Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

1Central bank information from various countries:

Federal Reserve The Federal Reserve has accepted fixed rate reverse repos1.189Trillion US dollars, continuing to reach a new historical high.

European Central Bank The European Central Bank will9month9Next week and Thursday, we will discuss the monetary policy for the fourth quarter of this year. This week, several voting committee members have publicly hinted that the European version will reduce bond purchases(taper)Coming soon, the European Central Bank may learn from the Federal Reserve and decouple the emergency bond purchases and interest rate hikes to end the epidemic.

OPEC Tonight23:00,OPEC+The meeting is about to be held.

EURUSD

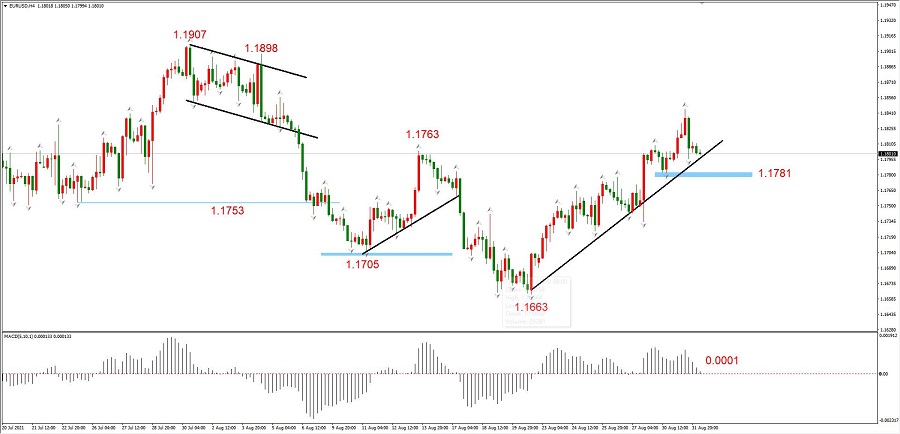

chart1,EURUSD H4level

Last Friday, at the Jackson Hole Central Bank's annual meeting, Powell confirmed that he would start reducing bond purchases within the year, but did not disclose the specific month. fromEURUSDFrom the performance perspective, the market interprets the news as a dove faction. However, from a financial perspective, debt reduction has a positive impact on the US dollar index, while it has a negative impact on the US dollar indexEURUSDNegative. Last Friday's trend may have been misjudged by market funds, and it is expected to be corrected in the future (in the long term).

MA5-MA10Above the zero axis, but the column line continues to shrink, with the latest value approaching0.0001Weak bulls may turn bearish in the future market;

Structurally, mid-term resistance1.1763It has been effectively broken through and has been supported in the near future1.1781In the future, the trend will continue to rise. The market price is close to the upward trend line and is expected to receive support. Long term bullish target position1.1707;

Comprehensive view: Continuing rebound, recent support level1.1781,

XAUUSD

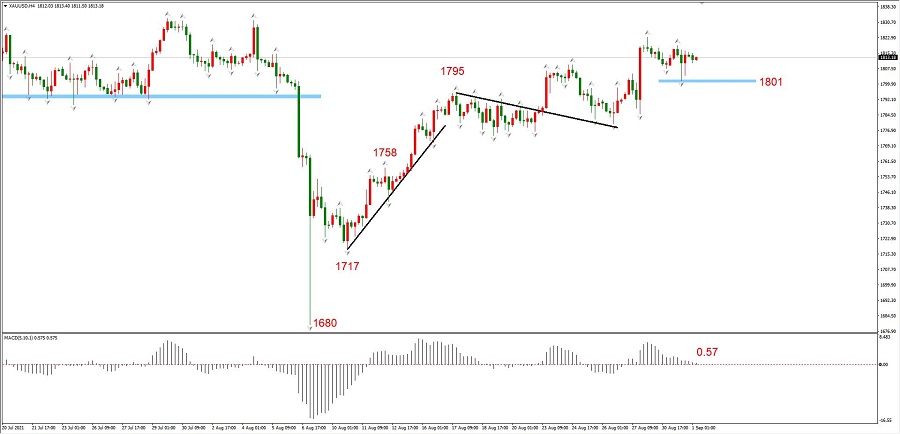

chart2,XAUUSD H4level

U.S.ACPIStill at a high level, sentiment of avoiding inflation risks has boostedgold;

