Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Investors are waiting for the release of Eurozone inflation data and US employment data this week.

Market Express

The US and European stock markets fell for the third consecutive day on Tuesday, as hawkish remarks at the economic conference held in Jackson Hole last week sparked expectations of interest rate hikes.

Large cap S&P500index(S&P 500)And the NASDAQ Composite Index, mainly focused on technology stocks(Nasdaq Composite)The New York stock market closed down1.1%。

In Europe, Stoke600index(Stoxx 600)fall0.7%, GermanyDaxIndex rise0.5%, recovered the lost land earlier. London FTSE100index(FTSE 100)Falling after a day of vacation0.9%。

Previously, global stock markets fell for two consecutive days, after central bank officials from various countries held talks in Jackson Hole, Wyoming(Jackson Hole)At the annual summit, they reiterated their commitment to addressing inflation, despite the prospect of tightening monetary policy potentially leading to a long-term economic slowdown.

Federal Reserve Chairman Jay Powell(Jay Powell)In a speech last Friday, it was stated that the Federal Reserve "must persevere until the task is completed," and reducing inflation may lead to a "sustained" slowdown in economic growth.

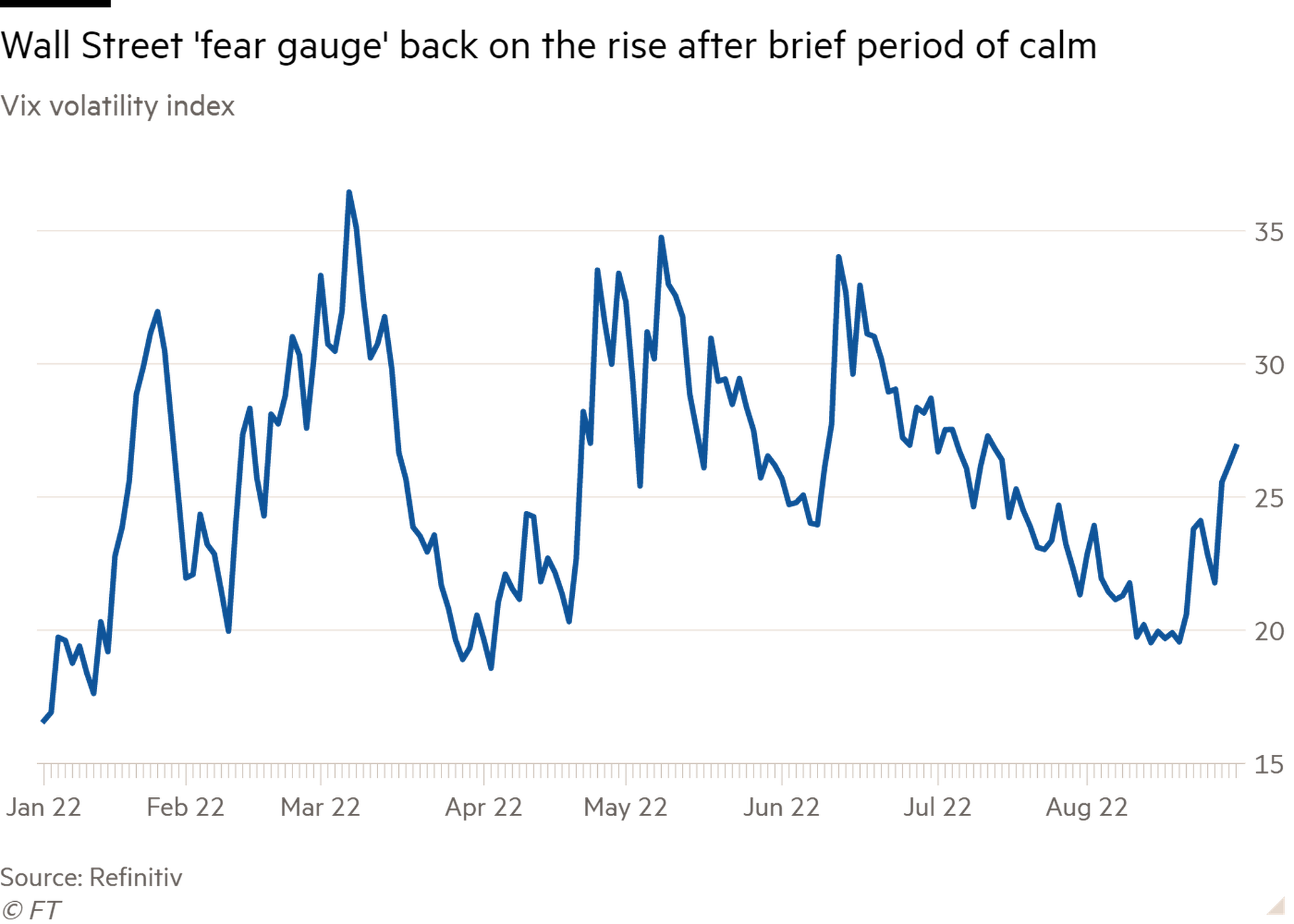

Known as the "fear indicator" on Wall StreetVixThe volatility index reached on Tuesday27.69, for7The highest level since mid month indicates that the market expects further turbulence.VixThe index fell slightly in late trading.

DataTrek ResearchCo founder Nicholas Krass(Nicholas Colas)Warning that the index may further rise. "Given the current macro and micro uncertainties, the US stock market has not reflected sufficient concerns," he said.

VixVolatility

The yield of two-year US treasury bond bonds sensitive to interest rate expectations rose Tuesday3.497%, continue to hover around15Annual high point.

Federal Reserve Bank of New York(New York Fed)President Williams(John Williams)Accepted by The Wall Street Journal on Tuesday(The Wall Street Journal)During the interview, he stated that he believes the Federal Reserve needs to maintain interest rates at high levels until2023In order to curb inflation.

Oil prices plummeted on Tuesday due to concerns that slowing growth in major economies would weaken global fuel demand, while there were reports that Iraq's oil production was not affected by the ongoing violence in Baghdad.

Brent(Brent)crude oilfuturesClosing down5.5%To each barrel99.31US dollars. In OPEC(Opec)After the riots in Iraq, the second largest exporter of crude oil, the international benchmark crude oil price touched per barrel on Monday105.48The one month high of the US dollar. On Tuesday, US oil prices also fell5.5%To each barrel91.64USD.

UBS(UBS)Oil analyst Giovanni Staunov(Giovanni Staunovo)During European trading hours, oil prices began to decline due to Iraqi state-owned oil tradersSomoIt is stated that oil exports have not been affected by the political crisis

Despite sanctions imposed by the West on Russia, the strong supply from Russia and the possibility of reaching a nuclear agreement with Iran are also putting pressure on crude oil prices. The de facto leader of OPEC, Saudi Arabia, warned last week that the organization may reduce crude oil production to stabilize the market. Saudi Arabia stated that "extremely thin liquidity and extreme price fluctuations" are weakening the market. OPEC will hold a meeting next week to decide on its oil production policy.

Investors will carefully study the data for the next few days, seeking further clues about the health of the global economy and the future direction of monetary policy. Accept Reuters(Reuters)Economists surveyed predict that the eurozone8The monthly inflation rate will reach9%, higher than7Of the month8.9%. The data will be released on Wednesday.

The US employment data released this Friday may help people understand the tense labor market in the world's largest economy. Economists surveyed by Reuters predict that the United States8Monthly job creation30Ten thousand, below7Of52.8Ten thousand.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|