Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

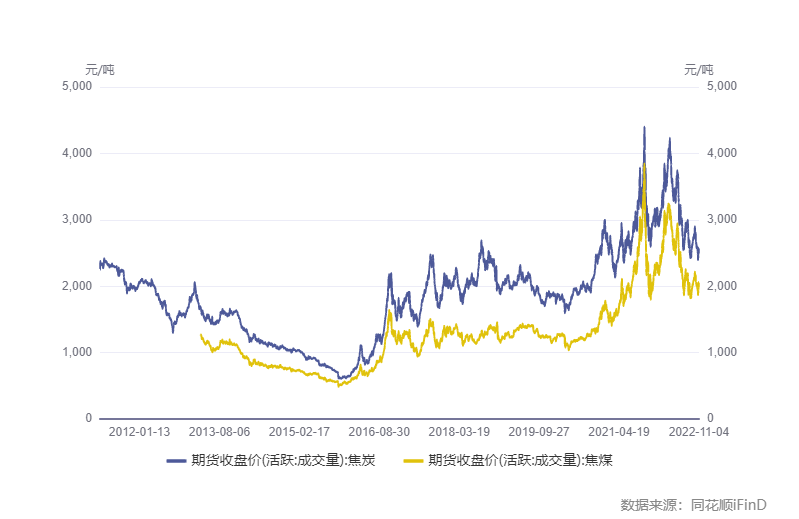

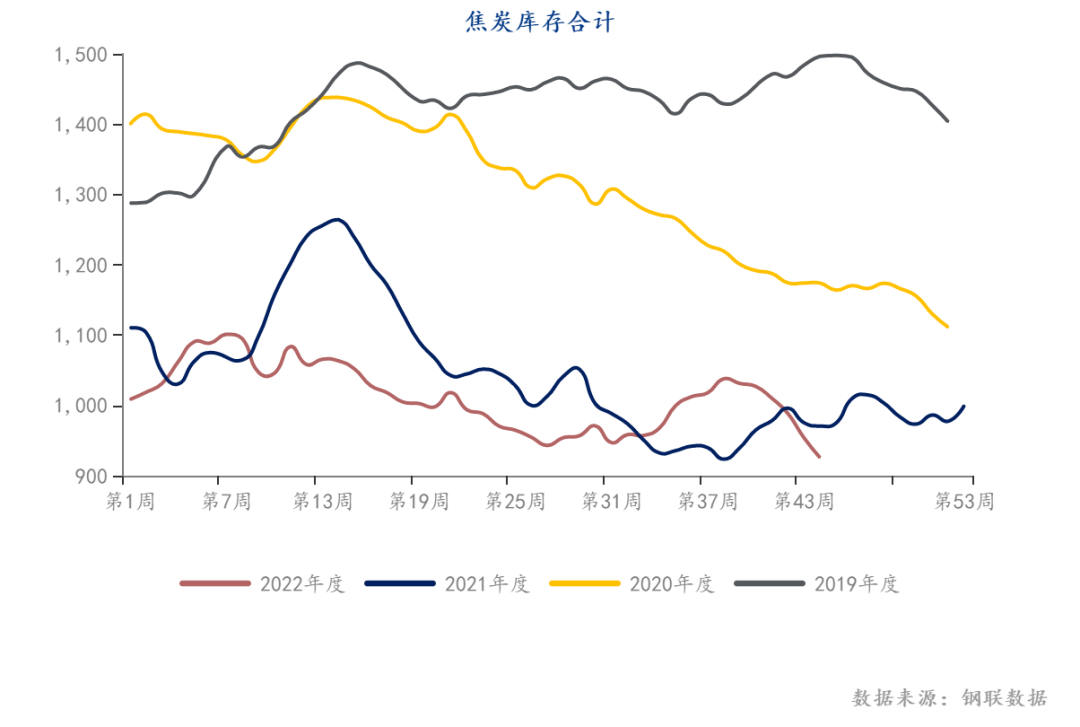

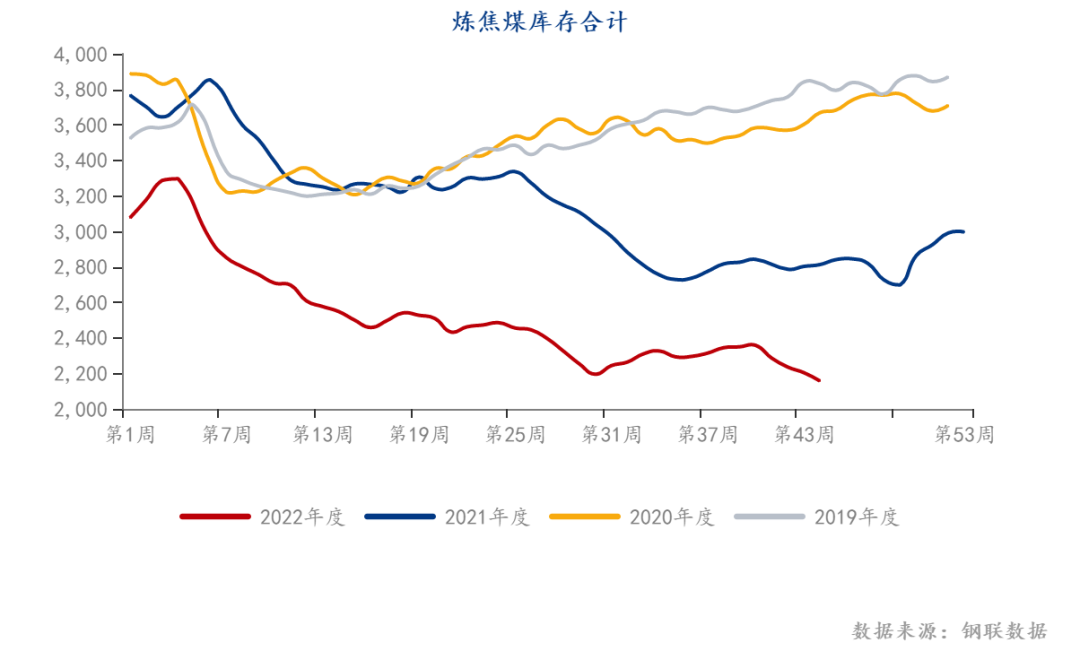

焦煤焦炭本周波动较大,铁水产量再次减少,但钢材表观需求有所提升,下周铁水减产幅度可能趋缓,对焦煤焦炭的需求可能趋于稳定。本周矿山企业焦煤累库,焦企焦炭累库,产业链下游按需采购,采购积极性较差,上游出现累库情况,但总体库存降幅明显,目前焦煤焦炭总库存同比均处在低位,焦企的焦煤库存降至低位,钢厂的焦炭库存降至低位,短期或存在补库需求。

Coke demand:

