Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

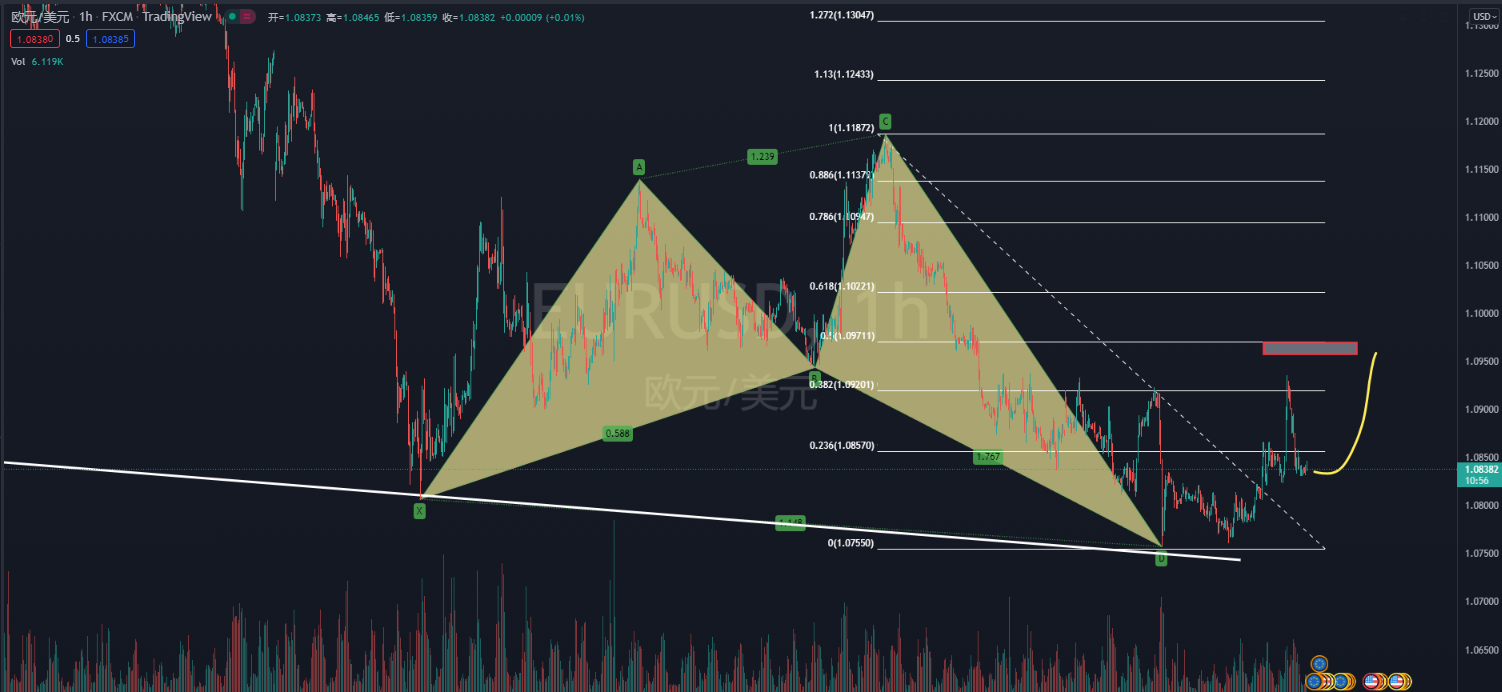

foreign exchangeThe grid trading method is commonly referred to as the fish net trading method. The specific operational strategy of the foreign exchange grid trading method is to take a certain point as the starting point, hang a certain number of short or long orders for each rise or fall of a certain point, set a profit target, but do not set a stop loss. When the price advances in the expected direction, profit is made to close the position, and hang the same buy or sell order at the origin. These trading orders arranged in this way form a fishnet like array, profiting back and forth in the oscillating foreign exchange market.

There are also things to pay attention to when using the foreign exchange grid trading method. Traders should note that the grid trading method is the most taboo against unilateral market conditions and is specifically designed for oscillating market conditions. Its advantage in arbitrage trading is that it can systematically govern large fund transactions.

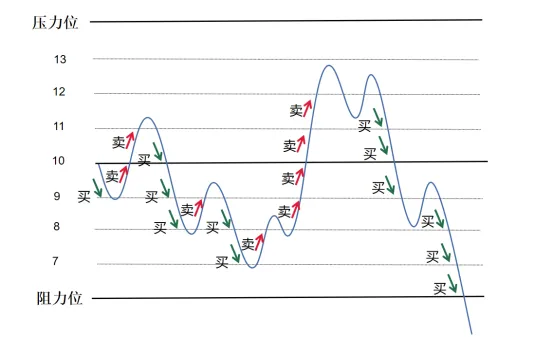

Advantages and disadvantages of the fluctuating grid trading method: Huiyou, who enjoys trading in volatile markets, strives to earn profit opportunities through price fluctuations between long and short positions. In a volatile market, there are numerous trading opportunities, which can make people unable to resist placing orders. It should be remembered that profits and losses are relative, and only by controlling within a reasonable range of asset management can stable profits be achieved. For Huiyou who like to set their short positions as stop losses, my personal suggestion is to think twice before acting, and think about doing itForeign exchange transactionsWhat is the purpose of it

Advantages:

1. There are numerous trading opportunities in volatile market conditions, and there is a probability of fast in and fast out completion100%Accuracy of

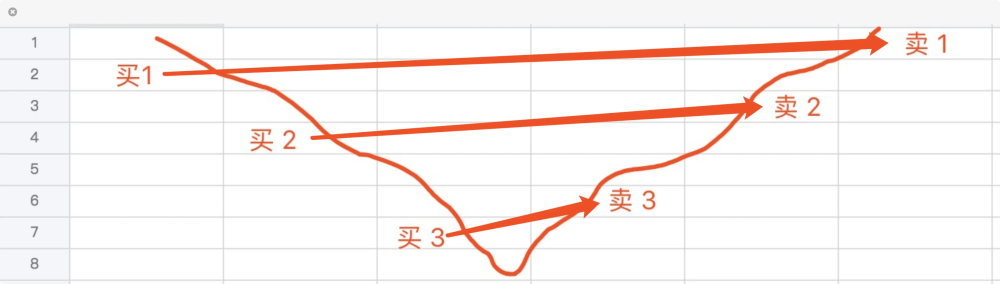

2. You can choose to open positions in both directions, in conjunction with the grid trading method, and there are profit opportunities for pullbacks. 3. By intelligently trading it, it saves a lot of time on repetitive tasks such as tracking, placing orders, and setting order parameters.  Disadvantages: 1. In a volatile market, there is a need for sufficient funds and a reasonable asset management system. Once a one-way trend occurs, account funds will be severely affected. 2. Need to filter and avoid major data trends, often requiring manual labor+Intelligent trading software cooperates in managing trading accounts. Therefore, it requires relatively more time to invest in transactions.

|