Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Background:

The easiest opportunity for the money market to operate is when the monetary policies of the two countries deviate from the market trend, such as the current situation in the United States and Japan, where the Federal Reserve implements tight monetary policies (reducing monthly bond purchases), and Japan continues to implement super quantitative easing policies during the pandemic. One is reclaiming currency, the other is still releasing currency, and the final result is obvious:USDContinued appreciation against the US dollar.

▋USDJPY

2020Year and2021year11Prior to this month, due to the lack of effective control over the epidemic, the Federal Reserve had been implementing unconventional quantitative easing monetary policy. Of course, Japan was also engaged in quantitative easing during the same period. So, in the11Before the month, we cannot clearly determineUSDJPYThe future trend is either up or down. However, after Federal Reserve Chairman Powell acknowledged that high inflation would continue for a long time, the Federal Reserve's monetary policy also tightened accordingly. At this point, we can determine the currency levelUSDJPYThe impact becomes very easy, with the United States tightening and Japan loosening,USDJPYWill continue the bullish trend.

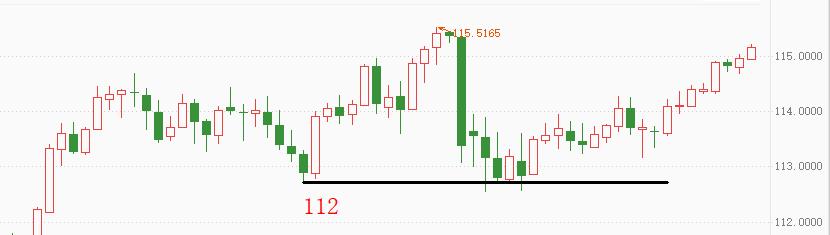

From a technical perspective,USDJPYLower support position112Confirmed effective, upper support position116It is expected to rise or fall. Considering that the upward band strength at the daily level is not strong, we are breaking through116There may be a temporary decline. The long-term target position at the monthly level is120Nearby, this price range is also close8in recent yearsUSDJPYThe oscillation range of.

▋ US short-term treasury bond bond yield

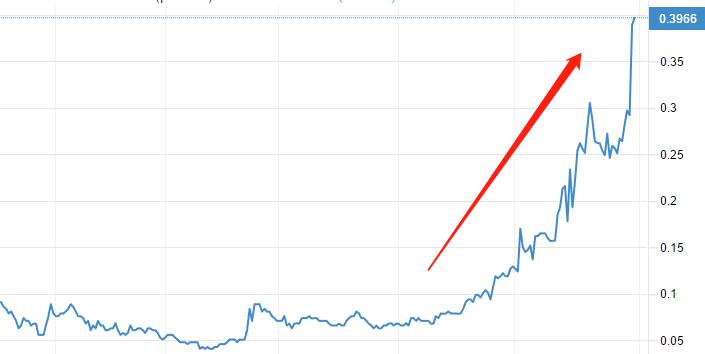

The yield of one-year US treasury bond bonds can be described as "crazy". It is breaking through the previous peak0.3%Afterwards, the current market price has approached0.4%Location. A higher yield indicates a sustained decline in bond prices, while a decrease in bond prices indicates that market risk aversion is cooling and the US economy is entering a recovery phase. This is a good phenomenon, as high interest rates can also stimulate the Federal Reserve to take faster rate hikes.

The yield on 10-year US bonds is also rising, but the increase is not as exaggerated as short-term US bonds. Looking at the extended cycle, the 10-year US Treasury bond is more of a broad volatility, with early highs1.7%Not yet broken through, currently operating in a fluctuating range(1.35%~1.7%)Near the central axis of.

For the US dollar index, both short-term and long-term US bonds are important, but it is long-term US bonds that play a decisive role. So, while the 10-year US Treasury yield remained volatile, the US dollar index also failed to break through the year's high and maintained a high consolidation trend. The decision-making power is still in the hands of the Federal Reserve. As long as it maintains the current rapid pace of debt contraction and smoothly adopts interest rate hikes in the middle of next year, an upward trend in 10-year US Treasury yields will be inevitable.

Summary

ATFXThe analyst team believes that:USDJPYLong period oscillation, upper limit120 。 Affected by the deviation of monetary policies between the United States and Japan,USDJPYThe short-term trend is still expected to rise and is expected to break through116Short term resistance is a high probability event.

*Risk Tips and Disclaimers*

There are risks in the market and investment should be cautious. The above contents only represent the views of analysts and do not constitute any operational recommendations.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|