Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

正在参与交易gold、白银、贵金属的朋友,可能会因为工作、生活等问题无法获取国际市场第一新闻或消息,这对咱们做黄金来讲是很大的困扰,所以蒋鑫鸿欢迎做投资的朋友找到我一起共同交流与进步,让各位随时随地第一时间知道国际市场动向,这样投资也会安心很多,蒋鑫鸿时刻在线,为你的投资保驾护航,时刻提供最新的金融动向。【蒋鑫鸿官微:jxh2357】

Trading is a process of patiently waiting for opportunities to emerge, not because one is at a loss, but because one has a plan in mind,95%The profit always comes from5%Trading, waiting for the rabbit, is a trading strategy. Sometimes taking the initiative will only scare the rabbit away, patiently waiting for the arrival of a certain signal to avoid blind investment in ambiguous stages. The market is a place where experienced people gain more money, and those with money gain more experience. Every novice will learn from the lessons of failure, while smart people will profit from the help of professional teams. The market is a magnifying glass that wirelessly magnifies your shortcomings. The real loss comes from not correcting or admitting mistakes that are already obvious, and continuing them. There is a strange phenomenon in the investment market, which is that those who make money are always making money, while those who are deeply invested are always deeply invested. They do not know their own tolerance limit, nor do they know their profit target. They are either trapped or on the path of being trapped. Not every transaction will yield good returns, and it is necessary to be prepared to bear the pain of losses, so as not to affect one's mentality. There is no winner in the market. If you are not prepared to lose, you should not have the intention of winning. Any investment carries risks. The path of cultivation is long, and time will accumulate the necessary experience and heal all wounds. Without accumulating small streams, there will be no river or sea. Investment will also go through the process of accumulating funds.

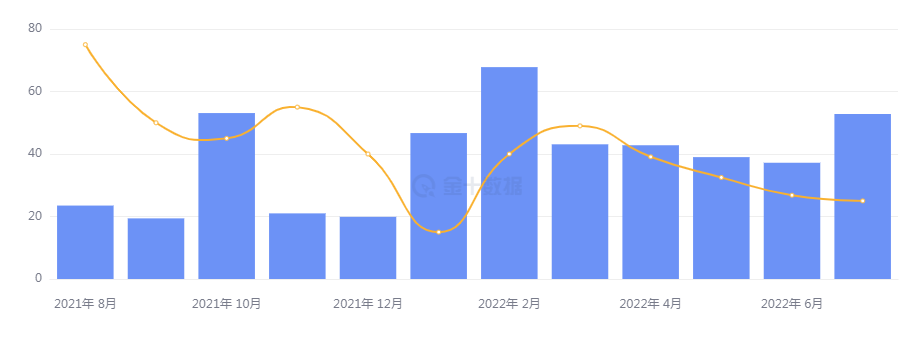

又到了非农时间,当前美联储9Monthly interest rate hikes are imminent,75个点的BP基本没跑,鲍威尔已经明确表态为了抑制通胀,不惜打压经济,那么就业市场的疲软是必然趋势,从这次小非农能看出暴风雨已经来临。ADP就业前值7month35Ten thousand people,8月预期是30万,而公布值只有13万,连一半都不到。

这次的大非农数据也差不多,前值52.8Ten thousand, expected30万,都是很难超越的水平。

所以个人认为今晚数据对于美元来说大概率是个利空的影响。

美股的崩盘加上GDP的持续衰退,这次大非农是否会成为压死骆驼的最后一根稻草?  In terms of gold,

The world's largest goldETF持仓报告显示,该机构6月以来已经连续2个多月减持,最近一次是昨天减持了0.29吨,总持仓来到了973.08Tons.

机构的抛售也带动散户的情绪开始悲观,现在市面上开始出现看空金价未来要跌至1500even to the extent that1300Yes.1500个人认为还稍有逻辑可言,毕竟这里是美国放水的启动点,加息收水的话回落至此也说的过去,但是1300就有点无厘头了,我劝大家还是要理性分析。

对于金价的连续下跌,现在很多人不理解为啥美股跌了黄金也不涨,不是说避险吗?