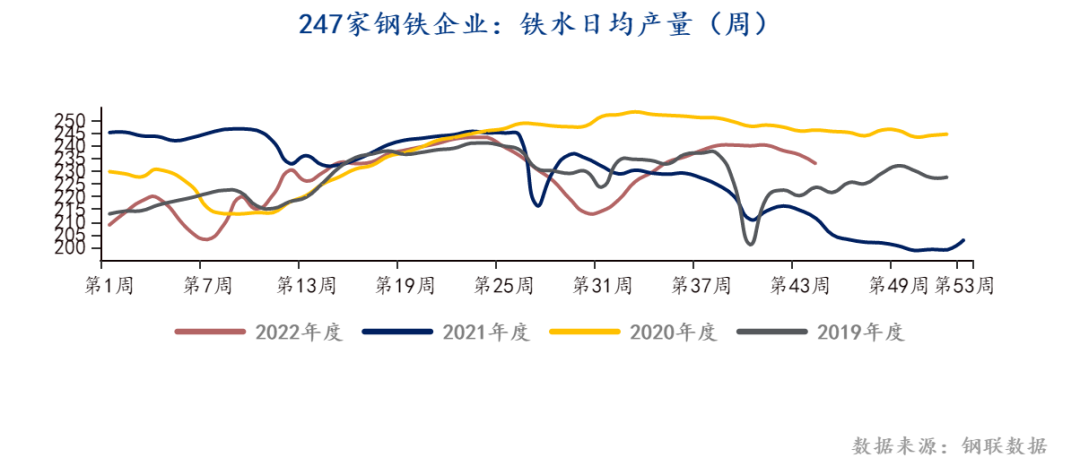

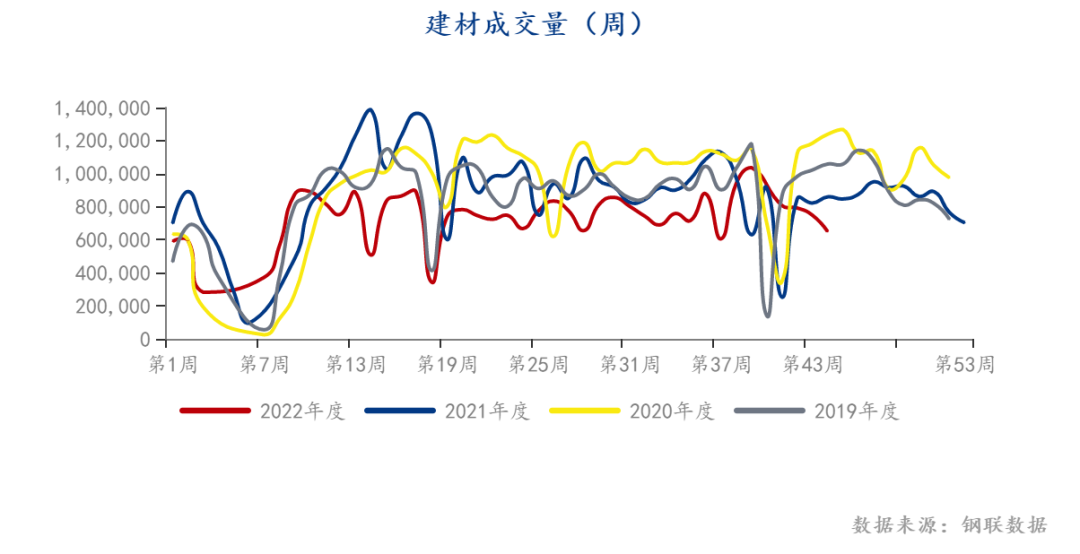

终端需求短期表现较好,本周钢材的社会库存和钢厂库存均有下降,表观需求本周也再次逆转向上。钢厂依旧处在亏损阶段,本周钢厂亏损有所减少但幅度有限,为增加自身的收入水平,钢厂自发减产,铁水产量再次下滑,目前铁水产量为232.8210000 tons, compared to10月初已有较大跌幅,短期跌幅可能趋缓,下周焦炭的需求可能维稳为主,降幅不大,需求逐渐企稳。

Coke supply:

焦企亏损持续,下游按需采购,导致焦企生产积极性较差,本周焦企日均产量为60.63Ten thousand tons, decreasing month on month1.88%,预期下周延续这一生产节奏。钢厂焦炭产量本周略增,下周钢厂铁水的减产幅度可能趋缓,对焦炭的需求可能维稳,焦企的减产幅度可能也相应的减弱,预期下周持稳运行,焦企供应可能趋稳运行。

Coking coal supply:

The clearance volume of Mongolian coal this week has decreased compared to last Sunday42.25车,甘其毛都通关量维持在500车左右,满都拉通关降至66车,蒙煤供给有所弱化。国内山西主动请缨增产,本周洗煤厂开工率和产量均有增加,矿山企业出现累库,但疫情仍对运输造成影响,供给扰动依旧存在。总体,供给压力有所缓和,煤炭的供应有所增加。 Coking coal inventory:

焦企和钢厂的煤炭库存持续减少,一方面钢厂主动减产导致对煤焦的需求减少,焦企和钢厂按需采购,不愿多囤积煤炭;另一方面煤炭价格高企,目前钢厂和焦企均有所亏损,利润主要集中在煤炭,下游对高价煤炭有抵触心理。山西主动请缨增产导致矿山企业库存有所增加,但下游按需采购可能导致矿山累库,短期形成上游累库,下游低库存,总库存较低的局面,但上游的累库说明煤的紧缺性不强,只是价格太高,压制了下游的采购积极性。

Future outlook:

10月初到现在铁水产量下滑明显,在钢材表观需求好转的情况下,下周铁水产量减产幅度预期有限。目前钢厂和焦企的煤焦库存已降至较低水平,后期或有补库需求。供给端蒙煤的供给有所减弱,山西煤炭有增产预期,但疫情的短期扰动依旧存在,供给趋紧局面近期有所改善,但增量始终有限。预期短期双焦可能超跌反弹,中长期产业链利润重新划分,煤炭延续下跌趋势的可能性依旧存在。 相关股票合约如下,请多加关注行情变化,控制好持仓!

|