The news that the Federal Reserve has reduced its monthly bond purchases during the year has created a bearish outlook for gold, but the buying sentiment in the market remains strong;

Short term technical aspects:

MA5-MA10Above zero axis, latest value0.57There are significant signs of attenuation in the column line, and weak bulls may even flip over in the future market;

Structurally, last Friday saw a single day increase30The highest point of the rebound in the US dollar is close to the early resistance intensive zone, and the upward selling pressure will become increasingly heavy, with the possibility of being hindered and falling back.

Comprehensive perspective: cautious and supportive below1801

USOIL

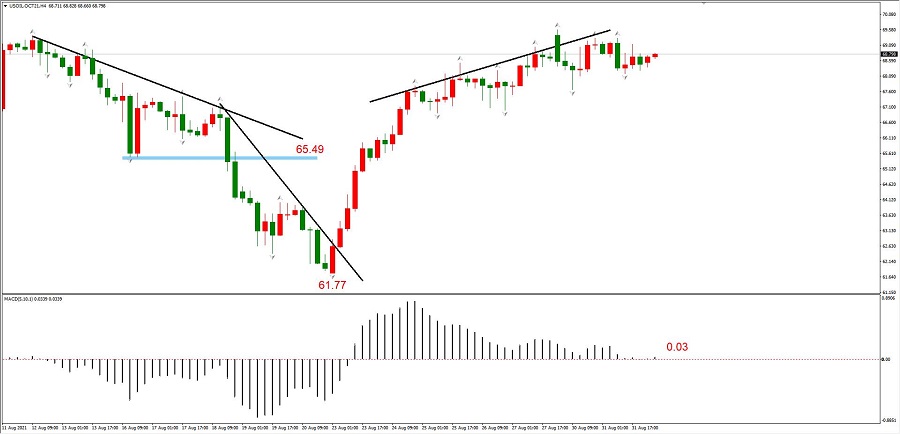

chart3,USOIL 2021year10Monthly contract H4cycle

Delta virus spreading in North America, containmentcrude oilDemand, bearish oil prices;

OPEC+Be cautious in increasing production and have less negative impact on oil prices;

The total crude oil production in the United States has already been achieved2020year3A new high since the beginning of the month has created a substantial negative impact on oil prices;

Tonight there will beOPEC+Meetings have a significant impact and require close attention;

Technical aspect:

MA5-MA10Latest value0.03The bar line is constantly shrinking, and weak bulls are expected to turn short in the future (with a higher probability of turning short);

Structurally, the strength of the multi head band is constantly decreasing, and the top feature has appeared, and it is expected to initiate a moderate correction.

Comprehensive perspective: There is pressure for a pullback

NAS100

chart4,NAS100 H4level

The Federal Reserve plans to reduce monthly bond purchases within the year, creating a bearish suppression on the Nasdaq; However, due to the relatively good interim performance of listed companies and the inertia of the market to go long, the bearish effect of interest rate hikes on the Nasdaq has been weakened; China's anti monopoly policies against internet concept stocks have had a relatively small impact on the Nasdaq index.

Short term technical aspects:

MA5-MA10Above zero axis, latest value21.16The column line is constantly shrinking, and the future market is looking weak for bulls.

Structurally, the Nasdaq has a good long-term bullish trend, with all previous pullbacks being buying opportunities and maintaining a bullish outlook in the future

Comprehensive perspective: Rising

Disclaimer:

1The above analysis only represents the analyst's viewpoint.

2、ATFXWe will not be responsible for any profit or loss that may arise from the direct or indirect use or reliance on this information.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|