Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

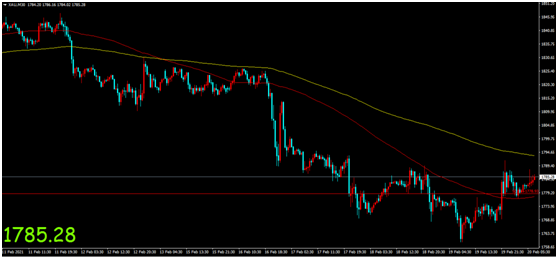

Market Review: internationalgoldFriday(2month19Day) bottomed out, rebounded, fluctuated and closed higher, opening price1778.35dollar/Ounces, highest price1791.41dollar/Ounces, lowest price1760.46dollar/Ounces, closing price1785.75dollar/ounce. Message surface: The United States announced on Friday2monthMarkitService industryPMIThe initial value is58.9(Creation)2015year3New high since the beginning of the month, higher than market expectations57.6.U.S.A2monthMarkitmanufacturingPMIThe initial value is58.5, in line with market expectations. United States1The total monthly sales of completed houses are annualized as66810000 households, higher than market expectations661Ten thousand households. Commentary states that despite the tight availability of unsold properties driving up housing prices, the United States1The total monthly sales of completed homes still unexpectedly increased. Low interest rates have effectively supported the real estate market, becoming one of the best performing markets in the United States as the overall economy enters a recession. The semi annual monetary policy report released by the Federal Reserve shows that vaccines provide hope for a further return to normalcy this year. Reiterate the need to maintain the pace of bond purchases until substantial progress is made. Due to social distancing measures continuing to restrict interpersonal activities, several non-traditional data sources indicate that US service industry spending remains constrained. The Federal Reserve's current emergency convenience tools will continue to serve as an important pillar in addressing future pressures. Federal Reserve official Williams stated that he is not concerned about excessive fiscal stimulus. The rise in 10-year US Treasury yields is a response to fiscal support measures. The increase in yield reflects the prospects and progress in vaccination. Distance recovery2%Inflation still has a considerable way to go. The very strong asset prices reflect investors' "outlook" beyond the COVID-19 epidemic and low interest rates. There are no signs of financial imbalance yet. The Federal Reserve's monetary policy decisions will be based on the position of the economy relative to dual goals. Due to the spread of the winter virus, the economy has been in a period of slow growth. Federal Reserve official Rosengren stated that Fed policymakers hope to maintain interest rates close to zero until they reach2%The inflation target. Given the severity of the economic crisis, the response of monetary and fiscal policies is quite appropriate. In the coming months, the US economy may face difficulties. The speed of recovery will depend on the launch of the vaccine. The Federal Reserve will continue to implement quantitative easing policy until substantial progress is made. Analysis shows that Federal Reserve Chairman Powell will submit a semi annual report on economic and monetary policy to Congress during a two-day hearing starting on Tuesday. Powell may once again signal that loose monetary policy will continue to exist for the foreseeable future and face issues such as the scale, interest rate levels, and bond purchase plans of the next fiscal stimulus plan, as well as whether inflation may rise while the economy accelerates. Morgan Stanley analysis suggests that despite the upward trend in inflation this year, gold prices are expected to further decline from current levels. Expected inflation rate in the United States to rise slightly above in the next two years2%Above all, but this is not the kind of inflation runaway situation that is most favorable for gold prices. The relative improvement of the epidemic, improvement in economic data, and easing of the political situation are not conducive to gold prices. The expected year-end price of gold is slightly lower than1800dollar/ounce. New ZealandASBAccording to bank analysis, it is expected that the New Zealand Federal Reserve will2022year8The monthly increase in cash interest rates is due to the better than expected performance of the New Zealand economy despite the pandemic. The new interest rate hike expectation is one year ahead of our bank's expectation three months ago, reflecting a different situation from previous expectations. Although relatively optimistic, I believe that2021New Zealand's economic growth will slow down in2024The cash interest rate at the beginning of the year will stabilize at1.25%(Currently0.25%). It is expected that New Zealand and the global economy will take some time to develop2022Correctly enter the "recovery mode" in and achieve above averageGDPGrowth. The world's largest goldETF--SPDR Gold TrustPosition decrease compared to the previous day5.25Tons, current position is1127.64Tons. according toCMEFederal Reserve Observation: The Federal Reserve3Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25Bps to0.25%-0.50%The probability of the interval is0%;4Monthly interest rate maintained at0%-0.25%The probability of the interval is96%Interest rate hike25The probability of a basis point is4%。 This week's focus is on: Monday:17:00 Germany2monthIFOBusiness Prosperity Index;23:00 U.S.A1Monthly consultation chamber leading indicator monthly rate;23:30 U.S.A2Dallas Federal Reserve Business Activity Index for the month;

