Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Market surface:

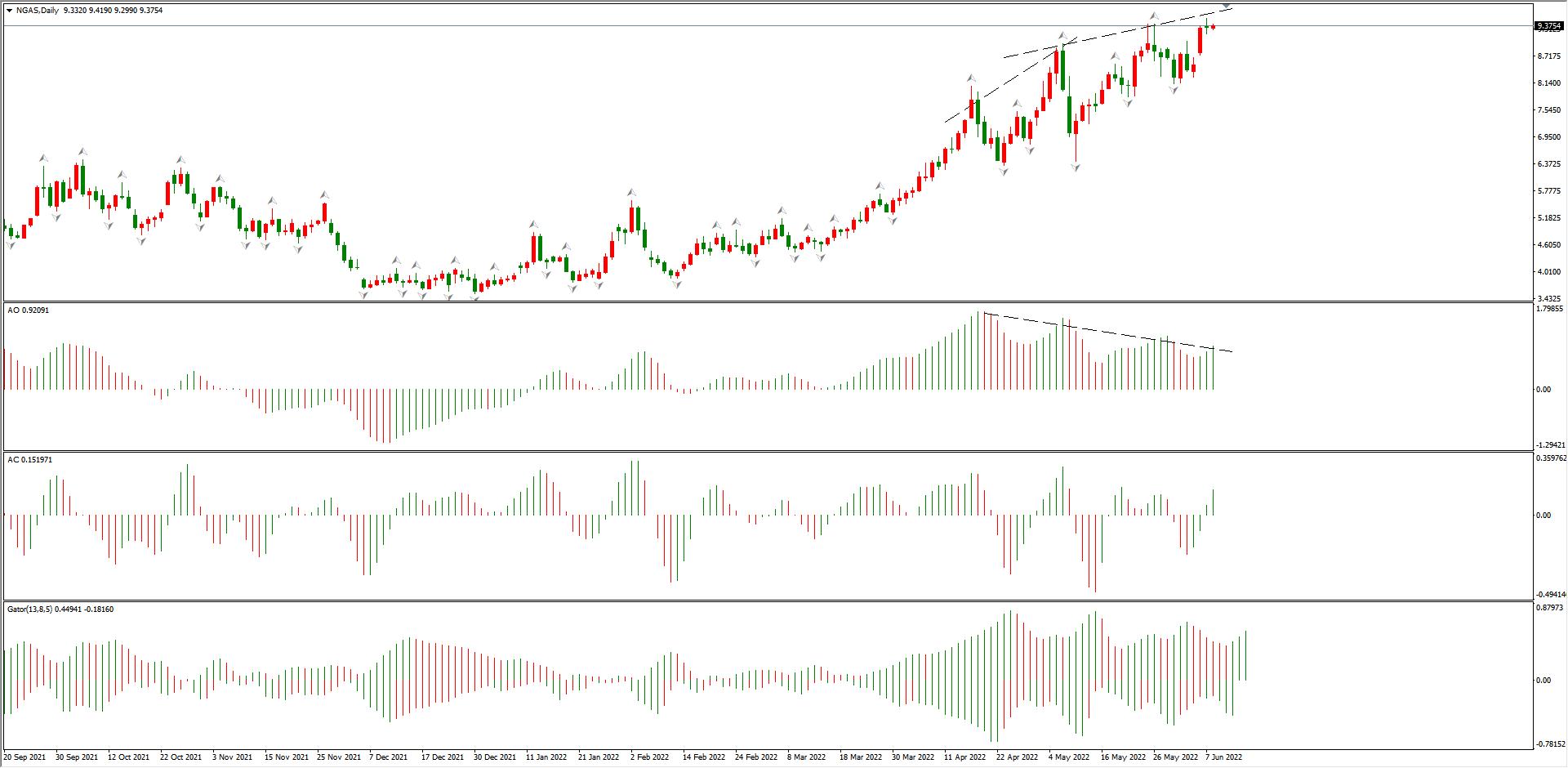

4month18Day5month6Day5month25On the day and yesterday, natural gas prices formed several high points:8.279 、9.052 、9.437and9.544At the same time, momentum indicatorsAOThe peak of the column line is getting lower and lower each time, which is a very obvious continuous top deviation signal. Once there is a significant resistance level in the future, it is possible to trigger a more severe decline.

Of course, this judgment only comes from the technical perspective, and the macro perspective does not support a decline in natural gas prices.3month23Japan and Russia have already stated that natural gas exports from unfriendly countries can only be settled in rubles. Due to its high dependence, the EU has tacitly adopted this method of purchasing natural gas.5At the end of the month, after the EU special summit, it was announced that an immediate ban would be imposed on the import of oil from Russia into the EU by sea, and the amount of oil imported from Russia would be reduced by the end of the year90%。 Although the European Union has not yet imposed a ban on Russian natural gas, based on its resolute attitude towards Russian oil, as long as alternative channels are found, the ban on Russian natural gas will soon be implemented. It is precisely because of this expectation that natural gas prices have been fluctuating at high levels. Although the extent of each breakthrough is not significant, there has been no sustained short selling force.

Natural gas in the United States is different from natural gas in Europe:

Our common natural gas quotation comes from New York Stock Exchange, which represents the price of natural gas in the United States. The United States does not have a shortage of natural gas and is less affected by the Russia-Ukraine conflict, so natural gasfuturesPrices should not have continued to rise. The reason why natural gas in New York has accumulated an increase in the past four months112.62%It is because the close economic and trade exchanges between the United States and Europe have led to a resonance in natural gas prices between the two regions.

The benchmark for natural gas pricing in Europe is not on the New York Stock Exchange, but on the Intercontinental Exchange, whereTTFBenchmark Dutch natural gas futures(Dutch TTF Gas Futures)It is the accurate target. The above figure showsTTFThe price trend of natural gas over the past year. stay3month7Daily contact206.905After the highest point, it has been in a downward trend. Yesterday's latest price79.608Compared to the highest point, it has accumulated a decline61.52%The market price was basically the same as before the conflict between Russia-Ukraine conflict.

3month25On the day, the European Union and the United States reached a large natural gas agreement, and the EU will purchase at least150Billion cubic meters of liquefied natural gas to replace energy imported from Russia.150One billion cubic meters of natural gas means that US natural gas exports to Europe will increase by two-thirds. The joint statement between Europe and the United States also mentioned that in the2027Years ago, we helped Europe break free from its dependence on Russia for energy, and2030Ensure that Europe can receive it every year before the end of the year500Billion cubic meters of liquefied natural gas. It can be seen that the EU's alternative channel for natural gas is to import liquefied natural gas from the United States at high prices, which indirectly drives up natural gas prices in New York.

Natural gas chart analysis:

Summary

ATFXThe analyst team believes that due to supporting factors on the macro level, we believe that the callback amplitude corresponding to the continuous top deviation signal of natural gas is relatively limited, and the medium-term target is6.42Horizontal.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|