Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Just entered the marketgoldOur friends may not be able to access the top news or news in the international market due to work, life, and other issues, which is a great problem for us to do gold. Therefore, Fang Yuan welcomes investment friends to come to me to communicate and progress together, so that everyone can stay informed of the international market trends at any time and place, and make the most stable orders. Fang Yuan's official WeChat account:fysj87Get more real-time investment information, market trend analysis, and trading strategy guidance.

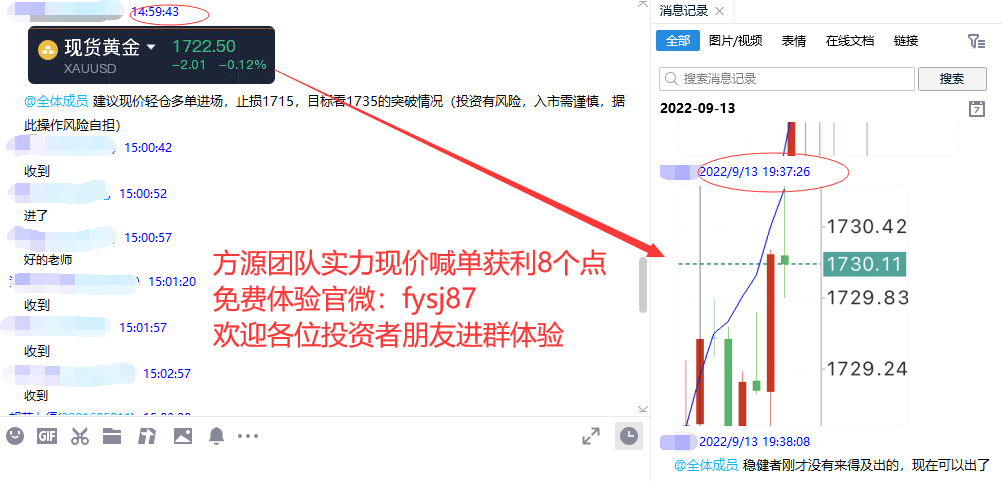

Experience benefits: For friends who have been added to Teacher Fang (official WeChat account:fysj87)The Fangyuan team provides free of charge3Call for orders at the current price to verify your strength.

Here is my current price order within the group. Real time updates every day. I usually have real-time layout of current price orders for everyone to keep up with. As a straightforward person, I won't keep accurate market trends. As long as I have accurate orders, I will enter the group through current price orders!

Analysis of the trend of gold market;

According to data released by the US Department of Labor on Tuesday, the United States8monthCPIMonth on month growth0.1%, year-on-year growth8.3%. According to Dow Jones estimates, economists had previously predicted that the United States8monthCPIThe month on month ratio will decrease0.1%, will increase year-on-year8%Data and display, US coreCPIMonth on month increase0.6%, the increase is relatively high7Monthly expansion0.3Percentage points; Year-on-year increase6.3%, the increase is relatively high7The month has significantly expanded. Economists previously predicted that8Monthly CoreCPIMonth on month growth is expected0.3%, will increase year-on-year6%。

U.S.ACPIAfter the data was released, the Chicago Mercantile Exchange tracked data showing that the market currently believes that the Federal Reserve will9Interest rate hike at monthly monetary policy meeting75The likelihood of a basis point increase82%Interest rate hike1The probability of one percentage point is18%。

The release of data during the US market period is to allow prices to swallow up three days of upward momentum in a bearish period, ultimately ending in a bearish period. This foundation represents that the short-term trend has turned short, so pay attention to intraday trading1712Short positions! Short term price trading1700First line, daily time correction position at1712Area, there will be effective pressure at this location today to reach direct air. The hourly chart has fallen below the upward trend line, and the bulls in the main trend have not changed much yet. They are going through a limit retracement. Follow below1690Location. Day lock1690-1712Engage in high-altitude and low volume trading! Approach with a bearish mindset rather than chasing after the empty market

crude oilMarket trend analysis;

Today Wednesday, the market needs to pay attention toIEAPublish monthly crude oil market reports andEIACrude oil inventory data, pay attention to the supply and demand situation, and supply and demand are still one of the main factors affecting the rise and fall of oil prices. The result will have a direct impact on oil prices.

Oil prices fell nearly yesterday1%Reversing the earlier intraday gains, the United States8The unexpected increase in monthly inflation data provides evidence for the Federal Reserve to raise interest rates significantly again next week; Early data shows that US crude oil inventories surged last week, and the Biden administration is reportedly considering using80Purchase crude oil at a price of around US dollars to replenish reserves. Focus on the United States within the day8monthPPIAnnual rateEIAdata

Crude oil fluctuated on Tuesday, and the market ultimately improved89Short term adjustments were made on the front line, of course, also due to the evening in the United StatesCPIThe bearish data has led to concerns in the market about the Federal Reserve's continued significant interest rate hikes. Starting in the early morning, bulls have regained their lost ground and are currently seen in a broad range of fluctuations. Today, the upward pressure is strong and it is not ruled out that it will fall again. Suggestions for crude oil operations rebound to88.50Selling, risk control89, Objective86.60~85.80~85。

(Click on the avatar to view information and join the group. Apply for free and directly join the group to experience the experience. Order at the current price every day)3-5Single)

Real time benefits within the group:

1Daily updates: market trends, intraday reminders, and opportunities to build positions.

2New fan welfare: trading tactics《KThe King of Online Trading,Teach you how to do a good job in the short term

3Welfare delivery: golden short line opportunity layout, continuous tracking (band opening)

4Special column: private chat, Q&A, solution τ, Analyze the trend of the day.

The most important thing in investing is not how much you can earn in a week, but whether you can make stable profits. Short term fluctuations, medium term bands, and long term trends are not good or bad methods. As long as they are suitable for oneself and can achieve stable profits, they are all good methods. As the ancients said, "Don't do small things for good, and don't do small things for evil. The answer to all questions is never unique and unchanging. Whether the market is going up or down, you cannot control it yourself. Only by keeping up with the pulse of the market can you avoid being eliminated. The market cannot always go up or down, and what is certain is that it will always go right.

This article is provided by Fang Yuan. I interpret world economic news, analyze global investment trends, and conduct in-depth research on commodities such as crude oil, gold, and silver. Technical Director Fang Yuan provides online solutions, returns losses, and provides one-on-one real-time guidance on WeChat. Due to the delayed nature of online push, the above content is my personal suggestion. Due to the timeliness of online posts, it is for reference only and at my own risk. Real time ideas are provided at the current price. Please indicate the source when reprinting.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|