Register now, make more friends, enjoy more functions, and let you play in the community easily.

You need Sign in Can be downloaded or viewed without an account?Register Now

x

Market Review: internationalgoldThursday(1month14Japan) maintains a volatile trend, opening price1857.88dollar/Ounces, highest price1859.54dollar/Ounces, lowest price1830.13dollar/Ounces, closing price1847.63dollar/ounce. Message surface: Thursday's announcement from the United States to1month9The number of initial claims for unemployment benefits in the current week is96.510000 people, higher than market expectations7810000 people. Commentary states that the United States1month9The number of initial claims for unemployment benefits jumped to96.5Ten thousand people, but at the same time, due to the impact of epidemic restrictions, recruitment activities show signs of slowing down. It shows that with the increase of COVID-19 cases, the labor market is suffering from continuous setbacks. Economists say it may take several years for the labor market to recover from the pandemic. According to reports, US President elect Biden announced1.9A trillion dollar stimulus plan, the first part of a two-step plan; among3500Billion US dollars for local aid, in addition1600One billion is for vaccine and testing costs. Biden's plan includes4000More than billions of dollars to support the epidemic response; Provide appointments for families1Trillions of dollars in direct relief; about4400Billion US dollars will be used for businesses and the most severely affected communities. The Biden plan will take place600Further increase in the issuance of US dollar checks1400USD. The Biden plan will increase unemployment benefits from the current weekly300Increase the US dollar to400USD and extended to9Month. Biden Calls for a National Minimum Wage of Every Hour15USD and update paid leave rules. Speaker of the United States House of Representatives Pelosi and Democratic leader of the United States Senate, Schumer, stated in a joint statement that Biden's proposed economic stimulus plan is the right approach. Speaker of the United States House of Representatives Pelosi and Democratic leader of the United States Senate, Schumer, have stated that they will begin advancing the stimulus plan proposal. Call on both parties to take action on Biden's stimulus plan. Federal Reserve Chairman Powell expressed optimism about the economy in the coming years. There are many reasons to remain optimistic about the US economy. It will soon return to the past economic peak. Interest rates and asset purchase guidelines are not based on time, but on outcomes. Now is not the time to exit (loose monetary policy). The US federal debt is not on a sustainable path. Unless there is unsettling inflation and imbalances, interest rates will not be raised. I hope inflation expectations remain stable at2%。 The Federal Reserve shoulders the dual task of full employment and price stability. Federal Reserve official Deli said she is completely not worried about upcoming inflation. The current monetary policy of the Federal Reserve is in a good position. If there is a slight inflation now, it would be a good thing. IMFThe spokesperson stated that the global economy is at a "critical moment", with a resurgence of the epidemic and enormous uncertainty in the recovery. The better than expected performance of the US economy in the third quarter and additional stimulus measures will be reflected in1month26In the next economic forecasting released on May. Given the ongoing uncertainty, this is not the time to relax efforts towards strong fiscal and monetary policies. The world's largest goldETF--SPDR Gold TrustPosition decrease compared to the previous day10.21Tons or0.87%The current position is1161.00Tons. according toCMEFederal Reserve Observation: The Federal Reserve This Year1Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25Bps to0.25%-0.50%The probability of the interval is0%; this year3Monthly interest rate maintained at0%-0.25%The probability of the interval is100%Interest rate hike25The probability of a basis point is0%。 Today's Focus:

15:00 britain11Monthly industrial and manufacturing output rate

15:00 britain11Commodity Trade Account after Monthly Adjustment

15:00 britain11Three months in a monthGDPMonthly rate

15:45 France12monthCPIMonthly rate

18:00 eurozone11Monthly adjusted trade account

21:30 U.S.A1New York Fed Manufacturing Index for the Month

21:30 U.S.A12monthPPIMonthly retail sales rate

22:15 U.S.A12Monthly industrial output rate

23:00 U.S.A11Monthly commercial inventory rate

23:00 U.S.A1Initial monthly University of Michigan consumer confidence index Technical aspect:

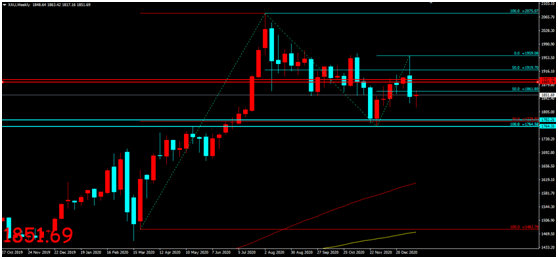

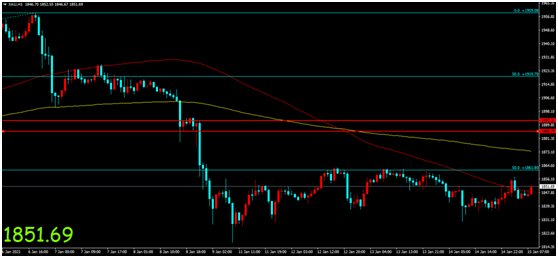

The international Golden Week four-dimensional trend is volatile, and the gold price hit the highest level in the Asian trading time1852After the first line, the short-term expansion has reached the lowest level of decline1833frontline. Gold prices rebounded slightly and stepped back in the afternoon trading session1846Gradually forming a short-term narrowing interval after the first line1836-1845Interval oscillation. The opening of the US market saw a slight increase in gold prices and further stabilization1843Stage range oscillations formed above, with gold prices hitting their highest point in US trading1857On the first line, there was no significant oscillation to shake off kinetic energy. The daily line recorded a longer shadow line with a small positive line, and the current gold price remains stable at the daily line200The technical indicators of the daily moving average support prices above, and the overall daily moving average shows a narrowing pattern, maintaining a slightly fluctuating trend to guide digestion. The hourly line shows a clear adhesive pattern with the extension of the narrow range consolidation cycle, and the short-term gold price formation shows a consolidation price performance around technical indicators. The four hour display shows that the short-term rebound has expanded, and the current gold price has returned to the technical indicators to support the pressure level price range. The short-term fluctuation upward may bring about a further upward trend in the current fluctuation range. Be cautious in maintaining a biased range operation approach during the day. Daily operating range: Multiple orders: radical1840Frontline participation, stop loss3-5Point, profit target1845upper steady1823Frontline participation, stop loss3-5Point, profit target1829upper Empty order: radical1868Frontline participation, stop loss3-5Point, profit target1863Below steady1886Frontline participation, stop loss3-5Point, profit target1881Below Biden Announces1.9The trillion yuan stimulus plan, with gold prices slightly rising and maintaining volatility, is cautious in maintaining a biased operating approach within the day

|