over the past year, Musk has continued to sell off his Tesla stock, with a total value of approximately400USD100mn The discounted funds were not monopolized by Musk, but instead transferred to the reserve funds for acquiring and managing Twitter. For Musk, there is no problem transferring Tesla's funds to Twitter; For Tesla's shareholders, Musk's capital transfer is to "empty" Tesla. You should know that Twitter is a pure internet enterprise, while Tesla is a technology based manufacturing industry, and the overlap between the two is not high. Perhaps' robbing Peter to pay Paul 'is not a good idea.

There is a voice that Musk acquired Twitter to "run for the next US President". This statement was denied by Musk, and he also claimed that he supported Florida Governor De Santis running for president. Imagine boldly that if Musk were to run for the next president, Tesla's stock price might soar.

ATFXOverall view of the analyst team: Tesla's performance is excellent, and the recent weakness in its stock price is mainly affected by Musk's selling. From the perspective of value investment, long-term stock prices will be supported by performance.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

2022-12-28

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|