Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

initialgoldThere is only one ratio for segmentation, yes0.618perhaps61.8%It represents the development of aesthetics: when a painting, photo, or setting conforms to the golden ratio, it can present the most comfortable aesthetic. Technical analysis masters Gann and Eliot both incorporated the golden ratio into their toolbox, because both believed that the golden ratio not only represents the field of aesthetics, but also represents the evolution laws of the entire material world. With the increasing number of people learning Gann's theory and wave theory, research on the golden section has become more in-depth, and ultimately formed a group dedicated to investing with the golden section. Professional users of the golden section, not just using0.618Other ratios will also be used.0.618The reciprocal of is1.618, using1subtract0.618namely0.382;0.382of0.618Times is0.236, using1subtract0.236namely0.764; and0.618to0.382The distance between them, multiplied by0.618Afterwards, add0.382That's it0.5Quantile. So, in a complete set of golden ratio, it often includes0.236、0.382、0.5、0.618、0.764、1.382、1.618These numbers. The author is not a fan of the Golden Section and believes that it is not necessary to be accurate to the ratio of three decimal places60%Proportion and usage of61.8%The proportion will not make a significant difference. Extra precise numbers are just for psychological comfort.

Traders who traditionally use the golden section believe that in a rising band, the magnitude of the pullback is less than38.2%Represents insufficient callback; The callback amplitude is within50%Nearby, representing a full pullback, it is likely to start a second round of upward trend; Callback amplitude exceeds61.8%Represents an excessive pullback, with an increased probability of a long trend turning into a short trend. Logically speaking, such a proportion division and proportion interpretation are very reasonable, but if the actual trading operation is carried out according to this interpretation, it will result in a relatively large loss because it is not in line with the actual situation.

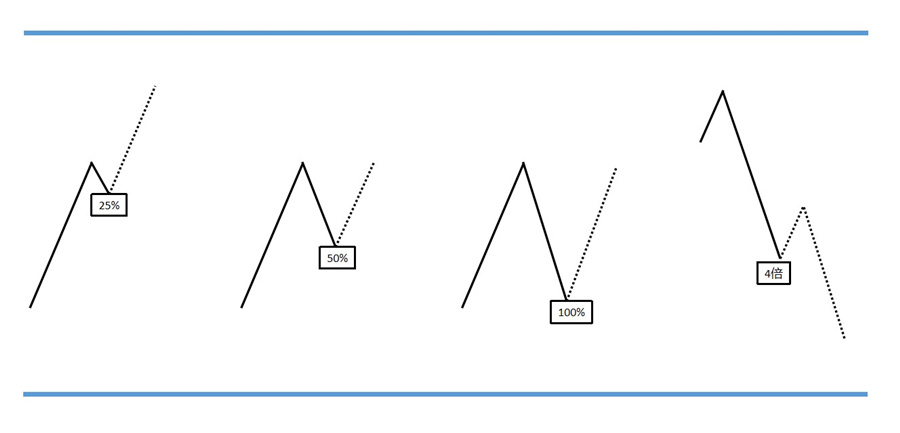

Based on the author's trading experience, in most trend markets, there are the following patterns, taking the bull trend as an example:

1Only the callback amplitude is less than38.2%Or more strictly, less than25%The proportion used by the author is more likely to result in a second round of stronger trend trends. The smaller the pullback, the higher the probability of a second round of increase with greater amplitude and better smoothness.

2As long as the callback amplitude is greater than50%It represents a weakening of the strength of bulls and an increase in the strength of bears, making it difficult to see a second round of trend trends with higher strength in the future.50%When the pullback line is touched, there is likely to be a volatile trend in the future, where the power of short selling has reached about half of the power of long selling, and the significant advantage of long selling has disappeared. This kind of oscillation is often of small to medium amplitude, with the range of oscillation ranging from the low point of the correction band to the high point of the rise band.

3If the callback amplitude is greater than50%Whether it's achieved70%still90%Both represent significant fluctuations in the future market, as the bulls have been completely defeated by the bears, and both sides are deadlocked and can only engage in a significant tug of war. The oscillation range at this time is in the overlap area between the bull band and the bear band.

4If the short band has already exceeded the lowest point of the long band and the amplitude of the short band is greater than or equal to the amplitude of the long band2The probability of small and medium-sized fluctuations in the future market is relatively high. The range of oscillations ranges from the lowest point in the bearish band to the lowest point in the bullish band. In simple terms, it refers to the non overlapping parts of multiple spatial bands.

5In extreme cases, the amplitude of the short band exceeds that of the long band and reaches4Times. This means that the bearish forces have completely dominated the current market trend, and the trend has shifted from long to short. The next round of upward trend in the future will only be defined as a rebound, rather than a second trend upward trend.4Multiple is a very large proportion, and if the amplitude of the upward band is too large, it can be basically determined that the bearish band is unlikely to occur4A decline of times. So, the prerequisite for a trend turning is that a certain band in the forward direction has a very small amplitude, giving the reverse trend band a very good opportunity to achieve quadruple amplitude.

The above five experiences have a unified core idea, which is50%Boundary line. The boundary here refers to both the boundary between a trend market and a volatile market, as well as the boundary between a long and short trend.

For the first article,25%The proportion comes from50%*50%=25%It is equivalent to dividing the bull trend into four stages. If the callback band cannot break through even the first stage, it indicates that the bull intensity is very high, and the probability of producing a second wave of bull bands in the future is higher. The second and fourth articles are actually correct50%The positive and negative use of proportion is very obvious in the second article, without further explanation. For the fourth article,50%The reciprocal of is2That is, the double relationship between multiple spatial bands. The fifth article actually corresponds to the first article,25%The reciprocal of is4Corresponds to the quadruple relationship of multiple spatial bands. The third point is right50%The most common use of proportion does not require excessive parsing here.

#Summary#

Relying solely on the golden section to make orders cannot achieve the best trading results, and comprehensive analysis must be conducted in conjunction with other technical indicators. In previous popular science articles, it was introduced thatMA5-MA10、RSIThe corresponding article titles for channel line indicators are: "Double moving averages andRSIThe Trading Strategy Based on Fractals, Trend Lines, and Channel Lines, as well as today's article "The Golden Section and50%The dividing line ", a total of three articles. Integrating the technical indicators described in these three articles is the majority of the pure technical trading strategy that I am currently using. Next, we will provide a series of explanations on the hook theory. After completion, we will form a comprehensive overview of the author's technical trading strategy. Finally, I wish all readers and friends a prosperous future.

Disclaimer:

1The above analysis only represents the analyst's perspective. There are risks in the foreign exchange market and investment needs to be cautious.

2、ATFXWe will not be responsible for any profit or loss that may arise from the direct or indirect use or reliance on this information.

|

"Small gifts, come to Huiyi to support me"

No one has offered a reward yet. Give me some support

|