Tuesday:15:00 britain12Three months in a monthILOUnemployment rate, UK1Monthly unemployment rate and number of applicants for unemployment benefits;18:00 eurozone1monthCPIMonthly and annual rate final values;19:00 britain2monthCBIRetail sales margin;22:00 U.S.A12monthFHFAMonthly rate of housing price index andS&P/CS20Annual rate of housing price index in major cities;23:00 U.S.A2Monthly Consultation Chamber Consumer Confidence Index and Richmond Fed Manufacturing Index;

Wednesday: 09:00 New Zealand to2month24The Federal Reserve's interest rate decision;15:00 Germany Q4 not seasonally adjustedGDPAnnual rate final value;17:00 Switzerland2monthZEWInvestor confidence index;23:00 U.S.A1Annualized total monthly sales of new homes;23:00 Federal Reserve Chairman Powell attends an online hearing held by the Financial Services Committee of the United States House of Representatives and delivers testimony on the biannual currency report

Thursday:15:00 Germany3monthGfkConsumer confidence index;18:00 eurozone2Final values of monthly industrial prosperity index, economic prosperity index, and consumer confidence index;21:30 From the United States to2month20Number of initial claims for unemployment benefits in the current week, actual fourth quarter in the United StatesGDPRevised annualized quarterly rate, United States1Monthly rate of durable goods orders;23:00 U.S.A1Monthly rate of contracted sales index for completed houses;

Friday:15:45 France2monthCPIMonthly rate, fourth quarter in FranceGDPAnnual rate final value;16:00 Switzerland2monthKOFEconomic leading indicators;21:30 U.S.A1Monthly CorePCEMonthly and annual rate of price index, monthly rate of personal expenditure;22:45 U.S.A2Month ChicagoPMI;23:00 U.S.A2The final value of the University of Michigan Consumer Confidence Index for the month; Technical aspect:

International gold bottomed out on Friday and rebounded in a volatile manner, closing higher. During the Asian session on Friday, gold prices rose from1776The first line fell again and hit the lowest point1760Frontline. Entering the afternoon trading session, gold prices have expanded, with short-term rebound amplitude fluctuating and reaching the highest point1777Frontline. Gold prices remain short-term during European trading hours1775-1768Narrow range sorting. Opening of the US market, gold prices expand, short-term rebound amplitude fluctuates, and the highest touch rises1791First line, gold prices fluctuated and fell slightly on Saturday morning1777After the first line, the short-term oscillation gradually rises, and Qiu Wenyu1779Above. The daily line recorded a longer shadow line with a small positive line, and the expansion of the short-term rebound did not change the overall regularity and downward divergence of the daily moving average. The technical indicators of the daily line maintained a bearish pattern to guide digestion, and the short-term fluctuation upward did not show significant unilateral upward continuation momentum. The four hour line shows that the current rebound in gold prices has expanded and returned to the pressure level price range supported by the four hour technical indicators. In the short term, gold prices have returned to the overall fluctuating trend, and the four hour moving average has shown a cohesive narrowing pattern. The intraday gold price may further continue to fluctuate within the range, or it may be difficult to change the trend. Be cautious in maintaining a biased range operation approach during the day. Daily operating range: Multiple orders: radical1779Frontline participation, stop loss3-5Point, profit target1783upper steady1775Frontline participation, stop loss3-5Point, profit target1779upper Empty order: radical1793Frontline participation, stop loss3-5Point, profit target1788Below steady1802Frontline participation, stop loss3-5Point, profit target1797Below The US economic data is mixed, with gold prices hitting the bottom and rebounding to maintain volatility. The cautious operation approach for the day is to maintain a biased range

|