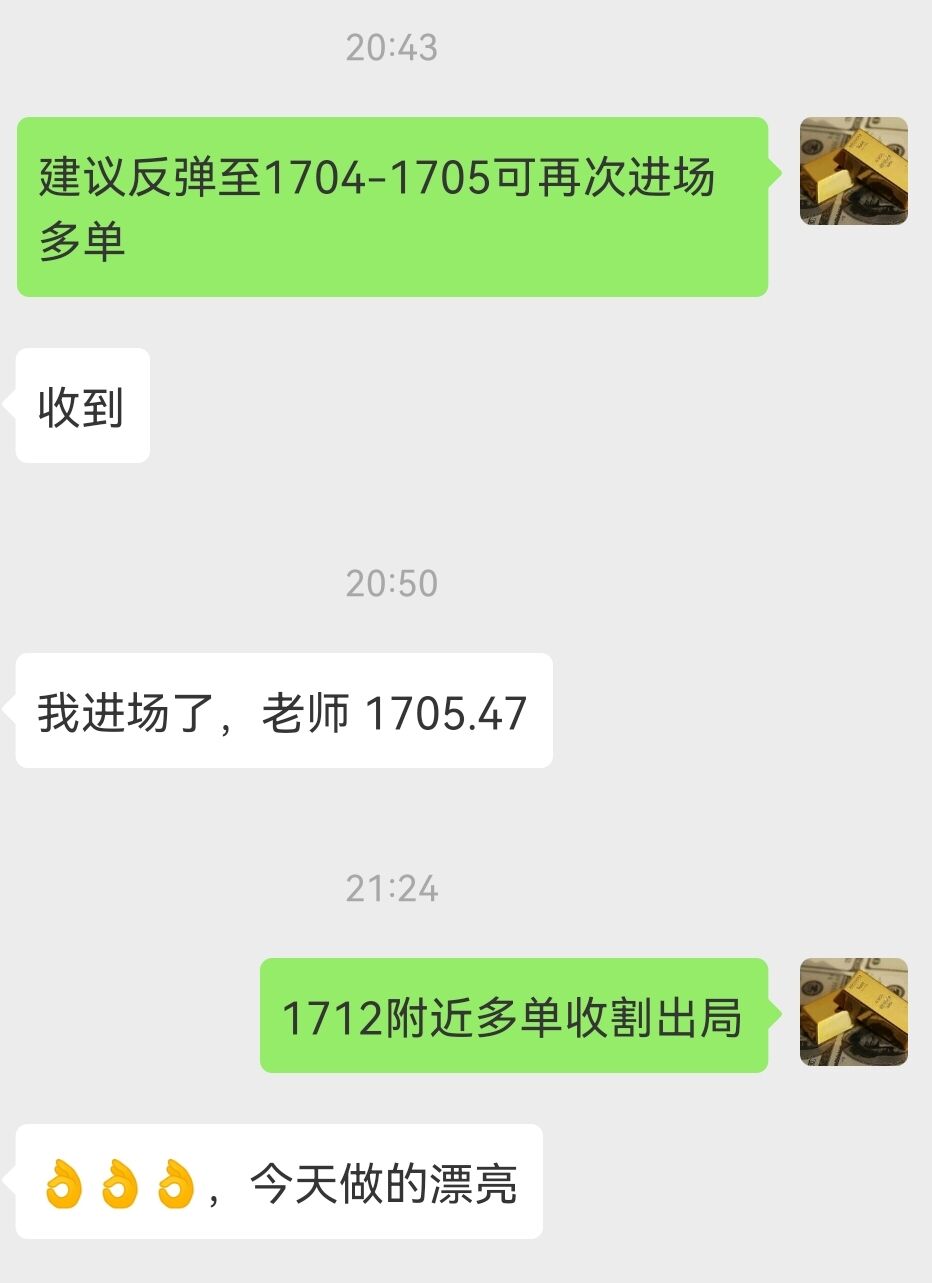

其实在高利率的背景下,黄金应该是算作风险资产的,毕竟这东西没有利息,波动又比较大,并不会比美债等无风险资产更抢手。  今天非农行情,大家操作上要注意一下上方的压力1710and1721,黄金六连跌之后,到达1688开始反弹,空间上满足了AB=CD的结构,所以大概率今天不会下破1680了,反弹会成为周五的主旋律。     4小时支撑:16941688Small cycle15minute 下降趋势线突破1705 走势偏多

结合数据,

1、 Announced value>预期值和前值

如果公布值大于前值52.8万,在大幅利多美元的情况下,贵金属价格或将承压回落,黄金上方需关注1710-1713-1718附近的压力情况,主做空,不建议接多单

2、 Announced value

如果公布值小于预测值30万,那么贵金属价格可能将迎来火箭行情,黄金可关注下方1694、1688、1680的支撑,顺势接多

数据行情瞬息万变,策略仅供参考,更详细的交易计划,我们会在实盘的一对一沟通中给出,感谢你的关注!

投资有风险,交易需谨慎!

蒋鑫鸿寄语;

Our investment philosophy is to first ensure the safety of principal, and then to increase value on the basis of preserving value. But the market is constantly changing and unpredictable. There are two problems with this: firstly, in order to reduce risks, we cannot maximize profits; Secondly, due to market uncertainty, losses are bound to occur at a certain stage.

Any successful trader needs to follow strict trading principles - no hedging,Don't lock the order! The survival law of the market is the law of the jungle. No one is destined to be unlucky, but there is a group of people who will be eliminated by the market. War will not give soldiers an opportunity to explain, and investors will not enjoy preferential treatment because you are weak. The waves wash away the sand, the sink is gold, the wind blows the clouds, and the "left" is king.

一篇文章的牵引,可能看不出什么,但是长长久久的精准分析,才是我们稳步提升利润的主要途径。可能你见过太多的分析,也见过太多的盈利,然而亏损还是跟随你,那是因为你总喜欢综合分析操作,而市场本身就是多数必死,少数必盈的抉择。综合分析,不如只跟一人,虽然没人能保证百分百盈利,但是,我们只要建立入场、出场、风控三位一体的平衡术,实现稳定盈利即可。积少成多,其实也没那么难。

本文由蒋鑫鸿(微信;jxh2357)独家策划,分析文章只是对市场未来可能的描述,只是观点的表达,不作为投资决策依据,投资有风险,交易务必注意合理的仓位配置、资金管理和风险控制,无风控不交易,不要让交易失控!

|